Costs and Consequences of Truck Driver Detention: A Comprehensive Analysis

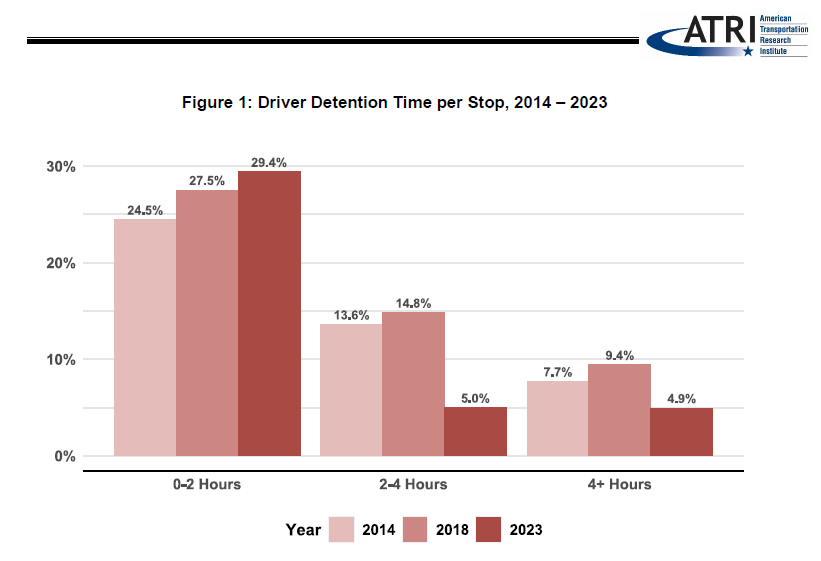

The American Transportation Research Institute recently released a report detailing the impacts and costs associated with truck driver detention. ATRI’s report defined detention as, “any time spent at a customer facility in which a driver is waiting for active operations to commence or resume is operationally considered detention, this research follows a standard industry definition of detention as any dwell time longer than 2 hours.”

Key findings of the study, “Costs and Consequences of Truck Driver Detention: A Comprehensive Analysis,” included that while detention is slightly improving overall, it’s still pervasive. “Though the frequency of stops with detention dropped by 6.5 percentage points between 2014 and 2023, drivers still experienced detention in 39.3 percent of all stops,” the report states. “Drivers experienced detention times of more than four hours in 4.9 percent of all stops.”

Another challenge is that although most carriers have a form of detention fee, it’s often not billed or paid. The report added that only 75% of the time did carriers invoice customers, and only 55% of those invoices were paid. Refrigerated carriers received the most in detention fees but only for 36% of all detention incidents. Specialized carriers experienced 45.9% of all incidents while truckload carriers were slightly lower at 43.5%.

Regarding ways to mitigate detention, the report highlights five recommendations from respondents: negotiating detention fees, arriving early, using trailer-based approaches like drop-and-hook, increasing customer communication and finally, if nothing else works, refusing service.

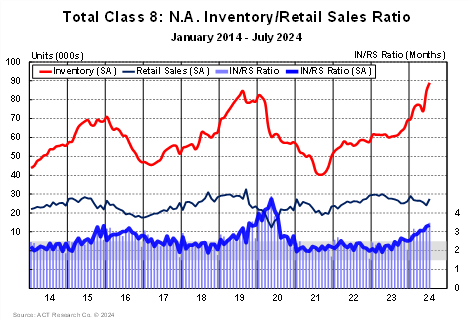

Excessive inventories put all eyes on upcoming Class 8 order season

A Thursday release by ACT Research is hyping an upcoming order season that hasn’t been as important since fall 2016. August order and build volumes are reaching their annual low point before September, when OEMs open up next year’s order books. Complicating this annual trend are excessive inventories and cloudy demand outlooks.

Kenny Vieth, president and senior analyst at ACT Research said in the release, “A year ago, the total Class 8 inventory was 61,800 units. At the end July 2024, the Class 8 inventory was a record 88,800 units, an increase of 27,000 units y/y. The increase has not been supported by demand, pushing stocks significantly above an inventory-to-retail sales inferred level.” Vieth adds that the medium-duty market, which includes classes 5-7, is also experiencing near-record inventories at 101,900 units, an increase of 24,100 units from 77,800 in July 2023.

Vieth concludes: “We are sitting in the lull before a hoped-for sustained surge as ‘order season’ gets underway. September is the month in which seasonal factors flip from accretive to dilutive, though September’s factors are modest. The ‘season’ gets underway in earnest starting in October. While inventories are ultimately a headwind, the path of orders is foundational at this juncture: backlogs are low, and BL/BU ratios for Class 8 and trailers indicate unsustainable production levels relative to backlog support. Strong orders in Q4 and into Q1 are imperative.”

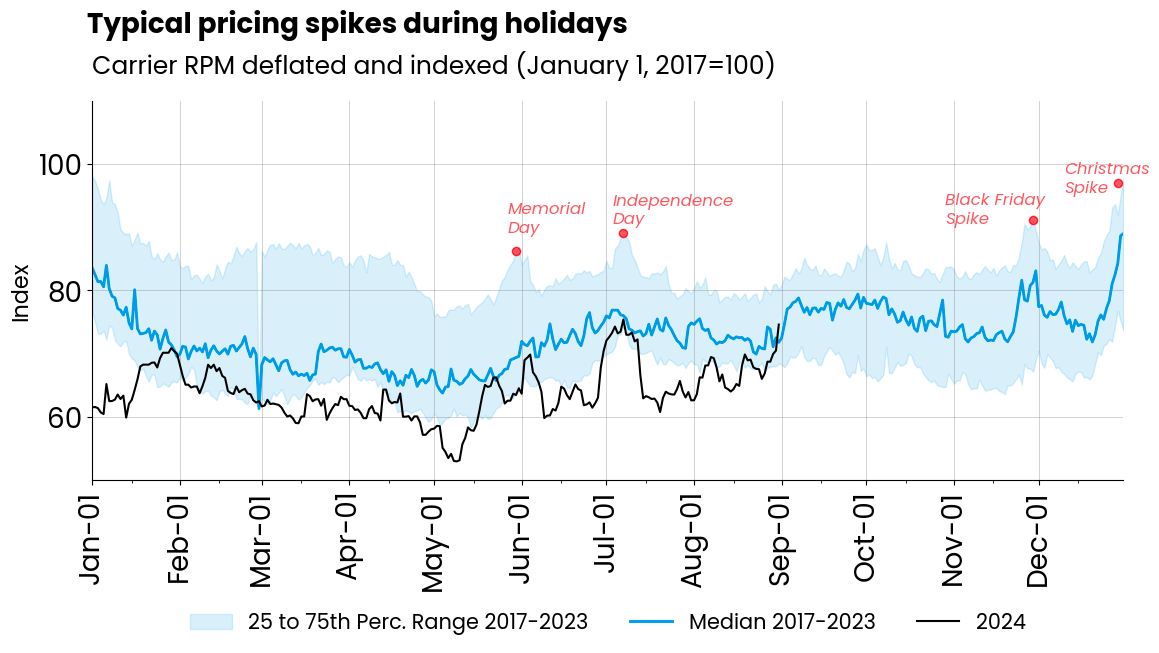

Market update: Loadsmart rate forecast predicts September peak

A recent Loadsmart monthly market update for August saw a 19.17% month-over-month increase in its pricing index compared to July. The report said Labor Day saw rates spike in some areas as capacity tightened but added that Labor Day is not historically known for causing price spikes. Loadsmart’s volumes index also rose 20.1% m/m in August, with a spike in the last week of the month due to pre-holiday demand.

Loadsmart’s model predicts that spot prices will rise from $2.81 in August to $2.93 in September, the peak price in 2024. After September, the report notes, prices are forecast to stabilize and remain around the $2.80 range for Q4. The report adds, “From a macroeconomic standpoint, there is no demand catalyst to drive a sustained long-term uptrend. Consequently, our projections continue to interpret the recent rate increases as seasonal.”

One potential reason for the increases in volumes is consumer goods data, which saw shipments increase in July and August. Loadsmart theorizes that “we could be experiencing a peak season pull-ahead, similar to last year,” adding, “Consequently, rate behavior is expected to closely follow last year’s pattern, when prices peaked in September before declining by 2-5% in the Q4.”

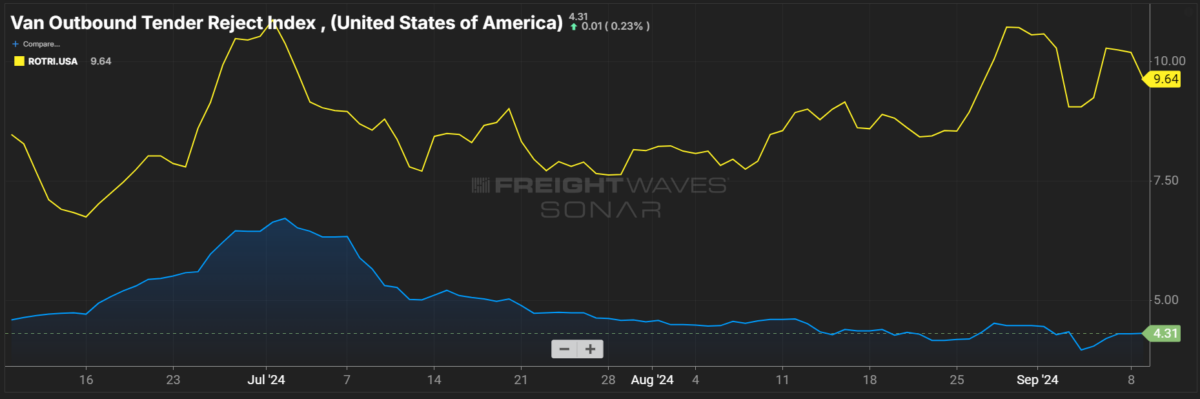

FreightWaves SONAR spotlight: Reefer roller coaster, dry van doldrums

Summary: The days leading up to and following Labor Day create roller coaster conditions for the reefer truckload segment. In the past week, reefer outbound tender rejection rates fell 65 basis points w/w from 10.29% on Sept. 2 to 9.64% but had a range between 10.29% on the high end and 9.06% on the low end. Part of this whipsaw movement came from a decline in outbound tender volumes following Labor Day, but the following week saw a surge in volumes. ROTVI rose 383.62 points or 32.9% from 1,166.7 points on Sept. 2 to 1,550.32 points as shippers resumed operations and tendering following the holiday.

Compared to the positive seasonal bumps of the reefer segment, the larger-volume dry van segment saw a boost in volumes but lower tender rejection rates as truckload capacity came back online following the Labor Day weekend. Dry van outbound tender rejection rates were nearly flat, up 3 bps w/w from 4.28% on Sept. 2 to 4.31%. The notable tell that the dry van segment continues to struggle with overcapacity lies in the middle of that week, when VOTRI dipped to 3.96% on Sept. 4, the first time since May 16 that VOTRI was below 4%. Dry van outbound tender volumes also saw a boost during the past week following shippers’ resuming operations and saw a boost, up 1,883.07 points or 27.13% w/w, from 6,940.25 points to 8,823.32. This whipsaw is common following a holiday but should normalize by this time next week.

The Routing Guide: Links from around the web

Supreme Court to hear case of truck driver who failed CBD-related drug test (FreightWaves)

Wabash National hit with $462M verdict in trailer equipment case (FreightWaves)

Model years vs. calendar years (Commercial Carrier Journal)

What’s Happening With FMCSA Proposed Rules? Not Much Before 2025 (Heavy Duty Trucking)

FreightTech startup Aifleet raises $16M Series B to expand operations (FreightWaves)

Wabash’s nuclear verdict exposes fleets to equipment liability issues (Commercial Carrier Journal)