Paul Lackey worked as a contractor for Nikola in the early days of the electric truck company. On the witness stand in Trevor Milton’s fraud trial this week, he spoke of a founder more interested in making money than cleaning up the environment.

But Lackey wasn’t exactly a dream witness for the prosecution. He collected about $600,000 in stock sale proceeds after aligning himself with short sellers that nearly crushed the startup.

As the prosecution’s first witness on Tuesday in a trial expected to last four to five weeks, Lackey described an environment in which he and other contract engineers worked on an early natural gas and electric prototype of the since-canceled Nikola One fuel cell truck. Lackey said the truck had to be pushed on stage for its reveal in December 2016.

Milton told the audience that day the truck was missing some parts. But he maintained it was “not a pusher” and capable of running under its own power. That assertion and a later video of the truck rolling down a hill are keys to the government case. They are trying to show a pattern of Milton lying to entice investors to buy Nikola stock.

Money over environment

“When we brought up making the prototype zero emissions, Mr. Milton was dismissive. He said, ‘I don’t give a s*** about the environment. I just want to make money,’” Lackey said, “I was shocked. At that time about climate change I was a bright-eyed idealist.”

But under cross-examination by Milton’s attorney, Ken Caruso, Lackey acknowledged he was the whistleblower who alerted the Securities and Exchange Commission about Nikola.

Later, he worked with Hindenburg Research, the short seller whose report on Nikola led to Milton’s resignation. It also caused General Motors to walk away from a $2 billion manufacturing partnership with the startup. Lackey said he did not know how much Hindenburg made by betting Nikola’s stock price would fall. But he was paid $600,000.

“And you stand to make more than the $600,000 you already made, right? Caruso asked.

“I might,” Lackey replied.

Federal whistleblowers can earn big money based on the quality of the information they provide. The SEC’s case against Milton is paused until his criminal trial is over. It’s unclear whether Lackey qualifies for 10% to 30% of the $125 million fine that Nikola is paying the SEC. If so, that could be a cool $12.5 million — or more.

Volvo hits the clicker on electric trucks

If there is a horse race among legacy truck manufacturers to sell the most electric trucks, Volvo Trucks North America is winning. Or placing. It most certainly is showing.

The Sweden-based OEM pulled in an order for 40 VNR Electric trucks from Rialto, California-based 4 Gen Logistics this week. The trucks will operate in drayage runs from the Port of Long Beach to California’s Inland Empire and back.

Each 4 Gen truck qualified for a $150,000 voucher through California’s Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) and the Mobile Source Air Pollution Reduction Review Committee. And 4 Gen gets one additional Volvo VNR Electric from the Volvo LIGHTS project . That’s a total of 41 electric trucks.

Volvo appears to have aced out Chinese truck maker BYD, whose first-generation electric trucks in 4 Gen’s fleet are getting long in the tooth. The second-generation VNR Electric more than doubles the 125-mile range of the aging BYD trucks.

The VNR Electric travels up to 275 miles between chargings. 4 Gen will operate them two shifts per day, making up to six runs to and from the Port of Long Beach and 4 Gen Logistics’ headquarters in Rialto.

Talking up sales

Since Volvo announces nearly every order it gets for a battery-powered truck, it appears more active than rival Daimler Truck North America. DTNA doesn’t announce electric truck orders unless its customers want to. Peterbilt and Kenworth chronicle practically every electric truck sale, as does Mack Trucks with its battery-powered Class 8 LR Electric refuse truck.

Simple math suggests that a May order from Sysco Corp. for up to 800 Freightliner eCascadias through 2026 and a 200-unit order from Canada’s Pride Group would presumably give DTNA a lead.

Still, it’s worth remembering that this is a nascent market for Class 8 electric trucks. Double-digit orders are more prevalent than triple-digit bookings. Four-digit orders might be some ways off.

Separately, Volvo said Wednesday it is beginning serial production of electric versions of its heavy-duty FH, FM and FMX trucks in Europe. The three models account for about two-thirds of company sales.

In the news …

New CFO at Hyliion

Hyliion Holdings has a new CFO, railroad veteran Jon Panzer. He joins the hybrid powertrain startup from Union Pacific His predecessor, Sherri Baker, left the company in what is called a “termination of convenience.”

CEO Thomas Healy indicated to me the parting was amicable, or at least there was no disagreement with the company or its board over operations, policies or issues regarding accounting policies or practices. Baker gets everything she was promised financially as long as she doesn’t sue Hyliion, according to a Securities and Exchange Commission filing.

Panzer gets a $350,000 cash signing bonus and will earn $450,000 a year and a prorated portion of 200,000 shares of Hyliion stock.

Harbinger and Wabash collaboration

Harbinger, a newcomer to the electric Class 4-7 commercial vehicle space, is a little fuzzy on its financing and how it plans to make good on its claim of being at cost parity with diesel powertrains on an acquisition basis.

But it has attracted interest from Wabash, the trailer maker increasingly focusing on last-mile delivery. Wabash is not writing checks to Harbinger at this point, but it is collaborating on … something. Harbinger co-founder and CEO John Harris has worked at Boeing, Faraday Future and Xos Trucks.

Atlis nears public trading

Public trading is getting closer for Atlis Motor Vehicles, which paused crowdfunded share sales this week as it awaits the go-ahead from the SEC to trade publicly. The latest funding in the Reg A+ round priced the stock at $27.50 a share, close to what Atlis expects to price its mini-initial public offering.

Whether that will hold up in a volatile stock market is a question. Certain early investors who bought in at 29 cents a share should be fine. Atlis eschewed special purpose acquisition companies offering to sponsor its public debut. Instead it chose to sell its shares to more than 20,000 nonqualified — basically retail — traders, raising more than $32 million.

Atlis claims signed contracts for more than 24,000 of its XT trucks with another 60,000 nonbinding reservations. Atlis sought SEC approval for its public listing on July 19.

Sneak peak at IAA Transportation

The global commercial vehicle industry gathers in person for the first time since 2018 next week at IAA Transportation, the massive show for trucks, buses and vocational equipment in Hanover, Germany. A green tinge is apparent in preshow announcements.

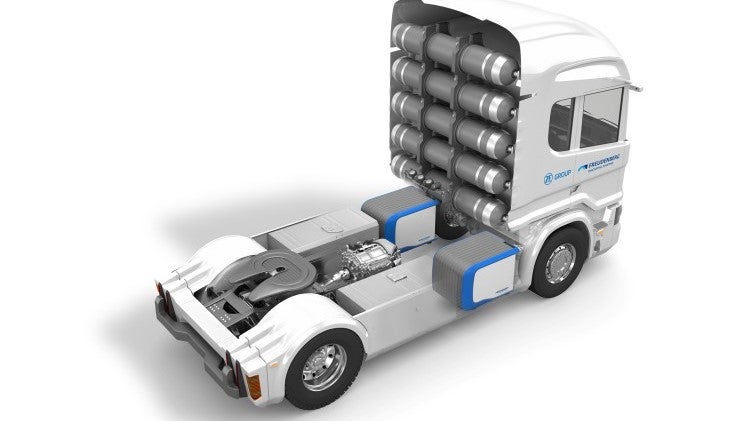

ZF’s Commercial Vehicle Solutions division is working with Freudenberg e-Power Systems on an integrated fuel cell e-drive “powerpack” for commercial vehicles. Freudenberg will offer scalable e-power systems in kit form with various power outputs; ZF will offer complete electric driveline systems of up to 360 kilowatts of continuous power.

Cummins will show the first fruit from its recently completed $3.7 billion merger with Meritor Inc. Meritor’s 17Xe ePowertrain assembled with a Cummins battery system is designed for heavy-duty trucks in the 4×2 and 6×2 segment. It has the capacity to support 44 tonnes (98,560 pounds) or more of gross combined weight.

Truck Tech will report from IAA next Friday with coverage at FreightWaves.com during media days Monday and Tuesday.

Thanks for reading. Click here to get Truck Tech in your email on Fridays.