Editor’s Note: Updates with shareholder lawsuit and closing stock price

As media coverage dies down on a short seller’s report questioning Nikola Corp.’s integrity, company executives are making the rounds of analyst events. They are touting the startup electric truck maker’s business case, including new details of its network of hydrogen stations.

Nikola (NASDAQ: NKLA) is silent on whether the U.S. Securities and Exchange Commission (SEC) and the U.S. District Court for the Southern District of New York (SDNY) are investigating allegations in a Sept. 10 Hindenburg Research report. Bloomberg and the Financial Times reported the investigations without naming sources. Neither agency would comment.

According to Bloomberg, a shareholder sued three Nikola executives in U.S. District Court in Brooklyn, New York, based on the Hindenburg allegations. At least one law firm solicited clients for a possible class action.

Nikola shares rose 1.65% Thursday to close up 55 cents at $33.83.

Virtual event appearances

Meanwhile, Chief Financial Officer Kim Brady and CEO Mark Russell kept scheduled appearances at recent virtual events sponsored by Cowen & Co., RBS Securities, J.P. Morgan and Morgan Stanley. Nikola founder and Executive Chairman Trevor Milton maintained radio silence after profanity-laced tirades at Hindenburg and other detractors.

Brady sought to calm investors during the Cowen, RBS and J.P. Morgan events. He talked through cost assumptions and other facets of the business. During the virtual Morgan Stanley Laguna Conference on Monday, Russell revealed new details about the company’s planned network of 700 hydrogen fuel stations for its Class 8 fuel cell trucks.

Trucking hydrogen fuel

For the first time, Russell said Nikola will need to truck the compressed gas to stations where electricity costs too much to justify on-site hydrogen production.

Class 8 fuel cell truck production is planned for 2023 at a plant under construction in Coolidge, Arizona. Around the same time, Nikola will begin constructing hydrogen station pairs to serve specific customers. The first will be the Los Angeles to Phoenix corridor along Interstate 10, Russell said.

Anheuser-Busch (NYSE: BUD) will begin testing early builds of Nikola’s fuel cell trucks in late 2021. The beverage maker moves beer from Van Nuys, California, to a distribution center in Chandler, Arizona. A hydrogen station at both ends of the corridor is the first of many pairs Nikola plans along its customers’ dedicated routes.

“There is going to be a lot of places in the United States and in Europe where we’re going to get access to power at the right price,” Russell said. “We can get the land at the right location accessible to the interstate highways and their equivalents.

Splitting water into hydrogen and oxygen

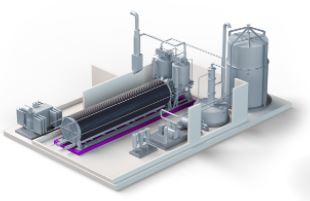

Nikola plans to use a common process using electrolysers that split water into hydrogen and oxygen molecules to make hydrogen.

“Parts of California, parts of the Eastern Seaboard, parts of the Midwest, Upper Midwest around the Great Lakes area where we won’t be able to get power at the right price,” Russell said. “In those locations we’ll get as close as we can. And we’ll make hydrogen in more bulk. Then we’ll move the hydrogen into those places.”

That approach is no different than how gasoline and diesel fuel move from refineries today. If Nikola uses its own fuel cell or battery-powered electric trucks to move the fuel, it stays on track to its goal of generating zero emissions.

Using grid electricity is the most efficient approach from an overall ecosystem perspective, he said — but only where the electricity is priced affordably.

Seeking a station partner

Nikola is looking for a station partner, preferably one that has access to electricity. So far, it has worked with NEL Hydrogen, which makes electrolysers and has experience in common station design. In August, Nikola ordered $30 million in electrolysers from NEL, enough for 10 stations.

“We’ve had great conversations with people in all aspects of that ecosystem. And they’re all interested in working with us,” Russell said. “But when it comes down to a partner, I think you’re looking for the people who bring the most to the table because we’re bringing the demand.”

A maker of industrial gas could work. Expertise in scaling a network would be helpful. So would know-how in site selection, permitting or station operation. Money also talks.

“All those things are important,” Russell said. “The biggest factor from a cost perspective, 80%-plus, is the electricity.”

Especially in the U.S. Southwest, solar energy is a cheap source of electricity. Unused nuclear energy generated at night by the Palo Verde nuclear plant also has potential.

“There is no demand for that nuclear plant’s electricity overnight,” Russell said. “We can certainly take a lot of it and make hydrogen out of it.”

Related articles:

Hydrogen fuel: Linchpin of electric truck maker Nikola’s business

Short seller Hindenburg renews attack on Nikola

Nikola

Quote: “There is going to be a lot of places in the United States and in Europe where we’re going to get access to power at the right price,” Russell said. “We can get the land at the right location accessible to the interstate highways and their equivalents. :End quote.

What a confusion Lol! Organizing H2 production is not difficult – the essential part is at what cost. There are ways to be done in very much optimal ways, but it seems this over the heads of Nikola Motors. In fact every statement of that guy (CFO) is technologically silly- and the total confusion continues……