Norfolk Southern officials are hoping for service improvements in the second half of 2023 following a first half marred by a number of prominent train derailments, most notably the February derailment in East Palestine, Ohio, of rail cars carrying vinyl chloride.

“We are going to learn from this accident to become a safer company,” NS President and CEO Alan Shaw said in prepared remarks during NS’ first-quarter 2023 earnings call Wednesday. He also noted that NS experienced fewer derailments in 2022 than in any other year in the past two decades and that the rate of employee injuries was the lowest in a decade.

The company expects costs associated with the East Palestine derailment to be around $387 million. This includes current and anticipated cleanup costs, as well as remediation costs paid to the Environmental Protection Agency. It does not include legal costs or any costs or payments from insurance.

NS and rail industry stakeholders — other railroads, rail car owners, leasing companies and equipment manufacturers — are working together to reduce incidents and bolster safety, according to Shaw. For NS (NYSE: NSC), this has meant accelerating analysis of how the company configures trains..

The Federal Railroad Administration earlier this month issued a safety advisory that calls on freight railroads to look closely at how they configure freight trains, saying that train configuration or makeup might have been a cause or contributing factor in at least six derailments within the past two years. Two of the derailments were those involving NS trains in September 2022 and March 2023.

The result of the accelerated analysis of train makeup is that NS has added more distributed power to some trains, according to COO Paul Duncan. While this change impacted network velocity initially because it created some congestion on the network, it will ultimately increase network reliability, he said.

NS is operating 50% more merchandise trains with distributed power compared with last year, Duncan said, and the railroad is going through each line segment and trying to figure out the right makeup for trains and locomotives.

Indeed, the increase in NS’ materials costs in the first quarter — up 24% year over year to $212 million — was due in part to getting locomotives out of storage and performing maintenance on them, according to CFO Mark George.

NS has been running trains single track with restricted speeds since March 3 on the line affected by East Palestine. That line links Chicago with eastern Pennsylvania, New Jersey and New York. The railroad has been pulling up tracks at the site and removing impacted soil in response to requests by the community and EPA.

But NS expects both tracks at the site to be in service by early June, according to Duncan.

“It will take some time to build resiliency, and we are making progress,” Shaw said.

Economic outlook for 2023 is uncertain

While NS expects service to improve in the second half of the year as it adjusts to new train makeups and the full restoration of the line between Chicago and New York/New Jersey, economic uncertainties make it more challenging to determine how volumes might go in the second half of 2023.

Merchandise growth will be led by higher shipments of automotive products and metals, according to Ed Elkins, chief marketing officer, which will offset potential weakness for chemicals and plastics, as well as crude oil and natural gas liquids. How intermodal performs will largely depend on the consumer economy, although there has also been weakness in the housing market while spot and contract rates have been competitive against rail.

“I think the one word that describes it best is murkiness. And quite frankly, it doesn’t matter if you’re coming from the consumer side or the industrial side,” Elkins said of the economic conditions facing the railroad. While growth overall “will be dependent on the macro-environment,” there is still pent-up demand in the industrial markets, he said.

Should NS see a sustained downturn, the company might slow down seeking new trainees and focus on investing in training and career opportunities, according to Shaw. However, NS is also still short on staff, with one-third of hiring locations below projected demand estimates, and so hiring initiatives are expected to continue for now in those areas.

“The one thing I want to reassure you of is that we’ll be ready when these markets turn. And they will turn,” Elkins said.

NS’ Q1 2023 results

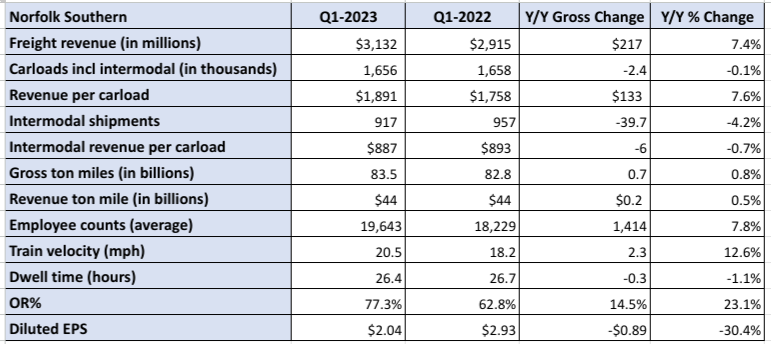

NS reported net profit of $466 million, or $2.04 per diluted share, in the first quarter of 2023, compared with net profit of $703 million, or $2.93 per diluted share, in the first quarter of 2022.

Costs of $387 million related to the East Palestine incident dented earnings. Indeed, expenses rose 32% in the first quarter to $2.4 billion year over year. Excluding East Palestine-related costs, expenses would have been around $2 billion on higher costs for materials, purchased services and rents, and compensation and benefits.

Revenue for the first quarter grew 7% to $3.1 billion. Operating income slipped 34% to $711 million. East Palestine-related costs put pressure on operating income; excluding those costs, adjusted operating income was $1.1 billion, with an adjusted diluted earnings per share of $3.32.

NS’ operating ratio (OR) deteriorated to 77.3% from 62.8%. Investors sometimes use OR to gauge the financial health of a company, with a lower OR implying improved health.

Subscribe to FreightWaves’ e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.