November data from Cass Information Systems showed sequential improvement in shipments and expenditures with the year-over-year declines narrowing.

The volumes component of the Cass Freight Index was up 0.5% from October (2.8% higher seasonally adjusted) and down just 0.7% y/y, the smallest decline in 21 months. A Thursday report credited “ongoing economic growth and slowing private fleet capacity additions” as the reasons for the improvement.

| November 2024 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -0.7% | -9.6% | 0.5% | 2.8% |

| Expenditures | -3.8% | -28.4% | 0.9% | 3.1% |

| TL Linehaul Index | -1.1% | -8.5% | 0.8% | NM |

The volumes dataset still has a hole to dig out of as it is down 9.6% compared to two years ago and projected to decline 3% y/y in December assuming normal seasonal trends. If the December forecast holds, the index would be down 4% y/y for the full year after falling 5.5% last year.

The report said private fleet growth presented a hurdle to for-hire demand during the year, and remains a headwind as some private fleets add capacity ahead of upcoming changes to Environmental Protection Agency emissions standards.

“Private fleets continue to show a surprising willingness to add capacity despite wider than normal cost disadvantages, which makes more sense in the context of significant equipment cost increases ahead in 2027,” the report said.

It noted “temporary pre-tariff shipping” in the first half of 2025 as a potential positive near-term catalyst for the for-hire market.

The freight expenditures index, which captures total freight spend including fuel, increased 0.9% sequentially (up 3.1% seasonally adjusted) and was off 3.8% y/y, the smallest decline in 22 months.

On a two-year stacked comparison, the index was off 28.4%, in part due to lower fuel prices. (November 2024 fuel prices were 33% lower than November 2022.)

Netting the y/y decline in shipments from the decline in expenditures implies actual rates, or “inferred rates,” were off 3.1% y/y during the month.

The expenditures index is expected to be down 11% y/y for full-year 2024. Inferred rates are expected to close the year 7% to 8% lower but are likely to see “a small upward turn” in the first quarter.

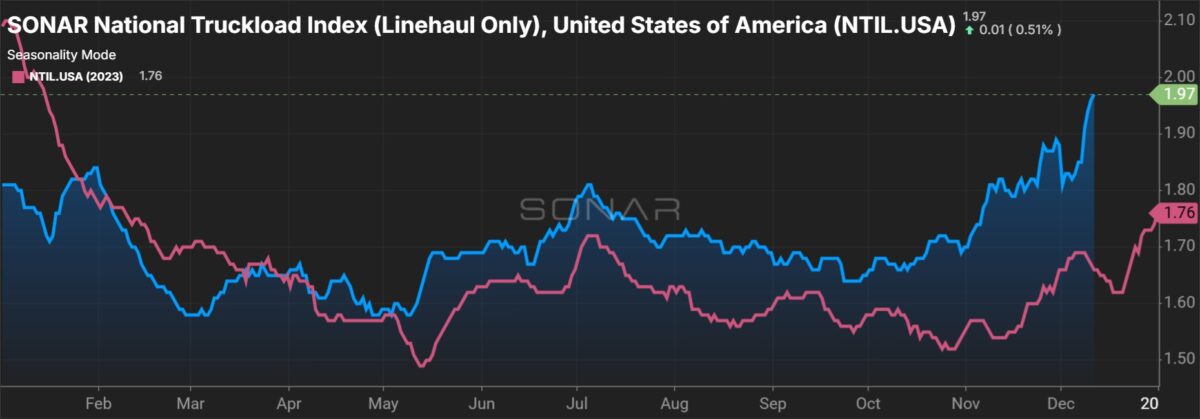

The Truckload Linehaul Index, which excludes fuel and accessorial surcharges, increased for the third straight month in November, up 0.8%. The index was down 1.1% y/y, the smallest decline in nearly two years.

“Spot rates have started to increase, and even contract rates are starting to turn slightly positive as bid activity picks up seasonally,” the report said.

The linehaul index includes changes to both spot and contract freight and appears to have bottomed in August.

Data used in the indexes is derived from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $38 billion in freight payables annually on behalf of customers.