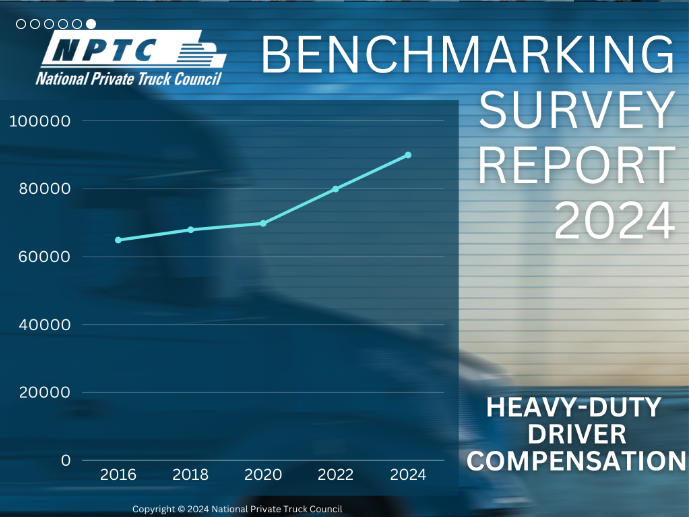

NPTC report shows continued private fleet growth

A recent survey by the National Private Truck Council highlighted the growth of private fleets as shippers prioritize reliable capacity and costs, and attempt to avoid the service disruptions that plagued them leading up to and during the pandemic. NPTC’s most recent benchmark survey saw a 7.5% year-over-year increase in shipments handled by private fleets. Volumes and freight value also increased 8.6% and 7.2%, respectively. Private fleet growth is expected to continue, with 72% of respondents planning to increase drivers, equipment or shippers in the next five years.

The private fleet growth at the expense of the for-hire space has its roots not in the pandemic but the previous freight cycle upswing in 2018. Gary Petty, president and CEO of the National Private Truck Council, told Transport Topics, “It was 2018, a bleak time in the freight markets.” Petty added that the higher demand compared to capacity caused rates to skyrocket and caught many shippers off guard, “not only those [private fleet operators] who used outside carriers to move excess loads, but in particular, those who were depending totally on for-hire.”

Looking at the advantages over using for-hire carriers, Petty added, “They are very reluctant to give that freight back to for-hire,” he said. “They don’t want to disrupt the optimized operation of their in-house fleet just for a few pennies of potential savings from temporarily low rates in the for-hire market.”

Another advantage private fleets have is lower turnover. The NPTC report showed private fleet respondents reported a turnover of around 20% compared to a large for-hire fleet, which can run 85% to 100%.

Canadian railroads CN’s and CPKC’s rail networks shut down due to lockout

Canadian National and Canadian Pacific Kansas City have formally locked out union rail employees as of 12:01 a.m. Eastern time Thursday, shutting down Canada’s largest rail networks. This comes after the Canada Industrial Relations Board cleared the way for rail work stoppage after the Canadian railways couldn’t reach an agreement with the union that represents the train crews.

Firecrown’s Stuart Chirls writes: “The contract dispute covers a combined 9,300 union employees ranging from train crews to dispatchers at Canadian National (CN) and Canadian Pacific Kansas City (CPKC), the country’s largest railroads. Employees represented by the Teamsters Canada Rail Conference (TCRC) are seeking higher pay and improved benefits, as well as provisions for more predictable work scheduling, similar to recent deals at U.S. railroads. Negotiations typically take place every other year; a one-year extension of the previous pact expired at the end of 2023.”

A rail network shutdown may benefit truckload carriers, as the spike in demand from shippers seeking alternate providers could boost rates. Paul Brashier, vice president of global supply chain at ITS Logistics, told FreightWaves earlier this week, “If the railroad starts locking out workers this week and there is a subsequent strike, operations will grind to a halt and everything will have to move to the road for both domestic and international containerized freight. When/if this happens, it will drive [trucking] rates through the roof overnight, if capacity can be obtained at all.”

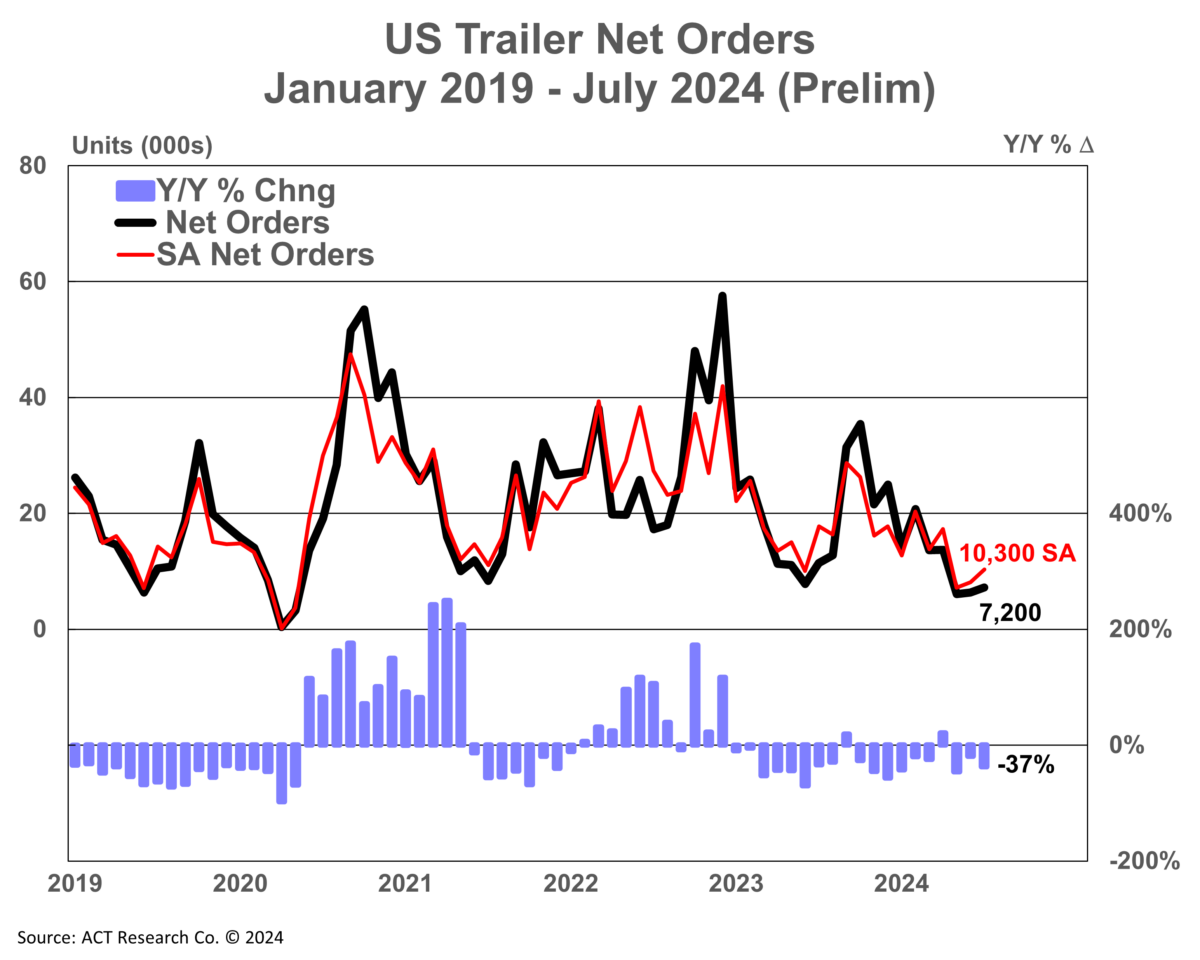

Market update: July preliminary net trailer orders remain depressed

Recent data by ACT Research reported continued softness in the trailer market with preliminary net trailer orders in July at 7,200, an increase of 1,000 orders from June but down 37% year over year. Seasonal adjustments are expected to raise that July number to around 10,300 units. Adding July’s trailer order tally, year-to-date 2024 U.S. trailer net orders are under 82,000 units, down 26% from the first seven months of 2023.

Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research, noted in the release, “Despite the sequential improvement in orders, July data continues to bear witness to our expectations of weaker demand against the backdrop of elevated order velocity the past few years, continuing weak for-hire truck market fundamentals, and already-filled dealer inventories. That said, it is important to remember that for orders, we remain in the weakest months of the annual cycle, minimally suggesting there is no catalyst for stronger orders before the fall and the OEMs’ opening of their 2025 order books.”

Trailer OEM maker Wabash was also feeling the pressure, noting in its Q2 earnings that net sales in its Transportation Solutions segment fell 21% y/y to under $499 million. Brent Yeagy, president and CEO, said in the release, “With greater information on customers’ capital expenditure plans, we feel it’s appropriate to reduce our full year guidance.” Despite the declines, Yeagy was optimistic, stating that “it’s important to remember that the overarching theme remains unchanged: Wabash is on track to achieve the best financial performance on record during a correction in our industry.”

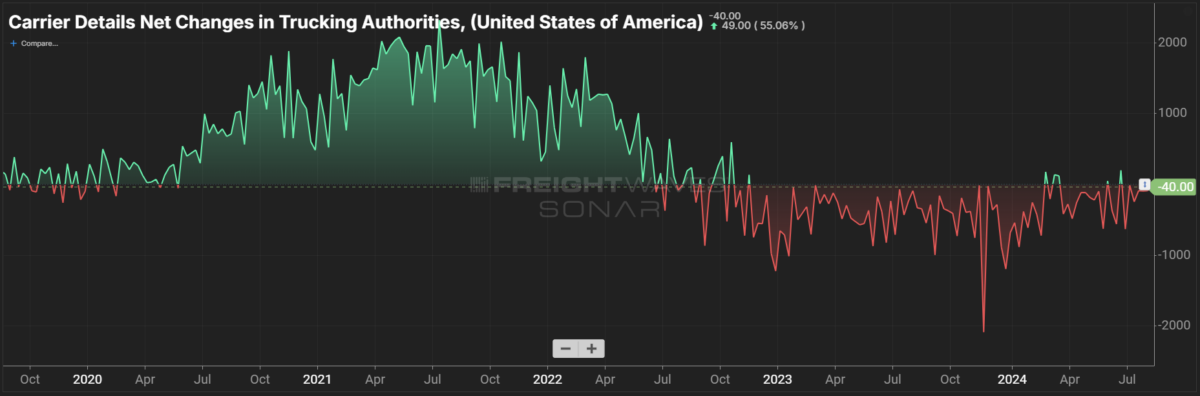

FreightWaves SONAR spotlight: Net losses in trucking operating authorities drop

Summary: A positive trend for observers looking at truckload market conditions came from the Carrier Details Net Changes in Trucking Authorities (CDNCA), which saw net losses in operating authorities but at a lower rate of decline compared to the beginning of the year. In the weeks ending in August through this past Monday, there was a net loss of 221 carriers, compared to the start of the year, when weeks ending in January saw a net loss of 2,489 unique operating authorities.

Looking at averages quarter over quarter, Q1 of 2024 saw an average net loss of 361 carriers per week, Q2 had a net loss of 235 carriers and Q3 quarter to date has seen a net loss of 171 carriers per week.

While net gains and losses are helpful when evaluating the health of truckload supply, the rate of Net Revocations in Operating Authorities (CDNR) is trending downward as well. Q1 2024 saw an average of 1,417 revocations per week, Q2 fell to 1,369 and Q3 through the week ending Aug. 19 saw an average of 1,226 revocations.

A stabilization in the net decline in trucking operating authorities does not account for whether those operating authorities exiting the market are drivers deciding to work under a large fleet as a lease purchase or owner-operator. Additionally, drivers giving up their authority working in the for-hire space and leaving to join a private fleet may not be accounted for. Regardless, this data suggests that the great reset in trucking capacity may be nearing its completion and conditions for the next upward swing in the freight cycle may arrive sooner rather than later.

The Routing Guide: Links from around the web

Perdue Transportation drivers blindsided by layoffs (FreightWaves)

Averitt Express pilots EV yard switcher in Nashville (Trucking Dive)

Trucking industry helps veterans find purpose after service (FreightWaves)

PAM Transportation Services’ owner-operator truck count grows (Trucking Dive)

ATRI launches cargo theft survey for brokers, carriers (FreightWaves)

Pride Group: ‘Business as usual’ amid bankruptcy proceedings (Commercial Carrier Journal)