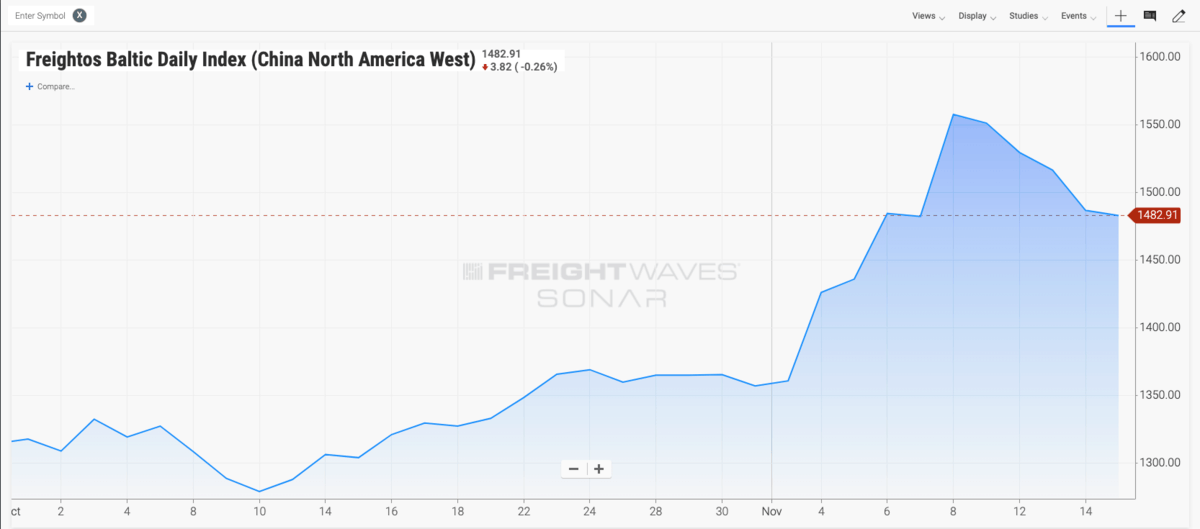

After a brief November surge, spot rates for ocean freight appear headed lower again as container volumes disappoint.

The rates for China to the U.S. West Coast (SONAR: FBXD.CNAW) are $1,486 per forty-foot equivalent unit (FEU), according to the Freightos’ Baltic Daily Index. The rate is up 13% from the level seen at the start of October. But momentum appears to be weakening as November’s spot rate peaked at $1,558 per FEU the week earlier.

China-U.S. East Coast prices (SONAR: FBXD.CNAE) are at $2,648 per FEU after peaking at $2,745 per FEU last week.

Freightos Chief Marketing Officer Ethan Buchman said in a statement that peak season prices “hit their zenith in early November.” Last year, peak season ocean freight rates dropped 8% between the middle and end of November.

November is the last month for U.S. importers to move goods into place for holiday shopping. Likewise it’s the last chance for shippers to avoid a 15% tariff on a wide range of consumer goods such as electronics and toys that is slated to go into effect Dec. 15.

The National Retail Federation has said container volumes coming into U.S. are expected to reach 1.97 million twenty-foot equivalent units (TEUs) in November, the highest level for the year and up 9% from a year earlier.

“Even though December 15’s trade tariff was recently deferred, there will still be a steady stream of advance shipping orders, which may help avoid a total price freefall,” Buchman said.

“Early indications are that prices will indeed fall and that we’ve reached the peak of peak season. While 2020’s new low-sulfur fuel regulations may help keep prices from falling too dramatically, most signs are pointing to this being the full extent of peak season. Flagging global production, some diverting of sourcing from China and strong supply management by suppliers have held prices back.”