It’s mid-August. The price to transport containers from Asia to the U.S. would normally have risen by now with the build-up to peak season for the trans-Pacific trade. It hasn’t, but expectations are for a price increase just around the corner – particularly given the new tariff wild card in the deck.

Tariffs had an enormous impact on container shipping rates and volumes in 2018. Pricing and volumes surged in the second half as importers raced to get cargo to the U.S. before the tariffs went into effect. By bringing 2019 shipments forward, importers created a ‘hangover’ of lower volumes this year.

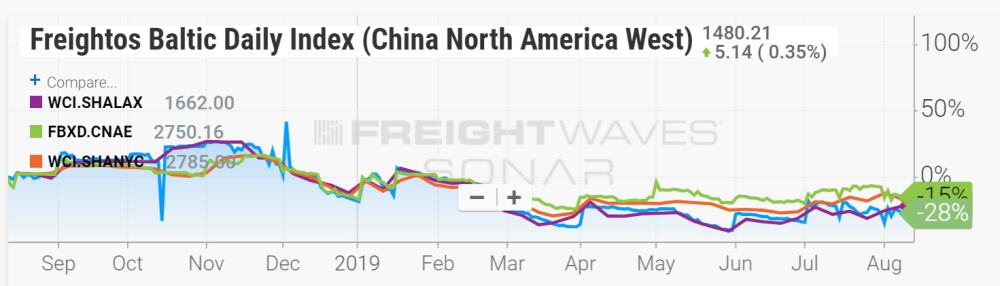

The Freightos Baltic Daily Index for the route between China and the U.S. West Coast shows that the average cost to transport a container across the Pacific to California was $1,480 per forty-foot-equivalent unit (FEU) as of August 13, down 28 percent year-on-year. While pricing is up from lows seen in May, August pricing is down versus July’s.

The Freightos index for China-to-U.S. East Coast shipments shows a price of $2,750 per FEU, down 15 percent year-on-year and also below July pricing.

Weekly port-to-port indices from Drewry reveal the same general trend. Box rates from Shanghai to New York are down 29 percent year-on-year and rates from Shanghai to Los Angeles are down 24 percent.

Amit Mehrotra, transportation analyst at Deutsche Bank, noted that “after firming throughout July, China-to-U.S. freight rates took a step back.” Nevertheless, he remains optimistic on the belief that “retailers who have drawn down inventories in recent months” have begun the restocking process.

Tariff impacts ahead?

Will implementation of the next round of U.S. tariffs on imports from China starting September 1, then another round starting December 15, buoy container rates as importers rush to beat deadlines?

The items exempted until later this year include electronics such as cellular telephones, laptops and video games. If shippers of such products bring imports forward, it could have more consequences for the air freight market than for ocean shipping.

According Henry Byers, maritime expert at FreightWaves, “Much of that freight actually travels via air because of the high value, liability and risk involved.” Mehrotra agreed, noting that “the delay [in tariffs for certain items] should have a positive impact on second-half transportation demand given concerns around the impact of tariffs on peak season demand, particularly for air freight markets.”

As for the cargoes that face tariffs starting September 1, there could be some added volumes in the very near-term to beat that deadline, but given transit time, only for trade to the West Coast. “We should see volume growth between now and September 1 on the West Coast, particularly as it is no longer possible to make it to the East Coast [in time to meet the deadline],” said Byers.

In general, Byers is still optimistic on the potential for the 2019 peak season despite currently lackluster container rates. “Regardless [of tariff issues], volumes will continue to grow,” he predicted. “We have seen some major jumps in the last few weeks in New York/New Jersey and Savannah in the U.S. customs transactions. I think it will be a good peak season this year and I expect volumes to grow, even if it’s by just 2 to 3 percent year-on-year.”

Asked about the reason for currently low shipping costs on the trans-Pacific route, Byers responded, “I would say that’s a lag from last year’s pull-forward. I think rates will pick up.” The fact that rates did not increase starting around August 1 “shows you just how much volume was pulled forward last year,” he maintained, adding, “It sure isn’t increasing capacity that’s keeping rates low. It’s just that demand hasn’t quite started to pick up.”

According to Freightos chief marketing officer Eytan Buchman, the reason August’s rates are lower than July’s is that “tariff fears artificially shifted August’s demand forward.” He asserted that August’s lower pricing “doesn’t mean that the peak season is a write-off. Near-record import volumes are forecasted for the coming months, which will push prices up.”

The East-West spread

Meanwhile, Mehrotra pointed out that the premium in rates to send Chinese goods to the U.S. East Coast instead of the West Coast is rising. “A widening of the spread supports our view of shippers driving U.S. freight flows east, which has implications for intermodal versus truck penetration,” he said. The more volumes go to the East Coast, the better for trucking and the worse for intermodal rail.

The Freightos daily index tracking the east-west spread is currently at $1,270 per FEU, meaning that it costs that much more to bring a box on the longer route via the Panama Canal to the East Coast than the shorter route to the West Coast. The Freightos east-west spread is up 6 percent year-on-year.

The increase in the spread implies that U.S. importers are not preemptively shifting shipments to the West Coast in preparation for IMO 2020. That regulation requires the use of fuel with no more than 0.5 percent sulfur content on ships that are not equipped with exhaust gas scrubbers starting January 1, 2020.

Carriers plan to pass along the cost of more expensive low-sulfur fuel to shippers through a surcharge, which would take voyage distance into account. This has raised the question of whether shippers would switch to shorter ocean trips to the West Coast, plus an intermodal rail component, instead of the longer ocean trip to the East Coast, plus a trucking component. The widening spread implies this is not happening – at least not yet. More FreightWaves/American Shipper articles by Greg Miller

Editor’s note: Freightos has a business agreement with FreightWaves that includes editorial coverage.