Less-than-truckload carrier Old Dominion Freight Line (NASDAQ: ODFL) said it is in “good position” to continue capturing market share. The carrier said it took share in the first quarter of 2021 in route to its highest-revenue quarter ever.

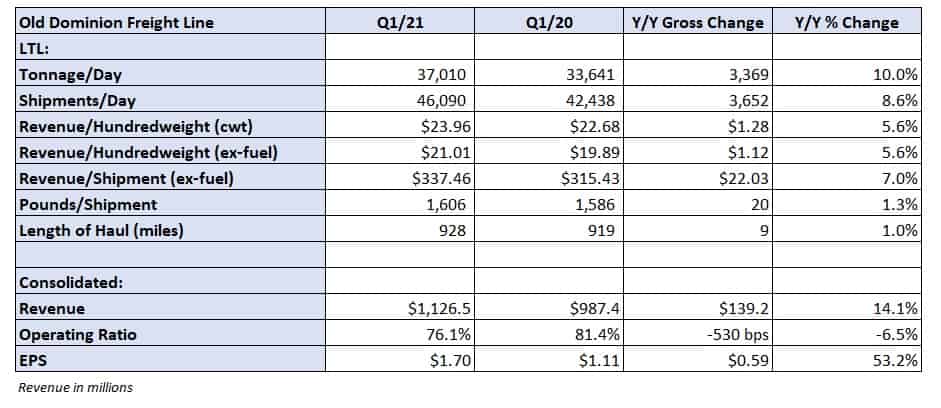

The company reported a 14.1% year-over-year increase in revenue as total tonnage rose 8.3% (shipments up 6.9%) and yields climbed 5.6%. A record first-quarter operating ratio of 76.1%, 530 basis points better year-over-year, was the result of improved yields and weight per shipment (+1.3%).

The end result was earnings of $1.70 per share, 12 cents better than the consensus estimate and way ahead of $1.11 per share in the year-ago quarter.

Share capture follows recent capacity investments

On a Thursday call with analysts, management said capacity isn’t constrained, noting door space availability of roughly 25%.

The remarks contrasted with comments provided by management from freight broker Landstar System (NASDAQ: LSTR) on its Thursday call, which described “utter disruption” in the LTL market. They said capacity was stressed and linehaul demand was unlikely to slow anytime soon.

Old Dominion’s ability to take share stems from past and recent investments.

The company opened or expanded nine facilities in 2020 with plans for similar additions in 2021. The carrier has also been adding employees, announcing plans to add 800 drivers and more than 400 dockworkers in March.

Old Dominion’s real estate budget is $275 million for the full year with $290 million slated for fleet investments.

During the quarter, headcount increased 4.3% sequentially from the fourth quarter. Normally there is no change. Historically, headcount increases 2% on average from the first to the second quarter. This year it may surpass 5%, which is a meaningful move for a company that employs 20,000.

April surge and cost headwinds

Revenue per day is trending 45% to 50% higher year-over-year so far in April. Strong demand has continued into the second quarter, and the year-over-year comparison will benefit from widespread shutdowns during the 2020 second quarter. April is the easiest revenue comp, down 19.3% year-over-year in 2020. The comps build throughout the quarter to down 11.5% by June.

Higher shipment weights and fuel prices will lead to improved yields, or revenue per hundredweight. Management said yields typically increase 1.5% to 2% sequentially in the second quarter and that the company strives to realize 4.5% annual increases on revenue per shipment throughout all phases of the cycle.

Old Dominion tries to capture “a little more” in robust freight markets like this one, indicating “the environment is supportive of our pricing initiatives.” The yield increases are typically only partially offset by 75 to 100 basis points of cost inflation.

There are some cost headwinds.

The annual wage increase averaged 3% to 3.5% in September, and the company is adding headcount, which results in initial productivity declines. Purchased transportation expense is higher, up 100 basis points year-over-year as a percentage of revenue in the first quarter, as spot market rates remain elevated.

Health and dental costs have increased, and travel and entertainment expenses are expected to inflect upward during the year. Incentive compensation will increase as well given the company’s recent financial performance.

While management expects cost per employee to move higher, the salaries, wages and benefits expense line declined 470 basis points as a percentage of revenue in the quarter. Better yields provided the improvement.

The company’s OR usually improves between 360 and 420 bps from the first quarter to the second quarter each year and revenue steps 10% higher. That suggests a low-70% OR could be in store for the second quarter, which would top the 74.5% record set in the third quarter. Management didn’t shy away from this possibility on the call.

Shares of ODFL were up 3% at noon on Thursday compared to the S&P 500, which was flat.