Less-than-truckload carrier Old Dominion Freight Line said Monday that there was no seasonal demand uptick in May, reporting volume metrics that were a little worse than those reported in April when factoring in the prior-year comparisons.

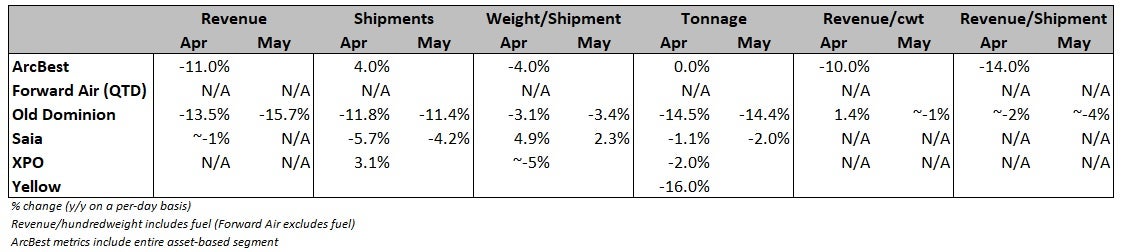

Old Dominion (NASDAQ: ODFL) reported tonnage was down 14.4% year over year (y/y) in May, which followed a previously disclosed decline of 14.5% in April. The tonnage declines were the result of daily shipments dropping between 11% and 12% y/y in each month, with weight per shipment sliding 3%.

While the y/y tonnage declines were similar in both months, the May comp (up 2.3% y/y in 2022) was 410 basis points easier than the April comp (up 6.4%).

Extrapolating the y/y declines, the carrier has seen tonnage dip approximately 2% from the first quarter, which is typically the weakest quarter for freight demand each year. The same math implies shipments are flat with the first quarter. By comparison, Old Dominion normally sees a 2% to 3% increase in shipments from April to May and another 2% sequential bump in June.

The y/y downward volume trends have also accelerated from the first quarter, in which shipments were off 10% and tonnage was down 12%.

For the first two months of the 2023 second quarter, daily revenue was down by a midteen percentage y/y. If the trend holds, the carrier will see revenue fall 1% sequentially from the first quarter, a stretch in which it normally records a 10% increase.

However, the volume comps continue to ease for Old Dominion. Tonnage was flat y/y last June, turning negative in July, with the declines accelerating through the end of the year.

“Old Dominion’s revenue results for May reflect continued softness in the domestic economy as well as a decrease in fuel surcharge revenue,” President and CEO Greg Gantt stated in a Monday evening news release. “While our volumes decreased on a year-over-year basis, our LTL shipments per day remained relatively consistent with the first quarter of 2023 and our yield continued to improve.”

The company was up against tough revenue comps from a year ago as it recorded a y/y topline increase of 29% in April 2022 and a 26% increase the following month.

So far in the quarter, average weekly diesel prices are roughly 27% lower y/y.

Old Dominion holds line on yields

The carrier noted on its first-quarter conference call in late April that it was holding the line on pricing and as a result losing market share to lower-cost carriers. Stacking the volume comps for the past two years shows the company’s tonnage was down 8.1% in April and 12.1% in May.

Management said some shippers were moving freight on a short-term basis to meet internal budgets and that in past cycles freight lost to a competitor usually finds its way back to the network relatively quickly.

Quarter to date, revenue per hundredweight was up 0.1% y/y, 7.9% higher excluding fuel surcharges.

“Our quarter-to-date LTL revenue per hundredweight, excluding fuel surcharges, increased 7.9% due primarily to the ongoing execution of our yield-management strategy,” Gantt said. “As we continue to deliver our unmatched value proposition, and consistently execute on the other key elements of our long-term strategic plan, we believe we will win market share and increase shareholder value over the long term.”

Competitor Saia (NASDAQ: SAIA) reported much more muted volume weakness on Friday. The carrier reported y/y tonnage declines of 1% and 2%, respectively, in April and May. It doesn’t provide any revenue-based metrics in its intraquarter updates.

Old Dominion normally sees 200 bps of sequential operating ratio (expenses expressed as a percentage of revenue) improvement in the second quarter each year, but management said on the first-quarter call that the margin would likely be flat if volumes didn’t improve.

Shares of ODFL were off 1.2% in after-hours trading on Monday, following a 1.9% decline during the day’s session. The S&P 500 was off just 0.2% on Monday.

More FreightWaves articles by Todd Maiden

- Saia’s Q2 update suggests worst of downturn in rearview

- Northeast LTLs combine: RIST Transport acquires AMA Transportation

- Descartes sees February as cycle low point

Coleman T

It was said (hinted) Knight was looking to expand their LTL, so this might be the opportunity to pounce?

Freight Zippy

Interesting, June will be the big month to see what how future plays out for ODFL.

With the Teamsters Union approving a strike at ABF, the upcoming T-Force contract, the ongoing shennagains at Yellow and a potential disruption at UPS Parcel the folks at ODFL may be in a great position with the capacity they created?

Time will tell, but I suspect the folks at ODFL know how to operate an LTL Carrier…