The decline in the price of ultra low sulfur diesel (ULSD) on the CME commodity exchange Friday was historic.

Oil and equity markets fell broadly on fears of the economic impact of the new coronavirus variant. And in the case of the ULSD market on CME, the most basic building block for determining the ultimate retail price of diesel, its decline was one of the largest in the history of the contract going back to 1980.

ULSD on CME dropped 28.85 cents a gallon Friday, to settle at $2.0945. Excluding a few technical moves that are quirks of big movements when one trading month goes off the board, the decline was the second largest in the history of the contract. (The current ULSD contract had been a heating oil contract before the technical specifications of diesel and heating oil aligned through environmental regulations, and the price history of the contract is considered contiguous. Both heating oil and diesel are middle distillates.)

The drop of 28.85 cents a gallon was exceeded only on Jan. 17, 1991, when the price fell 29.6 cents, to 62 cents a gallon. That was the first trading day after the highly successful initial aerial attack on Iraq by allied forces seeking to reverse that country’s invasion of Kuwait. Oil markets had been elevated since the August invasion of Kuwait, but the realization on that first night that the military conflict might be short sent prices falling when trading pits — they existed then — opened the next morning. The decline in January 1991 marked a 32.3% drop, which is the biggest single-day decline percentage-wise as well as its biggest outright slide.

The ULSD settlement Friday of $2.0945 a gallon is the lowest for the contract since it settled at $2.0668 a gallon on Aug. 24.

Percentage-wise, the drop Friday of 12.11% was the third-largest since the start of the pandemic. It was exceeded by a 22.2% decline on March 9, 2020, and a 16.1% decline on April 21 last year, the day after crude oil fell to a negative price for one historic day.

Beyond the pandemic, that 12.11% decline has been exceeded several other times in the history of the heating oil/ULSD contract. So while the outright price drop is historic, the percentage decline might better be described as notable.

While it is too early to know what the reaction of wholesale markets will be to the decline, the reality is that wholesale prices need to stay competitive with prices sold through wholesale distribution channels but on formulas tied to spot prices. Given that, the size of the drop in wholesale levels will generally track broader market moves.

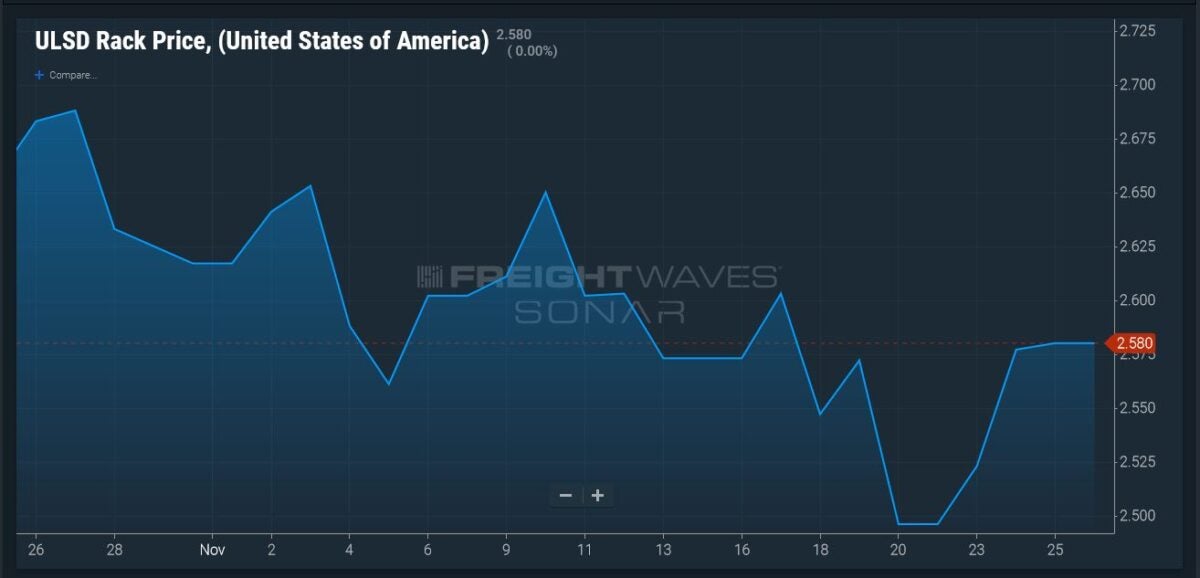

Wholesale prices have been swinging fairly widely in the last month. On October 27, the national average retail price per the ULSDR.USA data stream in SONAR was $2.688/gallon. By October 27, it had decline to $2.496/g before rising to $2.58/g Friday.

What is not known is how physical diesel markets will react to the big decline. Diesel is traded in physical markets as a differential to the CME price. But the major price reporting agencies such as S&P Global Platts do not work on the day after Thanksgiving, which means the traders who buy and sell physical diesel are not active either. Movements in that spread won’t make themselves visible until Monday. Changes in the size of that spread also are a factor in how wholesale prices are adjusted.

As for retail prices, it has long been established that retailers — who make their own decisions on where to set an individual station’s price — try to keep higher prices up as long as possible. With a drop of this magnitude, and uncertainty in how much wholesale numbers will decline in response, measuring when retail buyers will see some of this drop is difficult to predict.

The weekly Department of Energy/Energy Information Administration retail diesel price, the basis for most fuel surcharges, declined last Monday after 10 consecutive weeks of increases to stand at $3.724 a gallon. Recent levels have been the highest since 2008.

One significant development that might come out of what some traders were calling a “flash crash” is that OPEC+ might choose to delay its expected addition of 400,000 barrels a day in production that was assumed for December. OPEC and its non-OPEC member oil-exporting countries led by Russia are to meet next week to determine their next step.

Monthly increases of 400,000 barrels a day from the group have been added consistently to world supply since spring. There is now a question whether given a potential decline in air travel and other economic activity as a result of the new variant, OPEC+ might choose to pass on an increase or make it smaller than planned.

More articles by John Kingston

PAM, flying high on Wall Street, sets $1 billion target for 2025

Close Teamsters vote at XPO Albany certified as win for union

At RailTrends, an introspective look at an industry’s struggle for market share

Ute Becker

I am Earning $81,100 so Far this year working 0nline and I am a full time college student and just working for 3 to 4 hours a day I’ve made such great m0ney.I am Genuinely thankful to and my administrator, It’s’ really user friendly and I’m just so happY that I found out about this

HERE………….>> http://www.EarnApp3.com