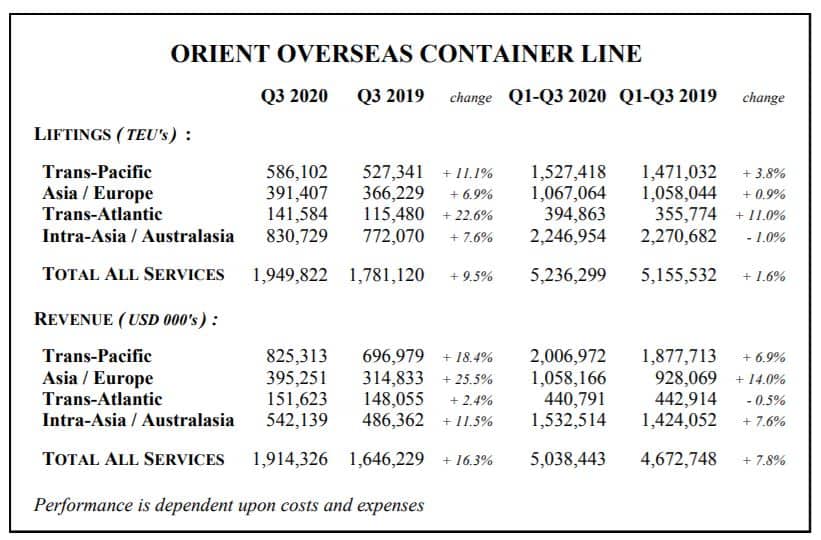

Orient Overseas Container Line (OOCL) posted a 16.3% increase in revenue — a healthy third-quarter recovery from the height of the COVID-19 pandemic.

The Hong Kong-based container carrier reported total Q3 revenue was $1.91 billion. Revenue on trans-Pacific trade was up 18.4% to $825.3 million and 2.4% on the trans-Atlantic to $151.6 million.

Total volumes were up 9.5% from Q3 2019, driven in large part by a 22.6% jump on the trans-Atlantic trade to 141,584 twenty-foot equivalent units (TEUs). Volumes on the trans-Pacific were up 11.1% to 586,102 TEUs. OOCL said it carried a total 1.94 million TEUs in Q3, up from 1.78 million in the third quarter of 2019.

In July, OOCL had reported second-quarter volumes were down 4.6% but total revenues had increased 1.1%. Second-quarter revenues totaled $1.58 billion.

Parent company Orient Overseas (International) Ltd. (OOIL), as usual, issued a brief overview of the third quarter, which ended Sept. 30. The Q3 earnings statement was four paragraphs long, with one of those paragraphs an introduction and the last a disclaimer that the results had not been audited.

Lars Jensen, CEO of SeaIntelligence Consulting, did provide commentary, posting on LinkedIn that the average revenue per TEU on the different trade lanes was interesting to note.

“Pacific rates increased 6.5% year-on-year, which is less than the changes in the available rate indices,” Jensen said, pointing out that the China Containerized Freight Index showed a 32% increase to the U.S. West Coast and 13% to the East Coast. “Spot rates from SCFI (Shanghai Containerized Freight Index) grew 124% to USWC and 48% to USEC. Backhaul spot rates from USWC to Asia grew 17%, according to the WCI (World Container Index) — i.e., OOCL’s rate increase on the Pacific appears to fall well short of the market increases.”

Jensen said it would appear OOCL’s total increase “was in line with [the] market if spot cargo makes up 50% of their total cargo.”

China’s COSCO Shipping Holdings acquired a 75% stake in OOIL in 2018. OOCL, COSCO, CMA CGM and Evergreen are members of the Ocean Alliance, one of the space-sharing agreements among container liner companies.

OOCL second-quarter revenues up, volumes down

OOCL revenue up in turbulent times

IMO hit with cyberattack; CMA CGM suspects data breach

Click for more American Shipper/FreightWaves stories by Senior Editor Kim Link-Wills.