OOIDA on regulatory challenges facing owner-operators

On Wednesday, FreightWaves hosted its Small Fleet & Owner-Operator Summit, with Todd Spencer, president of the Owner-Operator Independent Drivers Association, as its keynote speaker. 2024 is an election year and for OOIDA, the trucking regulatory landscape takes a pause as members of Congress lobby for reelection, diverting attention from passing legislation. Spencer notes, “The unfortunate reality is that this particular Congress is totally engaged in election season, and rather than focusing on some of the issues we would like to see them focus on, they’re pretty much engaged in doing what they think they need to do to retain or gain seats.”

For Spencer, despite the challenges, the goal remains to keep a list of trucking issues top of mind regardless of the outcome. One challenge Spencer highlights is the lack of driver bathroom access where facilities limit use only to employees. One piece of legislation addressing the issue is The Trucking Bathroom Access Act, originally introduced in 2022 and 2023. It would require companies to extend accommodations provided to their workers to truck drivers who deliver into their facilities.

OOIDA is also concerned about actions by government agencies like the Federal Motor Carrier Safety Administration. Recent FMCSA rulemaking regarding mandatory speed limiters is due in May, with Spencer against the mandate that is favored by large nationwide fleets. Spencer notes that lower speeds can cause more issues by impeding traffic. He adds, “I can’t really think of anything much more frustrating than to be in any kind of vehicle and be an impediment to other traffic — a rolling roadblock. And we know a mandate would turn trucks into that, creating frustration and road rage. [Big carriers] may claim to be well meaning, but we’re not buying that nonsense.”

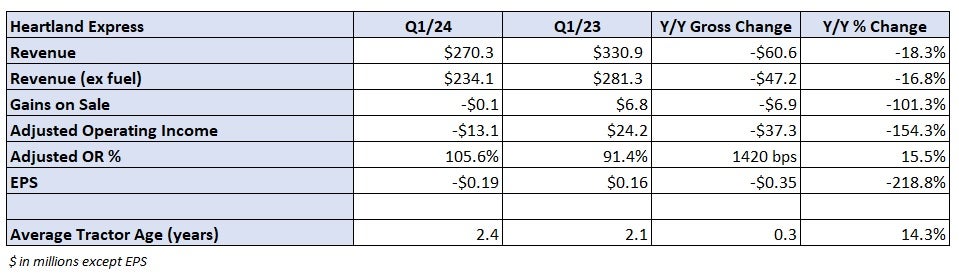

Heartland Express Q1 earnings record $15.1 million net loss

On Tuesday, Iowa-based truckload carrier Heartland Express reported its Q1 earnings, which saw a $15.1 million net loss as cost inflation, lower freight demand and lower freight rates weighed down the company. FreightWaves’ Todd Maiden writes, “Heartland has struggled to integrate two large acquisitions made in rapid succession in mid-2022, shortly after the onset of a freight recession. It normally provides an OR breakdown for recently acquired fleets — Contract Freighters Inc. and Smith Transport — as well as its legacy operations, but didn’t in the Tuesday update.”

Heartland is known for its pricing discipline, so its mention of the challenges means opportunistic shippers are still trying to extract concessions regardless of service. Mike Gerdin, CEO of Heartland Express, said in the earnings release, “we worked to reduce unprofitable freight, did not rely on broker freight, and refused to lower our freight rates to meet the unsustainable requests of certain customers, all of which had a negative impact on our revenues in comparison to the same period of the prior year.”

Driver compensation remains a focus despite the abundance of drivers. For Heartland, the focus appears to be on retaining good drivers, not just filling seats faster. Gerdin adds, “We are fully committed to taking care of our professional drivers as we continued to invest in compensation strategies to preserve the ability of our drivers to make a reasonable wage during these challenging times.” Higher costs are not only impacting carriers but inflation appears to be driving down driver earnings, creating another headwind for carriers attempting to stabilize their personnel costs.

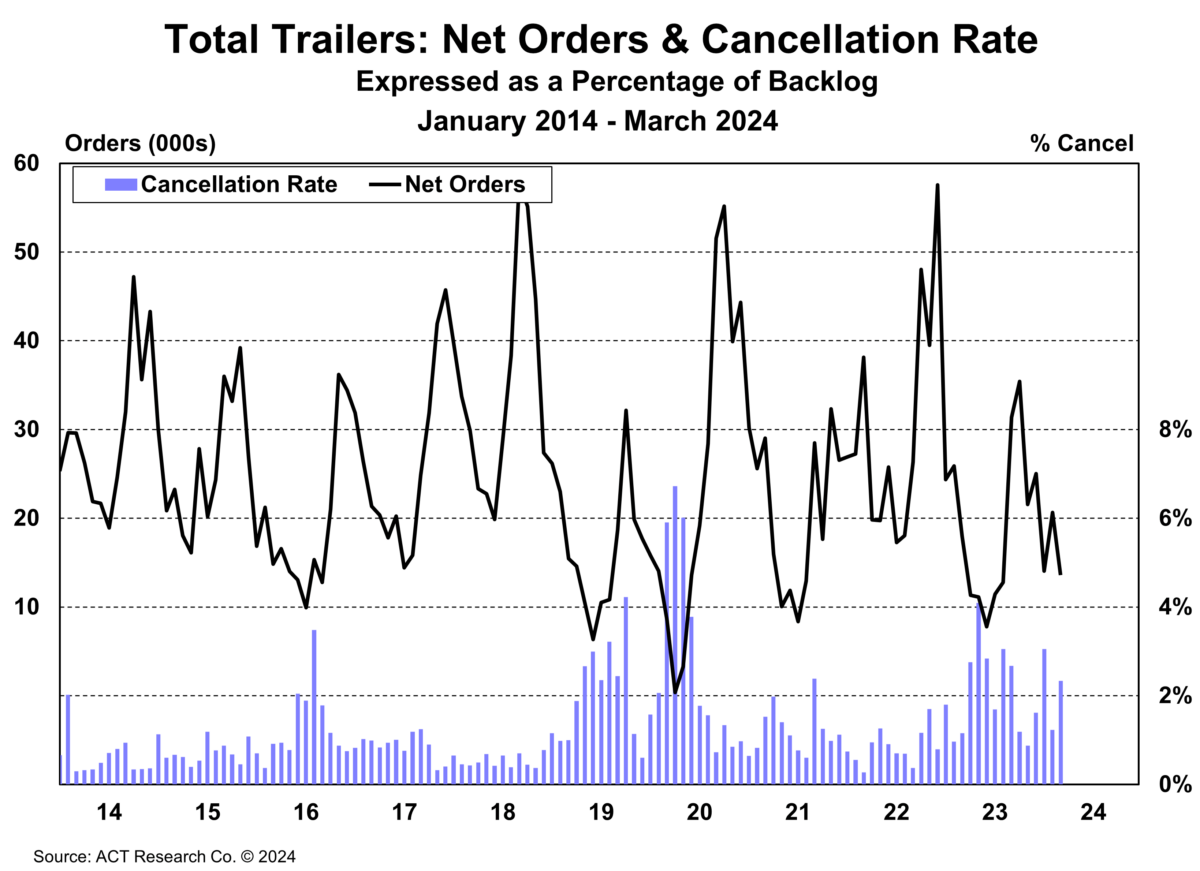

Market update: March trailer demand falls amid less capex spending

Trailer data released Tuesday by ACT Research showed March trailer demand falling amid declines of capital expenditures and concerns over looming Environmental Protection Agency regulations. March trailer net orders fell to 13,600 units seasonally adjusted, compared to February’s net orders of 20,200 units, and they were 25% lower than in March 2023. The declines in trailer orders primarily impacted dry van and flatbed equipment, with reefer units seeing an increase. Regarding March orders, Jennifer McNealy, director–CV Market Research & Publications at ACT Research, said, “orders decreased 32% m/m. Dry van orders contracted 28% y/y, with reefers up 6%, and flats 40% lower compared to March 2023.”

Higher costs continue to impact fleet capex spending plans, but an added cost comes from the recent Phase 3 final rules from the EPA, which will cause the cost of a tractor to rise. McNealy added, “Capex remains constrained, and this means fleets are forced to make even more difficult decisions about how to spend their money. In the current carrier profit trough, the decision is compounded by the impending EPA regulations for power units, which are expected to have materially higher costs. Softer fleet demand isn’t the only thing weighing on the minds of trailer manufacturers, though, as elevated dealer inventories have resulted in waning demand there, too.”

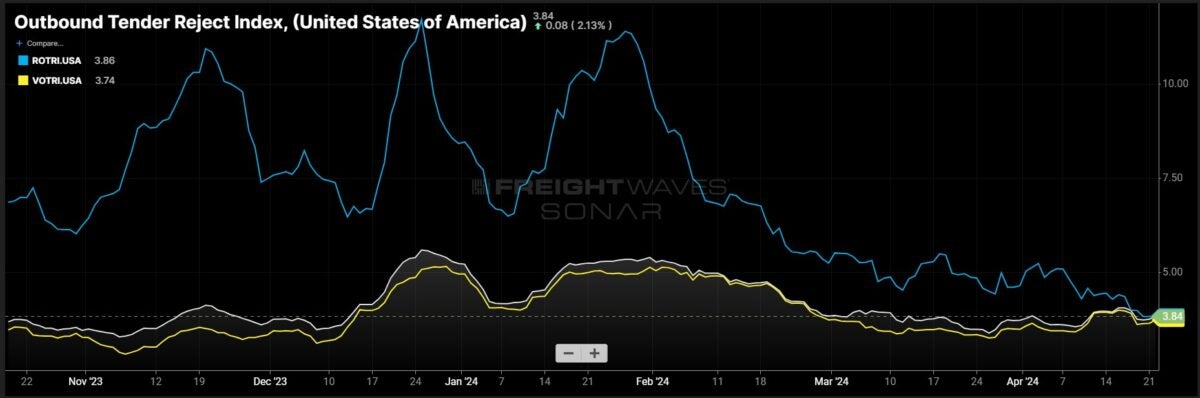

FreightWaves SONAR spotlight: Reefer madness: Tender rejection rates close gap with dry van

Summary: As produce season begins, reefer truckload capacity continues to loosen, driving down outbound tender rejection rates. The gap between reefer tender rejection rates and dry van tender rejection rates is only 12 basis points and appears to be narrowing. In the past week, ROTRI fell 43 bps from 4.29% on April 15 to 3.86%. For comparison, dry van outbound tender rejection rates saw a smaller decline of 18 bps from 3.92% on April 15 to 3.74%.

Part of the decline in reefer tender rejection rates comes from lower reefer outbound tender volumes. Despite an increase of 32.55 points week over week, from 1,234.94 points on April 15 to 1,267.49 points, year-to-date reefer tender volumes are 11% lower. Reefer freight is a smaller and more specialized subset of the truckload segment, necessitating specialized equipment to handle the temperate-controlled requirements. This also means this segment is more sensitive to changes in volumes.

This sensitivity will be put to the test in the coming weeks as May marks the beginning of a gradual stairstep increase in reefer outbound tender volumes as produce season comes to life. Given the excess of reefer truckload capacity, the interim will see increased pressure on spot market rates as reefer carriers attempt to backfill volume losses with dry van freight, typically under 42,000 pounds due to the added weight of the reefer unit.

The Routing Guide: Links from around the web

Covenant’s operating numbers mostly hold up in challenging first quarter (FreightWaves)

FMCSA standing up registration fraud team (FreightWaves)

‘Twitter is the new CB radio,’ says Hellbent Xpress owner Jamie Hagen (FreightWaves)

Landstar still waiting for break in freight recession (FreightWaves)

FMCSA removes inward-facing camera rule from apprenticeship program (Trucking Dive)

Scopelitis seminar delves into lease purchase deals, M&A, ESG and more (FreightWaves)