OOIDA sues EPA over greenhouse gas emissions standards

On Tuesday, the Owner-Operator Independent Drivers Association along with other industry groups filed a petition with the U.S. Court of Appeals for the District of Columbia Circuit challenging the Environmental Protection Agency’s Phase 3 final rule on greenhouse gas emissions standards for heavy-duty vehicles. According to the petition, the court should vacate the EPA rule, as it “exceeds the agency’s statutory authority and is otherwise arbitrary, capricious, an abuse of discretion, and not in accordance with law.”

FreightWaves’ John Gallagher writes that the rule “affects truck model years 2027 through 2032 and applies to a range of truck sizes, from delivery trucks and dump trucks to freight-hauling day-cab and long-haul sleeper-cab trucks. For long-haul tractors, for example, 25% of the fleet would be required to be zero-emission by model year 2032.”

Gallagher noted that a new Class 8 diesel truck costs approximately $180,000 while estimates for a battery-electric truck of similar capabilities would cost around $400,000. The federal government does not appear concerned, as the administration asserts that federal subsidies will bring down the costs while helping the industry adjust to the mandate.

Gallagher also highlighted attempts by lawmakers to spike the rule. “Last month, congressional Republicans initiated an attempt to roll back the rule by introducing in the House and the Senate a joint resolution against it. The legislation has yet to be considered by the relevant committees.”

ACT Research cites impact of Class 8 tractor prebuying on freight cycle

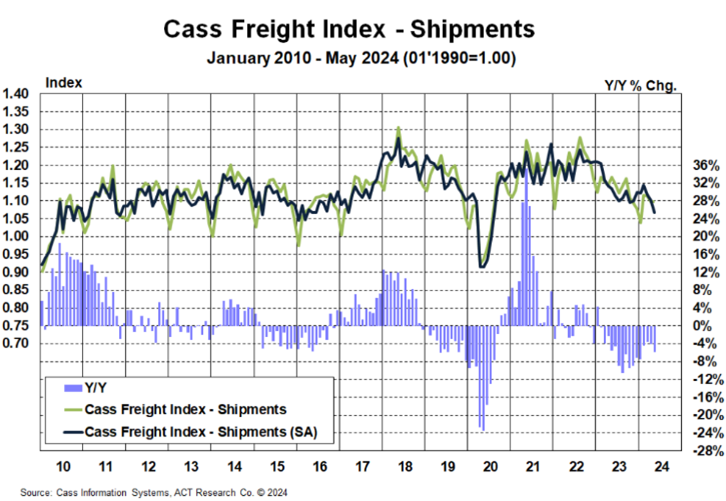

On Tuesday, ACT Research released its June freight and transportation forecast showing May’s disinflationary impact on trucking data. Higher truck orders, lower shipments from the Cass shipments index and the looming impacts of upcoming emissions rules were all noted.

Private fleets continue to draw attention, with their expansion potentially offsetting the loss of smaller fleets. Tim Denoyer, ACT Research’s vice president and senior analyst, said in the report, “Small fleets remain resilient as ever, but the record number of operating authority revocations over the past 18 months shows considerable capacity contraction. For-hire truckload conditions are taking longer to improve this cycle than in prior ones, partly because of that resilience. But we think the ongoing capacity expansion by private fleets is outweighing the capacity contraction in the small part of the market.”

Fleets remain concerned over upcoming changes related to the EPA’s new Phase 3 emissions final rule. “Elevated equipment demand as fleets gear up for EPA’27 is a key factor likely to drag overcapacity on even further. The for-hire cycle will improve once excess capacity additions end. That will likely be a while.”

This has the potential to lead to a bottleneck on new truck orders, as fleets want to lock in the less expensive trucks before 2027. The report adds, “Typically by this point in the cycle, Class 8 tractor orders have fallen considerably further, but longer-term considerations are outweighing cost economics in many cases. Strong truck orders provide more evidence of prebuying ahead of 2027 emissions standards, likely extending overcapacity a while longer.”

Market update: Cass Truckload Linehaul Index improves in May

On Monday, freight audit and payment provider Cass Information Systems released its May Freight Index report, “Same Song, Different Verse.” Part of this stemmed from its shipments index being unchanged in May while softness in the for-hire market persisted. Seasonally adjusted, the index fell 3.1% month over month to a SA 46-month low.

The report notes: “We think the 5.8% y/y decline in the shipments component of the Cass Freight Index was due in part to the consolidation of LTL shipments into TLs and/or insourced to private fleets. The Cass data set has considerable LTL mix, and LTL shipments have been consolidated into truckloads at an outsized pace over the past year.”

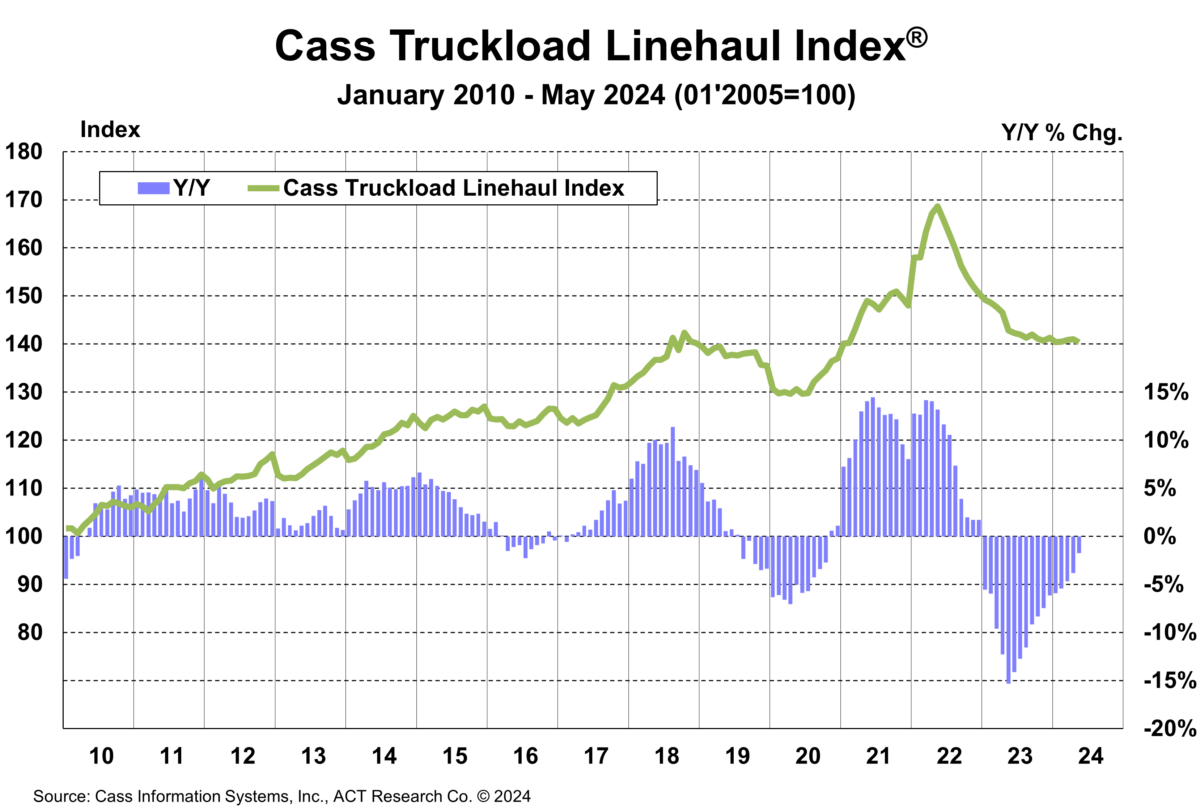

The Cass Truckload Linehaul Index saw a slight decline in May, down 0.5% m/m, breaking three straight months of slight increases. A positive sign was that year-over-year declines lessened to 1.7% compared to 2023. When looking at 2022 to 2023, that May decline was 15% y/y.

These declines in linehaul rates are also impacting contract rate moves. “With spot rates steady over the past several months, downward pressure on the larger contract market is lessening, with few instances of contract rate increases bucking the downtrend recently,” the report stated.

FreightWaves’ Todd Maiden wrote: “Similar commentary was shared by management from carrier Werner Enterprises at an investor conference last week. While rate pressure persists in the current bid season, Werner has been holding the line on pricing as it contends it has no margin left to surrender after years of above-normal cost inflation.”

The report also highlighted the impact of private fleets’ expansion, which is making forecasts challenging. “But we think another key reason is the capacity contraction in the small part of the market is being outweighed by the ongoing private fleet capacity expansion which continues to defy our expectations.”

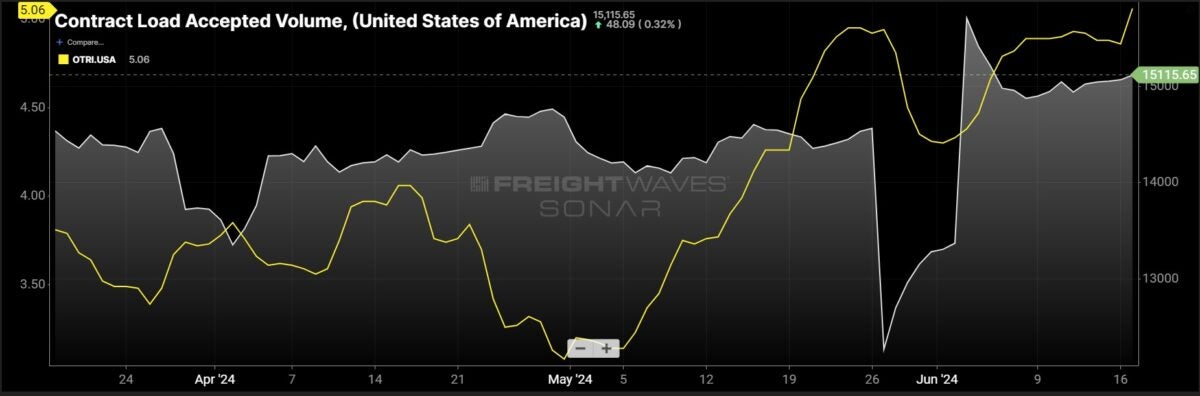

FreightWaves SONAR spotlight: June heats up contracted accepted load volumes

Summary: June contracted accepted load volumes (CLAV) continue to rise following a slight dip from the Memorial Day weekend. CLAV rose 170.02 points or 1.14% in the past week from 14,945.63 points on June 10 to 15,115.65. Month-over-month comps saw a larger improvement compared to this time in May, when CLAV was 570.27 points or 3.92% lower at 14,545.38 points. The increase in CLAV appears to be having an impact on nationwide outbound tender rejection rates, as more volumes begin to strain existing truckload capacity in the contract space. OTRI rose 17 basis points in the past week from 4.89% on June 10 to 5.06%. This is the first time since Feb. 8 that OTRI has been above 5% nationwide.

While the contracted space saw improvements, nationwide dry van spot market rates remain nearly unchanged in the past week, down 1 cent per mile all-in from $2.29 on June 10 to $2.28. A positive sign for a possible dry van spot rate increase is the increase in dry van outbound tender rejection rates. VOTRI is up 35 bps w/w from 4.59% to 4.94% and is at its highest level since Feb 8.

Reefer spot market rates and outbound tender rejection rates remain elevated but saw slight declines week over week. The all-in reefer spot market rate (RTI) fell 2 cents per mile w/w, from $2.56 to $2.54. Similarly, ROTRI declined 146 bps w/w from 8.48% to 7.02%. Reefer spot and contract rate volatility continues to be a positive sign for reefer carriers hoping to see sustained improvement from produce season compared to this time in 2023, when ROTRI was at 4.6%.

The Routing Guide: Links from around the web

Jury slams Schneider National with $47M ‘nuclear verdict’ in fatal crash (FreightWaves)

FMCSA approves 25% fee increase for carriers, brokers (FreightWaves)

Trucking conditions trending up for carriers (Commercial Carrier Journal)

The SCAC renewal deadline is approaching (Fleet Owner)

Averitt prepares for Mexico nearshoring boom with expansion in Texas (FreightWaves)

US logistics inflation remains high despite 11% drop in costs (FreightWaves)