Motive’s July economic report

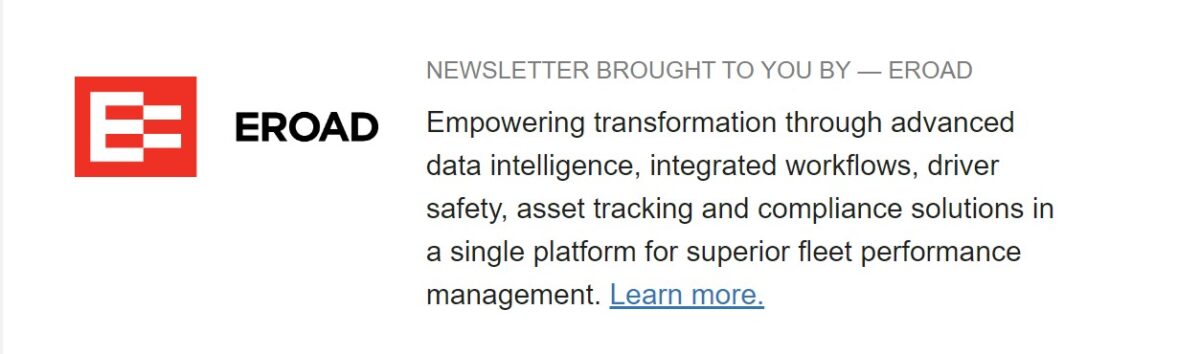

On Wednesday, telematics and analytics provider Motive released its July Monthly Economic Report, which looked at data across its platform of 120,000 customers. July is forecast to see higher retail sales compared to last year as the Fourth of July holiday and Amazon Prime Day drive sales. The foreshadowing of the strong July performance comes from Motive’s June data from its Big Box Retail index, which tracks visits to warehouses of the top 50 U.S. retailers. Restocking jumped 10.8% in June compared to May and 16% year over year. It varied across sectors.

Hamish Woodrow, head of strategic analytics at Motive, wrote in the report, “When it comes to performance across sectors, department stores, apparel & electronics (+32.9% YoY), and home improvement (+24.4% YoY) were top performers in June. Grocery & Superstores and Discount Retailers & Wholesalers also jumped 22.1% and 13% YoY respectively. We’re seeing particularly strong momentum in brick-and-mortar retail as these stores anticipate a very strong summer peak season. For example, department stores, electronics, and apparel retailers with brick-and-mortar locations saw a 13.8% jump heading into July, representing a 33% YoY climb.”

The growth in restocking throughout June and into July so far has not changed the current strategy for retailers, which involves a low-inventory approach and restocking at the last minute based on demand. Motive believes that trucking rates are set to increase in the second half of the year, forcing retailers to adjust this inventory management strategy and hold inventory longer. Higher transportation costs will make restocking more expensive, and Motive expects to see this change take hold by the holiday season.

Preliminary trailer order slowdown continues in June

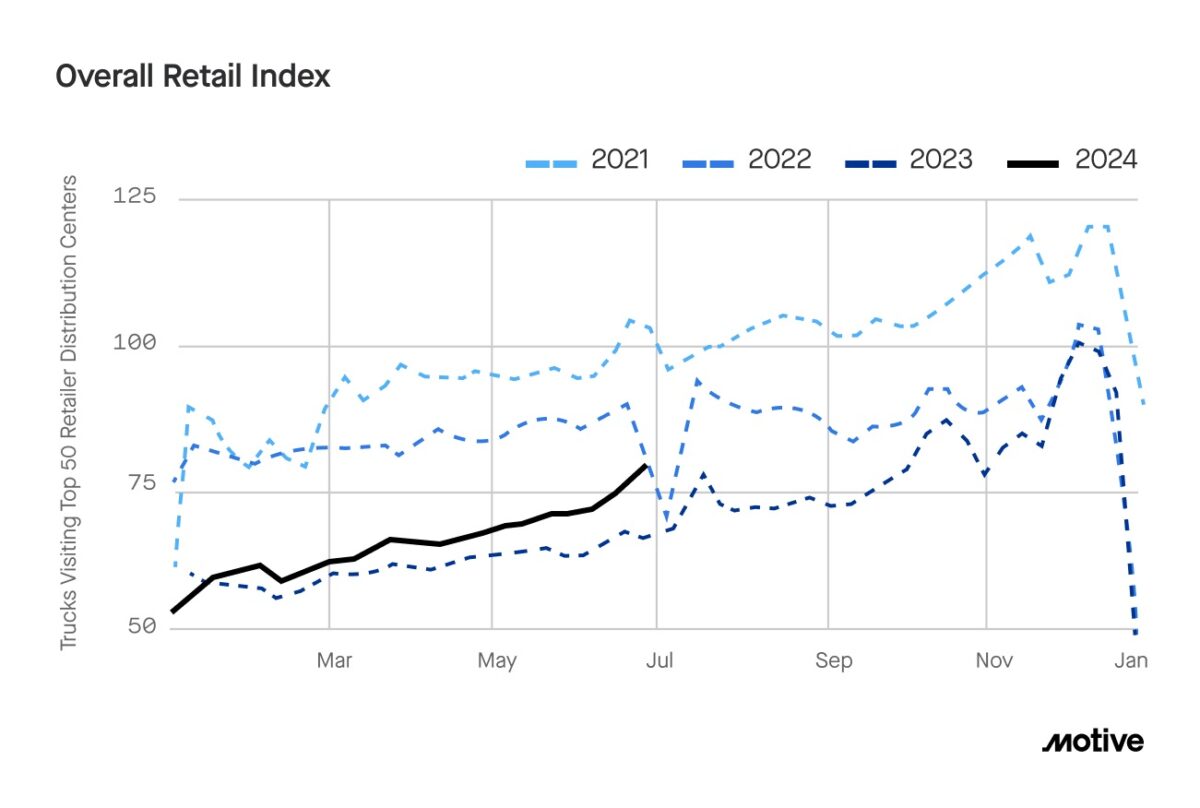

On Tuesday, ACT Research released its figures on June preliminary net trailer orders, which showed a continued slowdown as the trailer market experiences its seasonal slow period. Jennifer McNealy, director, commercial vehicle market research and publications at ACT Research, noted that June data shows 26,000 trailers were ordered in Q2 of 2024, a 14% decline compared to Q2 of ’23. Looking at total orders year to date, the first half of 2024 saw 74,500 orders placed, a decline of 24% or 23,900 units compared to H1 of 2023.

McNealy added that despite the lower numbers, this is in line with consensus based on trailer order seasonality. She wrote: “This year’s slower trailer orders are no surprise given the elevated order velocity of the past few years, and with continuing weak for-hire truck market fundamentals, and already-filled dealer inventories, it looks like trailer demand is likely to remain constrained for some time. That said, it is important to remember that for orders, we are now in the weakest months of the annual cycle, minimally suggesting there is no catalyst for stronger orders before the fall and the OEMs’ opening of their 2025 order books.”

Looking ahead, McNealy said, “Industry anecdotes suggest that the ‘pause button’ is expected to remain pressed through the remainder of 2024. The industry’s largest segments remain under pressure, cancellations remain elevated as dealers and fleets recalibrate their needs.”

Additionally, the looming EPA implementation of 2027 regulations represents another headwind to trailer orders as fleets will prioritize purchasing newer power units before the model year 2027 units, which are expected to be more expensive due to additional emissions regulations.

Market update: Cass June data shows lower shipments paired with hurricane impacts

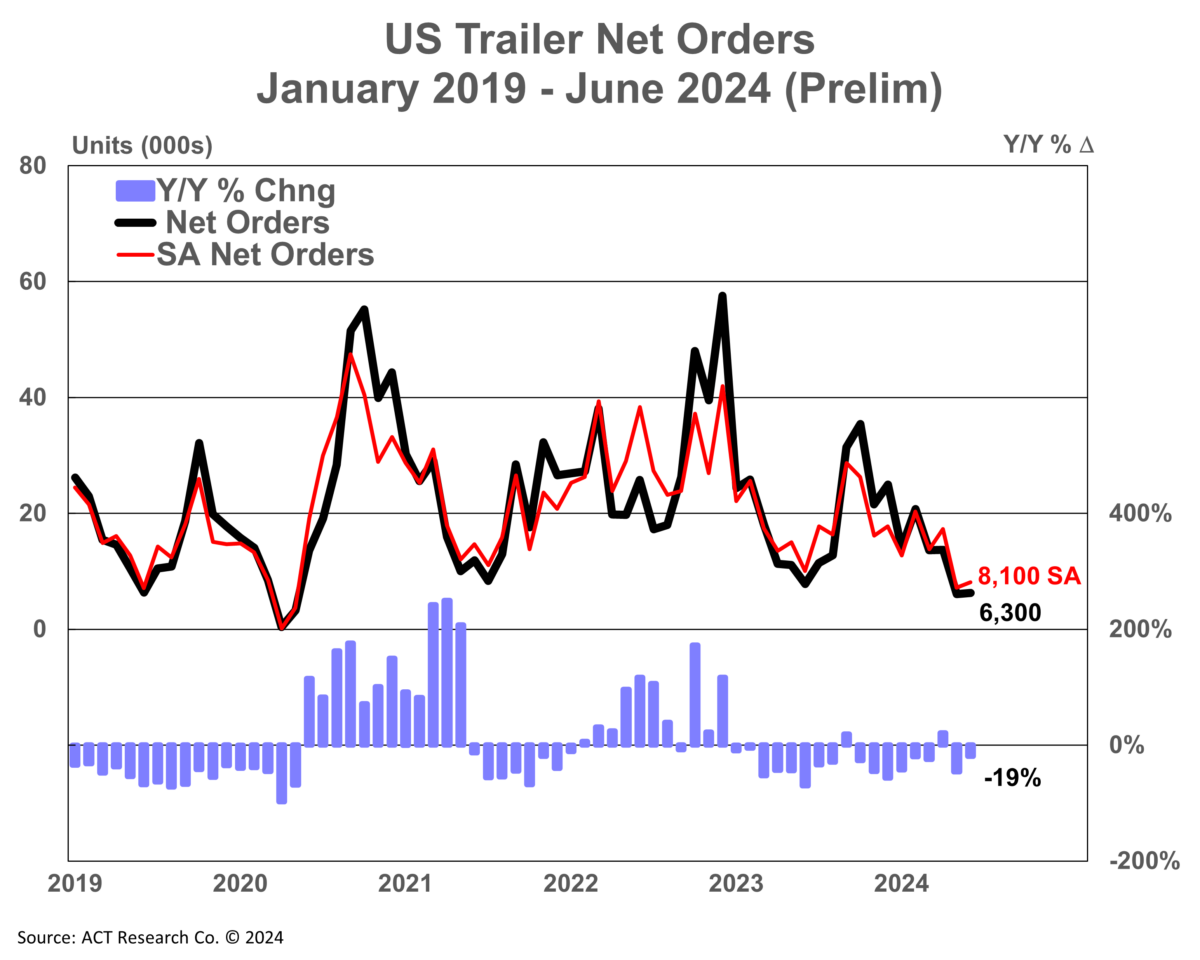

On Monday, audit and payment provider Cass Information Systems released its June Cass Freight Index data, which showed continued deterioration in freight volumes with an added warning for shippers based on the current hurricane season. The shipments index fell 1.8% m/m seasonally adjusted, down 6% y/y. FreightWaves’ Todd Maiden writes, “The shipments subindex fell to its lowest point since January despite June typically being a big month for freight flows. When seasonally adjusted, the index reached its lowest level since July 2020 when widespread COVID-related lockdowns were starting to be lifted.”

Two lingering challenges in the for-hire space remain an abundance of truckload capacity paired with increased private fleet activity in the spot market. The report notes: “The freight market continues to be characterized by overcapacity, and with private fleets engaging in spot activity more than in past cycles, rates remain only slightly above the Q4’23 lows. Owner-operators are resilient as ever, but ongoing private fleet capacity additions are putting less freight into the for-hire market in a slowing economy. We expect the for-hire freight market conditions will improve once excess capacity additions end.”

The report noted that Hurricane Beryl, the earliest Category 5 storm on record, impacted the U.S. in a weakened state but caused $30 billion in damage nonetheless. A more active hurricane season was described by the report as another “different this time” variable shippers need to consider. “But if forecasts for a bad hurricane season are right, and they are so far, shippers will have plenty else to worry about,” added the report.

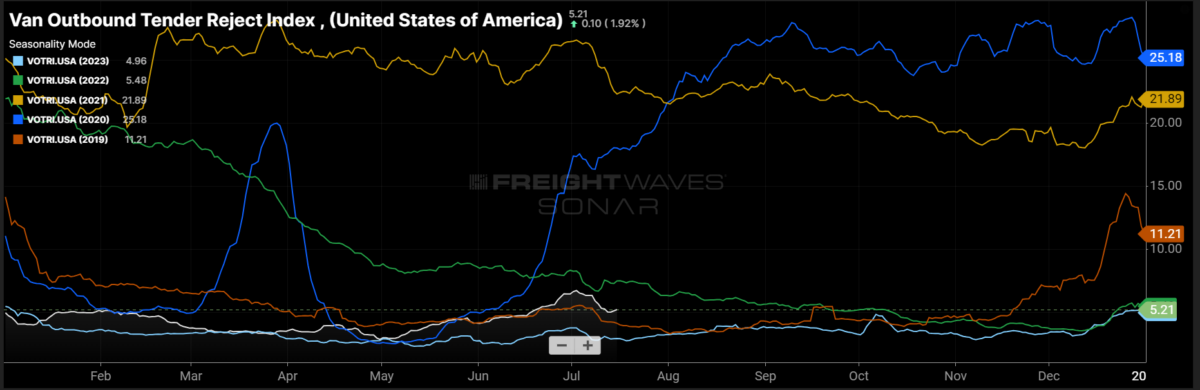

FreightWaves SONAR spotlight: Seasonal trends return for dry van tender rejection rates

Summary: Despite the absence of a sustained post-July Fourth rally, dry van outbound tender rejection rates remain elevated and continue to perform better than at this time last year. While VOTRI fell 68 basis points in the past week from 5.89% on July 8 to 5.21%, it is up 230 bps year over year from July 15, 2023, which saw VOTRI at 2.91%. Nationwide outbound tender rejection rates followed a similar trend, down 54 bps w/w from 5.65% to 5.11% but up 204 bps y/y from 3.07% to 5.11%.

Dry van spot market rates, while down compared to this time last week, continue to improve when compared to last year. The NTI fell 2 cents per mile all-in w/w from $2.37 on July 8 to $2.35. This is still a 10-cent-per-mile improvement compared to 2023 when dry van spot market rates were at $2.25 per mile.

The next big holiday on the freight calendar will be Labor Day, to see if outbound tender rejection rates show greater sensitivity through August and before the first week of September. In the meantime, second-quarter trucking earnings reports are being released this week, which should provide insights into whether carrier executives are optimistic moving into the second half of the year.

The Routing Guide: Links from around the web

Aifleet CEO discusses use of AI to boost driver utilization (FreightWaves)

When Convoy Collapsed, the Uber for Trucking Left Behind Collateral Damage (Inc.)

Cheema Freightlines CEO sees industry becoming more about ‘serious truckers’ (FreightWaves)

Trump’s VP pick supports truck parking, opposes speed limiters (FreightWaves)

Trucking groups receive extension in AB5 appeal (Land Line)

Debate on valuing freight for state income tax purposes heats up (FreightWaves)