A new FreightWaves Intel Group whitepaper reports that 2018 was a tale of two markets. The first half was characterized as, not one of, the best bull market many in the industry had witnessed since deregulation in the early 1980s. Trucking and logistics executives thought a new normal was emerging as trucking capacity trailed far behind a surge in load volumes.

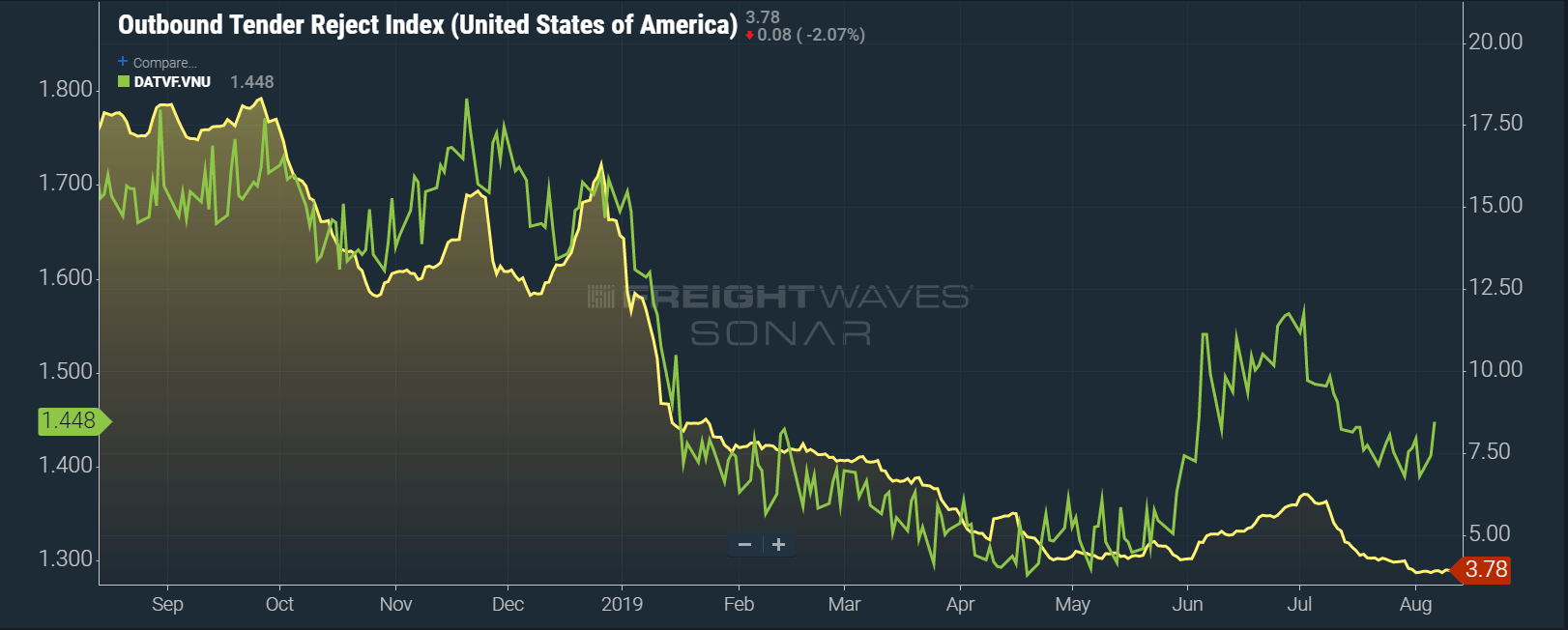

This euphoria did not last long, however. The perfect storm of dual hurricanes, electronic logging device mandates, and an economic boost created by corporate tax cuts, created an increase in load volumes and a constraint on capacity that lasted less than a year. In a five-month span from June to October 2018, tender rejection rates (OTRI.USA) halved from a high of 25.6 percent to 12.8 percent in early October. Tender rejection rates continued to fall following the holiday season and were under 6 percent at the end of June 2019.

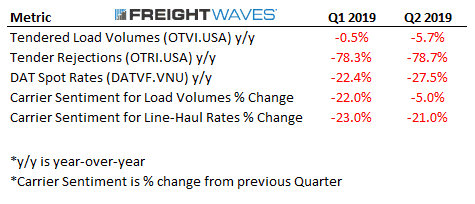

While there is not a universally accepted definition for a freight recession, FreightWaves believes any definition should include some combination of multi-quarter consecutive drops in tender load volumes, tender rejections, spot rates and market sentiment.

Based on the declines described in the table above, it is clear that the first half of 2019 the freight market has been in a freight recession. Carrier Outlook: Over-capacity and the Freight Recession of 2019 is now available to FreightWaves SONAR subscribers on the SONAR platform. The research goes into detail about the freight recession and what is ahead.

While load volumes have remained steady and showed signs of life in July, line-haul rates (DATVF.VNU) and tender rejections (OTRI.USA) are still struggling. The most likely cause is a continued over-capacity in trucking.

Over-capacity in the trucking industry

The slight decline in load volumes combined with the sharp loosening of capacity has led to the popular narrative of over-capacity in the market.

And for good reason too.

2018 was a record-breaking year for new truck orders as carriers rushed to increase capacity to capitalize on the unprecedented bull market. This led to over-capacity in the market that has continued to drag down rates through the first half of 2019.

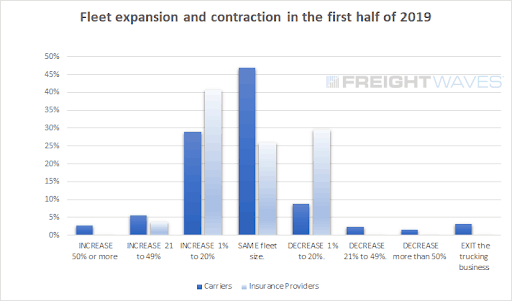

In its second quarter 2019 survey, FreightWaves asked carriers how much capacity they had added in the preceding 12 months. Nearly 50 percent of respondents had added capacity, with most growing their fleets between 1 to 20 percent. Only 15 percent of fleets had reduced capacity during this same time period.

While many industry experts (including FreightWaves) predicted small-and medium-sized carriers would begin selling off unprofitable trucks, this has not happened yet.

Surprisingly, it does not look like carriers are planning to begin to shed assets any time soon. Used truck values remain steady, even up 6 percent year-over-year in June according to ACT Research. Added evidence to this trend was seen in FreightWaves current carrier survey.

As seen in the chart below, even in a freight recession, carriers (dark blue) still plan to add capacity over the next 12 months. Forty-seven percent plan to remain the same size, while 37 percent plan to increase their fleet size over the next year.

Fleets running between 50 to 99 trucks were the most optimistic segment of the carriers FreightWaves surveyed. Plans to expand were more than double any other fleet segment.

*Notes: Carriers were asked about expansion or contraction plans over the next 12 months. Insurance companies were asked about policy renewals year-to-date in 2019.

For a trucking market drowning in capacity it seems odd that carriers still plan to add capacity. So, to add more depth to these results FreightWaves decided to survey insurance companies that specialize in underwriting insurance policies for trucking fleets.

The insurance survey (light blue) closely follows results from the Carrier Outlook Survey. Forty percent of policy renewals year-to-date have seen expanding fleets. With this said, it also indicates about twice as many fleets are contracting than what is seen in the Carrier Outlook Survey.

Has carrier sentiment reached a bottom?

Expanding fleet sizes in an environment of stagnant load volumes and over-capacity seems counter-intuitive. One would think carriers are highly optimistic about the second half of 2019 compared to 2018. Or at least a tiny bit optimistic.

Comparing carrier optimism from September of 2018 until July of 2019 indicates expectations for the second half of this year can be characterized as anything but positive.

Expectations for an increase in freight volumes are 31 percent among carriers. This level is a mere half of what they were last year. The outlook for increases in line-haul rates are even worse, dropping by two-thirds to 20 percent since the fourth quarter of 2018.

Carrier expectations for diesel pricing is one of the few positive expectations, dropping from 76 percent over the past nine months to only 45 percent who anticipate higher diesel prices for the remainder of the year compared to 2018. However, this may be misplaced as IMO 2020 is right around the corner and will most likely lead to higher diesel prices.

“Buy when there’s blood in the streets”

Enough with all this bad news though. As the saying goes, “buy when there’s blood in the streets.” There are enough positives in the freight markets now that it could be signaling better days ahead. Or at least defining a bottom of the recessionary trough.

Most notably, outbound tender volumes finished July at 2.24 percent higher year-over-year. July load volumes look even stronger using a 60-day moving average to compare year-over-year results.

Year-over-year load volume comparables will only get easier to achieve for the rest of 2019 and the first half of 2020. Assuming, of course, the economy keeps humming along at its current pace. If it does then it should be good news for trucking and logistics companies that have been up against some of the toughest year-over-year comparables for revenue and earnings that they have ever seen.

For all carriers and freight brokers it should signal at least a slightly higher floor for contract prices in the next round of negotiations. Based on several data points and industry insiders, shippers are aggressively clawing back the contract rate concessions they made over the past 12 months.

Carrier sentiment is also so low right now, that it can be viewed as a positive. It can always sink lower, but with an uptick in load volumes and any good news at all for contract rates, sentiment should slowly climb over the next few months.

For spot rates though, it is likely to get a bit bloodier before it gets better. It is likely that rates and rejections lag far behind any recovery in load volumes as the freight market is still flooded with capacity.

Until the supply of trucks shrinks to meet load volumes, rates will stay flat at levels far below 2018. Based on our survey data and the values in the retail Class 8 truck markets this has not happened yet, and may not happen quickly enough for most carriers.

Steven

Maybe it’s time to report volatility too…since only negative news are reported.

Hopefully this is not MSNBC news.

David Wilde

We are being absolutely ruined by increases in foreign drivers. The ones that are immigrants are subsidized by the gov’t and get a free ride. Then the NAFTA drivers STILL go where ever they want for loads. We remain restricted.

Rates are in the tank for a huge number of reason. One of the biggest factors is idiots taking below min rates for pennies on the dollar, OR underbidding just to get the pennies on the dollar. Huge companies it doesn’t hurt so bad, they get giant discounts on everything because of volume. Small independents are getting slammed because we do not move the volume, can’t get better rates and brokers are just being A**holes. Not to mention that manufacturers and shippers are NOT lowering item costs to the consumer. They are actually making even more of a profit by holding the industry hostage and demanding the lower rates for BS excuses. Self driving trucks, ELD’s, Taxes, Surcharges, Road use, Tolls, Fuel, Maintenance, Repairs, insurance, truck pymts! NONE of these are or can be covered at $1.00 a mile or less.

I was told by a broker at TQL that a load I inquired about was going for 77 cents a mile, and I better get used to it. I’ve even had brokers laugh at me on the phone when I ask for a decent living rate. Then they hang up… This S**t is real. If we don’t come together and put a stop to this, a lot of us won’t be around come the end of the year. And yes, I know some of you are happy about less competition. It will bite you in the a** in the long run. Good luck, God Bless.

Bill Hood

The media has power and I understand that you need headlines for clicks. But comparing YOY is not a valid comparison in terms of markets. Discussing SPOT rates when discussing capacity is interesting. Talking about a freight recession when freight volumes have increased doesn’t just start moving towards the manipulating data to sell a story but has jumped the line completely. And we haven’t even talked about comparing rates to past years without looking at 2018.

I would like to learn more about how shippers have changed their game plan because of 2018.

Marvin

Carriers are cutting costs as fast as they can to try to make up for the lower rates we are seeing. It seems to me they are turning to more technology solutions to do so like better / cheaper ELD’s (Keeptruckin anyone?) and dumping the older more expensive providers. They are also getting rid of the older TMS systems and moving to something like AscendTMS (it’s free for the small guys), and moving driver recruiting and management to things like Driver Reach rather that advertising traditionally and processing driver applications manually.

These lower rates are PUSHING the carriers – especially the smaller carrier – to become more efficient and more tech friendly – which is good for everyone over the long term.

Bill Hood

If you are talking about going from Omnitracs to something else I can see it but KT only hits cheaper. I would suspect that many that are caught in the spot rate desperation are using KT and looking to replace it with more stable, not pay a year in advance, not have to dodge endless sales calls ELD.