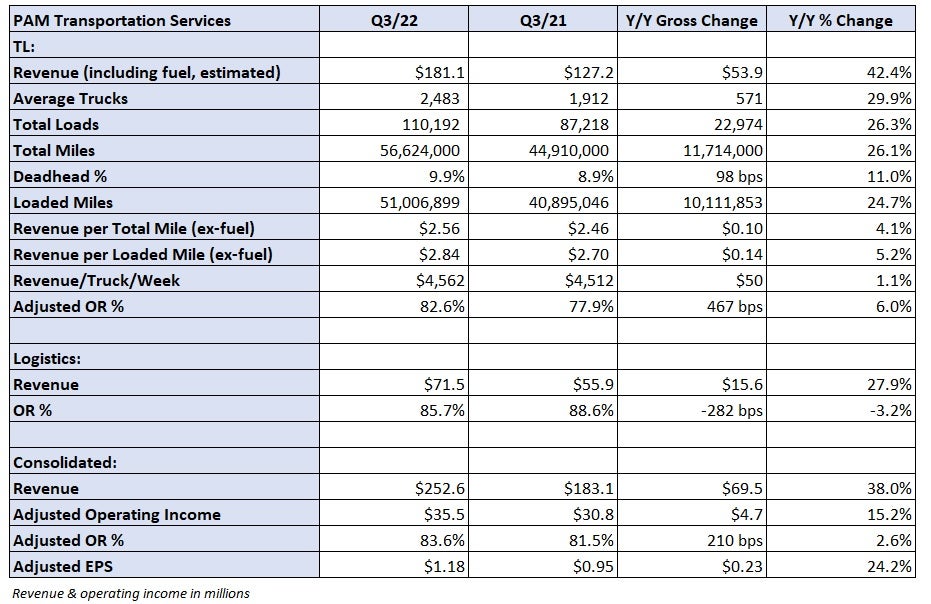

Truckload carrier P.A.M. Transportation Services reported adjusted earnings per share of $1.18, which excluded 9 cents per share of unrealized losses from equity investments on an after-tax basis.

The result was 3 cents better than the consensus estimate and 23 cents higher year over year (y/y).

Revenue in Pam’s (NASDAQ: PTSI) truckload segment was 31% higher y/y at $145 million excluding fuel surcharges. Pam’s average truck count was up 30% y/y at 2,483 units in part due to the acquisition of Metropolitan Trucking Inc. in June. That carrier runs a fleet of 320 trucks generating more than $80 million in annual revenue.

The adjusted operating ratio in the TL unit deteriorated 470 basis y/y points to 82.6%. Utilization declined as loaded miles per truck were down 4% y/y. Revenue per loaded mile excluding fuel was up 5% y/y to $2.84. On a consolidated basis, the wage and comp line increased 100 bps as a percentage of revenue.

Logistics revenue increased 28% y/y to $71.5 million. Pam doesn’t provide load or revenue-per-load data for its brokerage business. The OR in the division improved 280 bps to 85.7%.

“Improved [OEM] equipment delivery times” allowed Pam to take possession of most of its truck order for the year, but delays with trailer production have continued. It held equipment longer than in normal trade cycles to facilitate organic fleet growth of approximately 13% y/y. The average age of its truck fleet was 2.1 years at the end of the quarter, up from 1.8 years at the end of 2021. Its trailers are nearly a full year older at 6.4 years on average.

The company said it has not incurred any significant increase in maintenance expenses due to the extended trade cycle.

Pam ended the quarter with $138.5 million in cash, equity securities and liquidity on its revolver compared to outstanding debt of $258.4 million.

It generated $120.1 million in cash flow from operations. Through the third quarter, it has repurchased $5.9 million of its stock.

“Our driving associates continue to be a cornerstone of our success and we appreciate all they sacrifice to help us achieve these results,” President Joe Vitiritto stated in a news release. “Although we had a record revenue quarter, our culture is to never be satisfied with our results and continually look for areas to improve.”

More FreightWaves articles by Todd Maiden

- Logistics real estate market moderating but rents going higher

- J.B. Hunt looks to balance costs with moderating demand

- XPO, RXO financial targets imply no letup through 2027