On its earnings conference call, truckload (TL) carrier Werner Enterprises’ (NASDAQ: WERN) management team outlined the company’s sustainable model, which is designed to weather a downturn like the current one.

“No one is immune from this pandemic,” said Werner’s President and CEO, Derek Leathers.

Leathers believes that the second quarter of 2020 will be the worst of the COVID-19-related demand degradation, which has created a prolonged closure of many businesses throughout the majority of the country.

The company reported adjusted earnings per share of 40 cents, better than the consensus estimate of 35 cents. The result excludes $5 million in accelerated depreciation expense for the rapid depreciation of trucks that will be sold in 2020. The depreciated values will better reflect current residual values in a declining used-equipment market. Additionally, $1.2 million in pretax insurance and claims expense from an “excess adverse jury verdict” that is being appealed was excluded. The adjusted results did include $10 million in insurance and claims expense accrual for a “serious truck accident claim” that occurred during the quarter.

The Omaha, Nebraska-based carrier generates roughly 85% of its revenue from its top-100 customers. In the first quarter of 2020, 62% of the company’s revenue was produced by shipping goods in essential segments like discount retail, home improvement, food and beverage, and consumer packaged goods. The company’s dedicated segment saw 73% of its revenue come from this group.

Management sees its 60%-40% dedicated-one-way revenue mix as defensive during economic downturns without losing the ability to capture new freight opportunities when the market turns. They believe that the dedicated portion of the current freight mix could move higher as “quality shippers” continue to look to partner with “quality carriers.”

The company has completed one-third of its contractual bid renewals for 2020 with largely flat results to date. However, there has been additional noise in this bid season as some shippers have delayed or closed out the bid process due to a general lack of visibility. Management said the current bid pipeline is the strongest it has been in the past eight quarters, noting a good amount of pent-up bid activity for its dedicated offering. That said, some nontraditional dedicated carriers are attempting to lock up commitments for truck capacity, which is creating a bit of a headwind in negotiations. Management expects dedicated revenue per tractor per week to moderate, but not turn negative.

Management believes that the company is well suited to take advantage of an economic uptick at some point, but noted that driver enrollments in the schools have been cut in half during the pandemic. The carrier saw its driver turnover improve as the quarter progressed and lockdown mandates spread. However, management expects new driver entrants to remain low in the near term as many driver schools closed or lowered enrollment to preserve social distancing measures. Further, they believe robust unemployment stimulus benefits and the potential for national infrastructure initiatives could steer applicants away from the industry.

Guidance

Werner updated guidance for the year. The company now expects its total tractor count to be 5% lower to flat compared to the end of 2019. The prior guidance called for the tractor count to be down 3% to up 1%. Guidance for gains on the sale of tractors and trailers, booked as an offset to other operating expenses, was withdrawn due to diminished visibility and “very low” demand in the used-truck market.

One-way revenue per total mile is still expected to be down 7% to 5% year-over-year in the first half partly due to tougher comparisons. Management noted a “very difficult freight market in May and June 2020.”

Net capital expenditures (capex) is still expected to be in the $260 million to $300 million range. Werner has reduced its fleet replacement capex by $40 million, but this is expected to be completely offset by lower gains on sales.

Management expects to maintain the current equipment ages of 2 years on average for trucks and 4.1 years for trailers moving forward.

The company has temporarily suspended its share repurchase program and lowered executive salaries by 10% to 25%. Werner plans to continue to pay its regular quarterly dividend of 9 cents per share.

First Quarter 2020

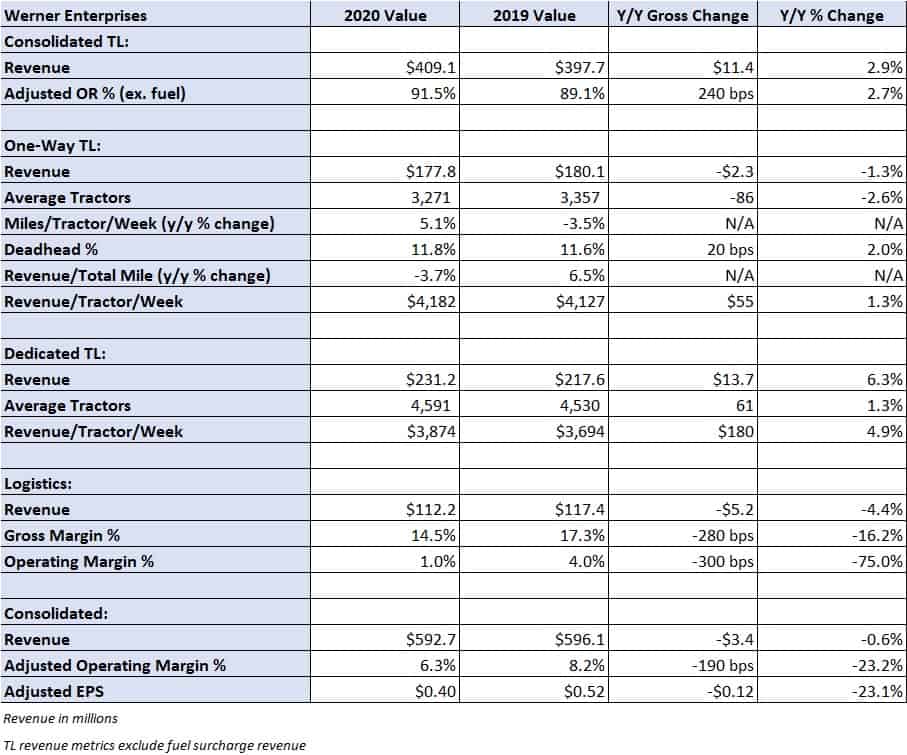

Werner reported first-quarter revenue basically flat year-over-year at $593 million. The company’s one-way TL segment reported a 1.3% increase in revenue per tractor per week to $4,182 as miles per tractor per week increased 5.1%, partially offset by a 3.7% decline in revenue per total mile. Werner’s dedicated segment saw a 4.9% year-over-year increase in revenue per tractor per week to $3,874, leading to a dedicated revenue increase of 6.3% with average tractors rising only 1.3%.

The company’s logistics segment reported a 4.4% year-over-year decline in revenue to $112 million as brokerage volumes “were challenged” in a “slowing freight economy.” TL logistics revenue declined 9% on fewer transaction opportunities in the period. TL logistics load count increased 1% as contractual volumes increased, but revenue per load moved 10% lower. Gross margin in the logistics segment fell 280 basis points to 14.5% as the cost of purchased transportation increased due to consumers stocking up their pantries as lockdown mandates took hold. The division reported $1.1 million in operating income.

Werner ended the quarter with $72 million in cash, $250 million in outstanding debt and $352 million in liquidity. Werner’s net debt-to-last twelve months’ (LTM) earnings before interest, taxes, depreciation and amortization (EBITDA) was 0.4 times, well below the less than 2.5x required by its debt covenants. The company repaid $50 million of its debt during the first quarter.

Werner announced that it will provide up to two weeks’ pay for associates unable to work because of COVID-19 as well as an additional $1 million in assistance for associates affected by the virus. The company’s founder and chairman, C.L. Werner, has also pledged $250,000 in relief.

Shares of WERN are up more than 5% in after-hours trading.

Robert jones

This is one of the companies totally responsible for the low wages in the trucking industry. They place unsafe and untrained drivers on the roads that endanger the nation. These “numbers” are mostly likely false and the SEC should investigate and hopefully close this menace to the highways down.

TCS53

He’s right you know☝🏻