Capacity management platform Parade announced Thursday it has closed a $17 million venture round led by I Squared Capital to continue enhancing its product.

“We’re excited to lead Parade’s funding round at a transformative time for the freight industry, which is on the cusp of a tech revolution. Parade’s AI-driven solutions are poised to unlock huge productivity gains in this industry often characterized by cautious adoption of technology,” said Kevin Crull, global infratech fund partner at I Squared Capital.

The round included participation from existing investors including Menlo, Greenhawk Capital, Jones Capital, The House Fund, Operator Stack and undisclosed angel investors. It also included new investors Earthshot Ventures, Lineage Logistics, 9Yards Capital, RedBird Capital, Rising Tide Fund, McVestCo, Ubiquoss and angel investor Malte Janzarik.

The company has raised a total of $36 million since 2015.

Anthony Sutardja, co-founder and CEO of Parade, told FreightWaves the new capital will go into growing its customer base and bringing more products to market leveraging AI to help brokers win more freight throughout RFP season.

| Funding details | Parade |

|---|---|

| Funding amount | $17 million |

| Funding round | Venture capital |

| Lead investors | I Squared Capital |

| Secondary investors | Menlo, Greenhawk Capital, Jones Capital, The House Fund, Operator Stack, Earthshot Ventures, Lineage Logistics, 9Yards Capital, RedBird Capital, Rising Tide Fund, McVestCo, Ubiquoss, angel investor Malte Janzarik and undisclosed angel investors |

| Business goals for the round | Improve AI offerings and create solutions for brokers’ bid season |

| Total funding | $36 million |

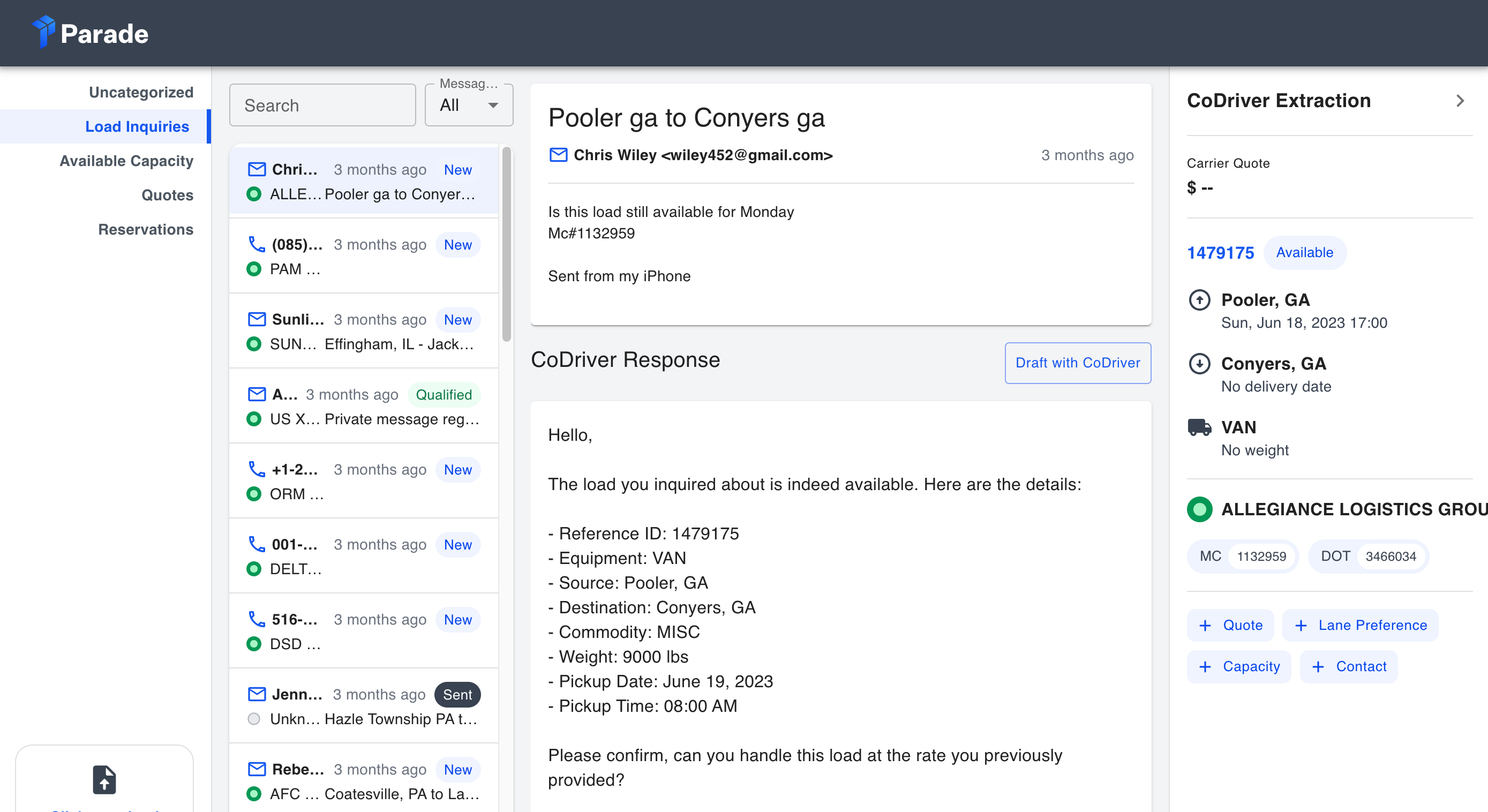

“At the end of the day, we are driving towards this transactional exchange of information between brokers and carriers,” he said. “They need to know more details about the shipment, like hours of pickup, and delivery time requirements, and often what is on a load posting is not enough to describe all that information. … By using generative AI we can automate these conversations using our co-driver capacity product.”

“Also, I think in the coming months we are focused on helping brokers win more freight. That is where generative AI and predictive AI can work together. Pricing requires a keen understanding of networks, and we have already announced our initial dynamic pricing tool for brokers. The next step is to help them actually go win freight more automatically, helping them scale up.”

Sutardja added that with current market conditions, paired with the increased emphasis on the operational efficiencies digital players can provide, brokers’ margins will be depressing.

“The digital experience is the new way of doing business and for the traditional folks out there, what does it really mean to operate in an upcycle? Traditional brokers need to catch up very quickly and need to be able to operate at the same scale as the digital folks who are already operating. The role of the carrier sales rep will begin to change and manage a lot more freight, and I think there is no better time to start investing in operations right now,” he explained.

The company has over $11 billion in annual freight volume flowing through its system and using that data, along with its fresh capital to develop more tools and deepen its relationships with partners including transportation management systems, load boards, benchmarking tools, onboarding solutions and other carrier components.

Read more

Terminal Industries departs stealth mode with $17M for AI yard operations

Rose Rocket closes $38M Series B to expand into enterprise fleet solutions

GoodShip raises $5M to provide analytics to both shippers and carriers