The most recent metrics from the Port of Los Angeles show supply chain constraints are still hovering near record levels, a trend that is expected to carry into 2022.

During a monthly update, Gene Seroka, the port’s executive director, said dwell times for containers remain at or near all-time highs, with “significant volume headed our way throughout this year and into 2022.”

As of mid-September, dwell time for containers at terminals was six days, the highest since the volume surge began more than a year ago. On-dock rail wait time was 11.7 days, compared to the recent peak of 13.4 days, as four times the average number of containers were waiting to be loaded on railcars.

The port’s Pool of Pools chassis, which are jointly managed by Direct ChassisLink Inc. (DCLI) and two other intermodal equipment providers, were waiting 8.5 days (8.8 days was the recent peak) on the street for space to open at the warehouses as “disruptions continue at every node in the supply chain,” Seroka said.

Lack of labor the real headwind

“The biggest thing we’re seeing is just the amount of time that customers are holding on to chassis,” Mike O’Malley, SVP government and public relations at DCLI, told FreightWaves in an interview. “In LA for example, it’s up probably 70% over norm.”

This has resulted in a good portion of the company’s fleet being utilized by customers simply holding on to equipment longer.

“They may be doing that because the warehouse is full and they’ve got a full container sitting there on a chassis waiting to be unloaded,” O’Malley said. “It may be that they can’t find enough drivers to pick up the container that’s sitting on a chassis near the terminal or at a facility. It’s all those things across the supply chain, much of which are labor-related.”

Hiring headwinds are stretching throughout the supply chain. Carriers continue to pay more to attract drivers, with shippers and warehouse operators struggling to find the dockworkers needed to unload freight and keep equipment flowing through the system.

A number of stimulus payments as well as enhanced unemployment benefits throughout the pandemic have constrained hiring. Also, a multiyear pull forward of e-commerce demand has added to the need for incremental headcount.

Under normal circumstances, DCLI said it has enough chassis to cover the current influx of containers.

“If you had ample labor, while supply would be tight, you’d be seeing throughput in the warehouses that would keep that end element flowing enough to where our chassis are coming back in five and a half days and not eight,” said Ryan Houfek, chief commercial officer at DCLI.

“In that case you would have enough chassis to meet demand,” Houfek continued. Without the labor issues, “you’re still operating the system at a really high level of utilization,” he added. “But freight would flow reasonably well.”

Not playing the rate game yet

DCLI said it is seeing instances in which truckers are holding onto chassis for an extra day or two versus returning the equipment briefly before leasing it out again. At a rate of $20 to $30 per day, carriers would rather pay for the extra day than risk not having equipment when they need it.

“In a normal circumstance, your chassis rental rates and economics drive a lot of behavior,” Houfek said. “Right now, we’re not sure that’s true.”

Asked why DCLI isn’t pushing rates higher given the current market or as an incentive for carriers to turn equipment faster, Houfek replied: “Even if we doubled our chassis rates, it’s not clear that would work. It really is a function of things outside of the trucker’s control that are determining this extended usage cycle that we are seeing on our assets.”

While the company is evaluating options to encourage faster turn times, it is taking the long approach with its customers, sacrificing some gain today for established relationships and greater market share down the road. However, it acknowledged increased chassis production costs will have to be addressed through pricing at some point.

Buying everything in sight

DCLI is the largest intermodal equipment provider in the U.S., operating a fleet of 140,000 of the industry’s roughly 600,000 marine chassis. A spinoff of Maersk (OTC US: AMKBY), the company has invested $2 billion over the past decade to grow its fleet from 64,000 units to the current level while at the same time upgrading the units to include items like radial tires, GPS monitoring and LED lighting.

The company is buying all of the chassis it can. It has secured capacity for over 30,000 marine and domestic chassis in 2021 and 2022 but acknowledged production headwinds at the manufacturers are limiting additions to the pools currently.

The U.S. Department of Commerce ruled in May that anti-dumping levies imposed at the end of 2020 on Chinese-manufactured chassis will remain in place. China Intermodal Marine Containers (CIMC), the largest chassis manufacturer in the world, was found to have dumped chassis in the market to manipulate prices.

The associated duties and remaining Trump-era tariffs in place have pushed the price of Chinese-made equipment three times higher than it was prior to the ruling. Further, U.S. manufacturers didn’t ramp production until after the ruling came out and are still working to staff production sites.

24-hour port operations a help, not a cure

Some ports in Asia and Europe operate 24 hours a day, every day. But the Los Angeles and Long Beach ports have historically operated on two shifts representing two-thirds of the day, with availability on Saturdays.

The Port of Long Beach recently announced a pilot to expand gate hours for truck pickup. The port is offering 24-hour service four days a week with a plan to eventually remain open all the time. The Port of Los Angeles is testing weekend gate hours and will continue to promote off-peak time as a way for carriers to access the port.

However, truckers typically don’t want to operate unless the warehouses are open. Some are willing to pick up a container/chassis and leave it at a drop yard, returning later to finish the shipment when the facility reopens. But that can eat into hours-of-service requirements.

O’Malley, as well as the port directors, said the change in gate hours at the ports will require cooperation from warehouse operators as well as the carriers.

“If you’re going to do that, you kind of have to do it across the board,” O’Malley said. “If the warehouses are not operating extended hours or truck drivers don’t have the opportunity to get enough turns in their day, then the benefit of it may be somewhat limited.

“It’s certainly going to be incrementally helpful. In order to optimize the system you really have to open up all the floodgates … allow them all to operate at that higher level of capacity.”

Pool of Pools’ equipment is used in approximately half of the chassis moves at the Los Angeles-Long Beach complex, with the remainder being handled by private pools or trucker-controlled chassis.

West Coast surge to continue

The current dynamic — a lack of ocean vessel capacity, an unending queue of ships at anchor, slow rail service, minuscule industrial warehouse vacancy, containers stuck at shippers’ facilities longer, etc. — is poised to continue.

“Strong American consumer demand has continued unabated for more than a year, evidenced by the steady amount of cargo streaming through the Port of Los Angeles,” the port’s August report concluded.

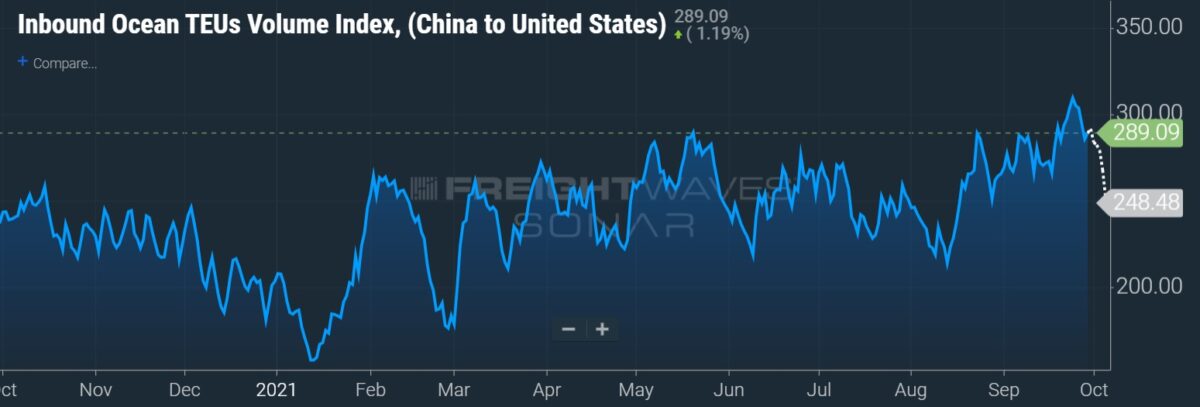

Through August, the port has handled 7.3 million twenty-foot equivalent units, a 30% year-over-year increase. The port expects to handle 10.8 million TEUs in 2021, a 14% increase from 2018’s record throughput.

James

I currently drive an owner operators truck hauling containers from the port of savannah to a local Walmart warehouse. there have been no chassis available in port for months without a long wait. this means that local container drivers pulling for other drivers or pulling to local warehouses are only willing to head into port with an empty container with a chassis they can use for their next load. they won’t accept that next load/contract otherwise.

mrbigr504

If the carriers were paying a driver what there supposed to get paid, they wouldn’t have to compete with the stimulus checks! It’s just a matter of time until this intermodal industry gets an overhaul & we can get this money straight that’s supposed to be paid to the owner operators! Get this hazmat load, totes, chassis split, overweight load pay, detention pay & paying for chassis tires that are already dry rott. Looks like somebody’s gonna have to Sh-t or get off the pot here pretty soon! Stop these agents from robbing the drivers! Waaaay too much pimp’n going on out here!

Don

Corrected for you:

Pick you bottleneck: Monopoly or Duopoly.

Rails, Chassis Suppliers, SSL are busy shoveling money – they don’t have time moving freight. The worse it gets – bigger the shovels.