The East Coast ports are benefitting from the diversion of trade away from the West Coast out of fear of a labor strike.

Bethann Rooney, director for the Port of New York and New Jersey, told reporters Friday the flow of trade originally bound for the West Coast and redirected to their port has been steady.

“Through April 2022, container volume was up 11.2% over the same period last year,” Rooney said. “Approximately 6.5% of the total volume during that period represented cargo that was rerouted from the West Coast.”

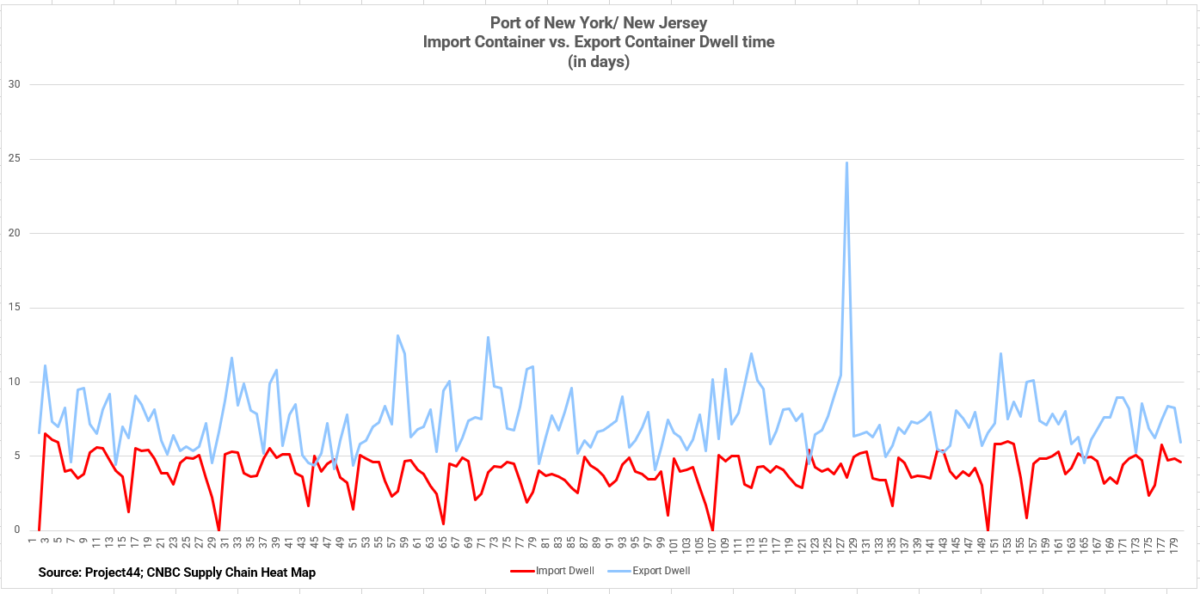

Rooney acknowledged the import containers are sitting a little longer and vessels are berthing a little longer, which is increasing at anchorage. The port has seen a whopping 33% increase in container volume since 2019. Rooney said the overall volume the port is receiving is more than 1.5% to 2% compound growth predicted.

“It is staggering,” she said.

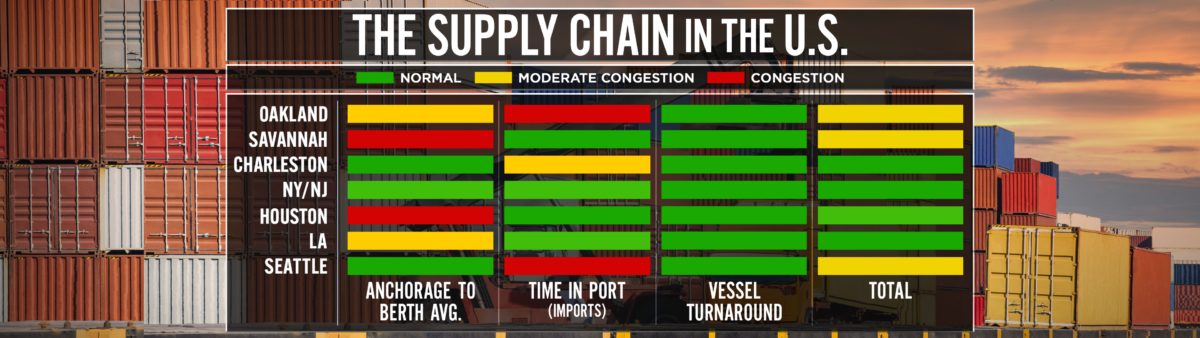

According to the CNBC Supply Chain Heat Map, the Port of New York/New Jersey is close to flipping to congestion based on the data metrics.

The CNBC Supply Chain Heat Map shows the dichotomy between the dwell times of imports and exports at the port.

“We have done the analysis, but I would not anticipate anything [changing] on this until after the summer,” Rooney said. “Long-dwelling import containers tie up much-needed capacity.”

Products in these long-term dwelling containers include household appliances, winter apparel and Christmas trees.

Rooney said she is meeting with the operators and truckers to make sure all hours of the terminals are being used consistently. She suggested one possible solution would be to spread out the dispatch of truckers to alleviate the morning lines they are currently facing.

Rooney has conducted weekly meetings with terminal operations since the beginning of 2022, discussing the lessons learned during the pandemic. Other topics have included what sustainable safety and security measures can be employed to promote efficiency.

A third depot C&C operates has been made available for empty containers. Rooney said she has spoken with both the large carriers and new entrants about picking up more empty containers.

Those talks have sparked some action. A total of 13 loaders have been received this year — five in May alone.

“We have chassis not being utilized because they have empty containers sitting on them,” Rooney said. “Chassis is needed to move cargo. Unfortunately, the chassis providers are lacking the parts and materials to generate that equipment.”