New official figures from China’s Ministry of Transport show that the volume of containerized ocean freight, as measured in twenty-foot equivalent units (TEUs) through China’s 49 main box-ports in the year continue to rise despite the Washington-Beijing trade tensions. But it seems that Vietnam might be benefiting from the turbulence, according to data found in FreightWaves’ SONAR database.

Chinese Ministry of Transport containerised port throughput data show that, in the year-to-July, the country’s national throughput stood at 132.7 million TEUs. That’s a 4.5% rise compared to the same period last year. Meanwhile, in the month of July itself, China’s 49 main seaports handled about 20.51 million TEUs. There is both anecdotal and statistical evidence that exports from Vietnam to the U.S. are increasing — and that’s presumably on the back of trade war tensions.

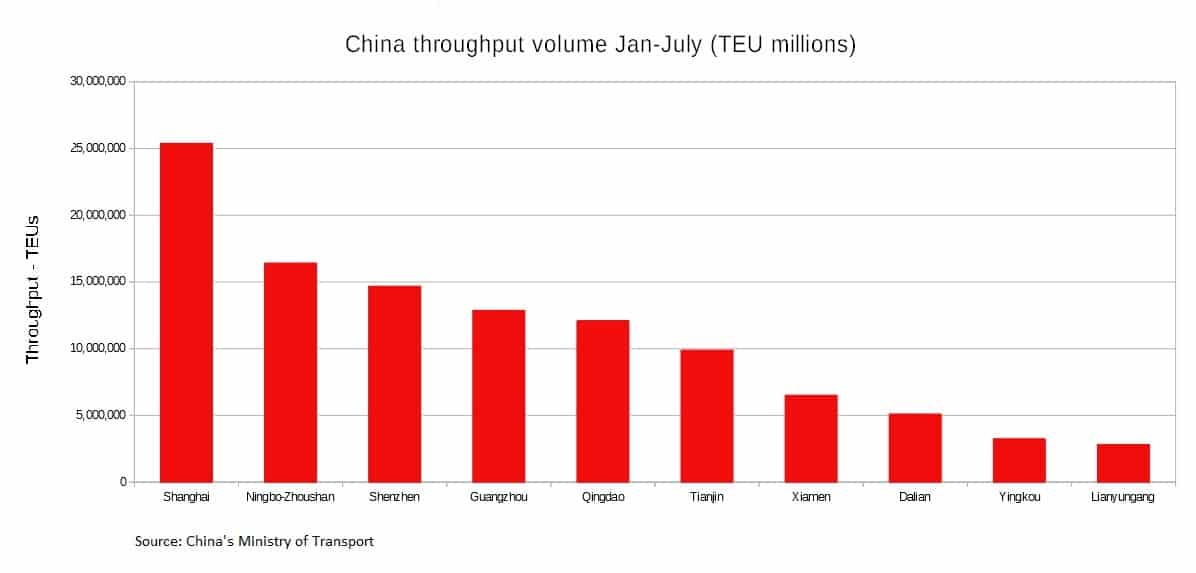

Much of China’s box throughput is concentrated in the top 10 ports. Together, those top 10 have handled about 109 million TEUs in the year to July and, together, account for 80.9% of China’s throughput.

China’s big container ports

The top five ports — Shanghai, Ningbo-Zhoushan, Shenzhen, Guangzhou and Qingdao — have so far together handled about 81.47 million TEUs, which accounts for about 60.4% of China’s throughput.

China’s busiest port by box throughput volumes is Shanghai. In the year to July, it has recorded throughput of 25.39 million TEUs, which is a 5.5% increase on the previous year. In July itself, Shanghai handled 3.85 million TEUs, which is a 2.4% rise on the port’s throughput in June.

Ningbo-Zhoushan has handled 14.4 million TEUs so far this year, which is a 6.1% rise on the prior corresponding period; Shenzhen handled 14.68 million TEUs and has had a much slower growth rate of 1.7%. Guangzhou handled 12.87 million TEUs and grew at 4.2%. Meanwhile, Qingdao has handled 12.11 million TEUs in the year to July and its year-on-year throughput has increased by 9.7%.

The next five most-busy box ports in China — Tianjin, Xiamen, Dalian, Yingkou and Rizhao — have together handled about 27.59 million TEUs in the year to July, which accounts for about 20.5% of China’s total throughput.

In the year to July, Tianjin has handled 9.89 million TEUs, which is 6.9% up from the previous year. Xiamen handled 6.51 million TEUs, a rise of 6.6%; Dalian handled 5.11 million TEUs, a fall of 10.6% in the year to July. Yingkou has handled 3.26 million TEUs, a fall of 11.2%, while Lianyungang has had a throughput of 2.82 million TEUs, a rise of 1.2%.

The next 39 seaports together have handled 25.82 million TEUs, which accounts for 19.1% of box throughput at China’s ports in the year to July.

Inland waterways

China’s main country-spanning waterways, the Yellow, Yangtze and Pearl rivers, carry considerable volumes of cargo and sea-going vessels can, and do, call river terminals a considerable distance into the interior of the country.

About 17.02 million TEUs of boxes were moved along China’s inland waterways from January to July, which is an 11.2% increase from the same period last year.

The trade war, China, the U.S. and Vietnam

So far, the effects of the trade war do not appear to be showing up in the Chinese Ministry of Trade statistics. There could be a few reasons for this. There have been concerns raised by numerous commentators over time about how much China-origin data can actually be relied upon.

Secondly, the lack of trade war effect on China’s Ministry of Transport data could be the consequence of a time lag between political disruption and companies changing their supply chains. Logistics is a complicated art and one does not simply walk into China and completely revamp a whole supply chain in a short time frame.

Thirdly, it is entirely possible that the throughput through China is simply going to/coming from other countries. As China’s Ministry of Transport data does not show origin/destination, there’s simply no way to know from that data set.

Sounding out insight

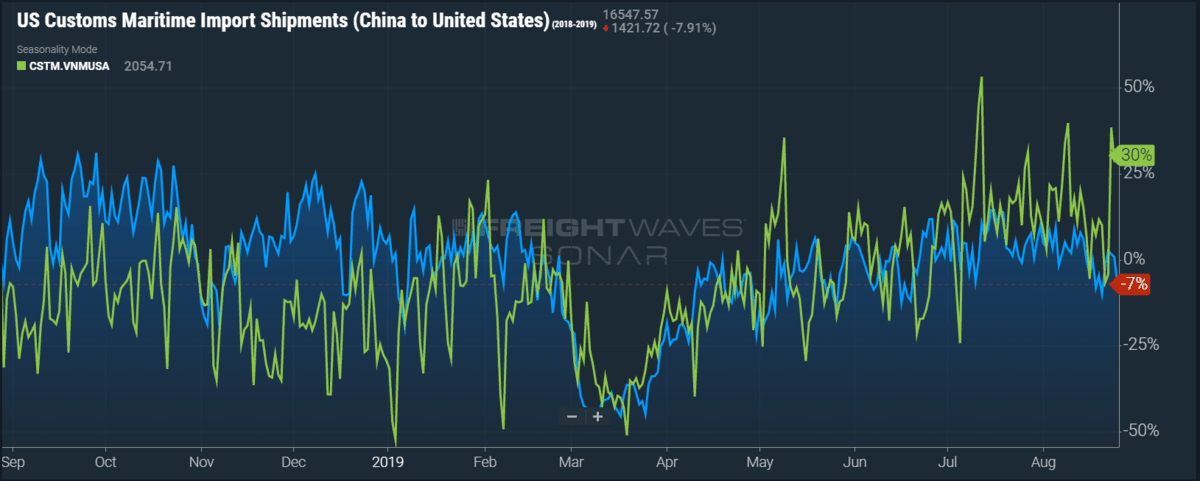

However, country-pair data sourced from the U.S. Customs authorities, available in FreightWaves’ SONAR database, provides insight.

This graph shows China-sourced maritime shipments imported into the U.S. in blue. The overlay in green shows Vietnam-sourced maritime shipments imported into the U.S. in green. The Y axis shows percent. The X axis is time series (months).

As can clearly be seen, there was a huge fall in shipments from both China and Vietnam from the end of February and through March. That’s likely the consequence of widespread holidays in China and Southeast Asia. The Chinese (blue) data resumes an upward trend but, crucially, does not appear to reach the highs of previous months. The orange arrow/box to the right shows that China-U.S. shipments are down by 7%.

However, Vietnamese (green) data rises greatly over the months following March, which is when the Washington-Beijing trade war really began to heat up. As can be seen from the green arrow/box to the right, there has been a 30% rise in shipments from Vietnam and into China.

Source: FreightWaves’ SONAR database.

Commentary

Jim Walker, the chief economist at Aletheia Capital, publishes insights via the SmartKarma platform. In his research note “Taking Off: Vietnamese Exports Are Rocking and Rolling,” Walker says, “No country in Southeast Asia is better placed than Vietnam to accept some of the production move out of China that is inevitable and partly a result of the current trade tensions. There is anecdotal evidence to support the view that production has already shifted but Vietnam’s export performance, given the relatively weak demand environment, confirms that it is taking export market share. We should only expect that trend to continue and strengthen.”

Around the maritime world

COSCO Shipping Ports aims for expansion despite slow economy

Unfavorable macro conditions will not stop the state port giant from taking an active approach in acquiring and developing ports in the overseas markets, says CSP Chairman Zhang Wei.

India cabotage reform boosts DP World’s Cochin volumes

Volumes have rocketed at the DP World Cochin terminal in India, a result of recent cabotage reforms that paved the way for foreign-flagged tonnage in the country’s coastal trade.

Ninety People Missing After Ferry Capsizes Off Cameroon

“The Austrheim, with around 200 people aboard, went down in bad weather near the island of Bakassi late on Sunday,” an army spokesman said.

Carriers ditch constant chase for market share in a quest for profits

ZIM’s return to the black in Q2, the carrier’s first net profit since Q3 of 2017, confirms a trend of container lines giving up their chase for market share in favour of profitability, according to analyst Lars Jensen.

Ship emissions responsible for thousands of premature deaths in China’s Pearl River Delta

Ship emissions caused more than 1,200 ozone-related and 2,500 particulate-related premature deaths in the Pearl River Delta region in 2015, according to new research in the AGU journal GeoHealth.