East coast ports are showing stronger growth in import volumes thanks to the ongoing sourcing shift for U.S. shippers hit with tariffs and the ports’ increasing ability to service larger ships.

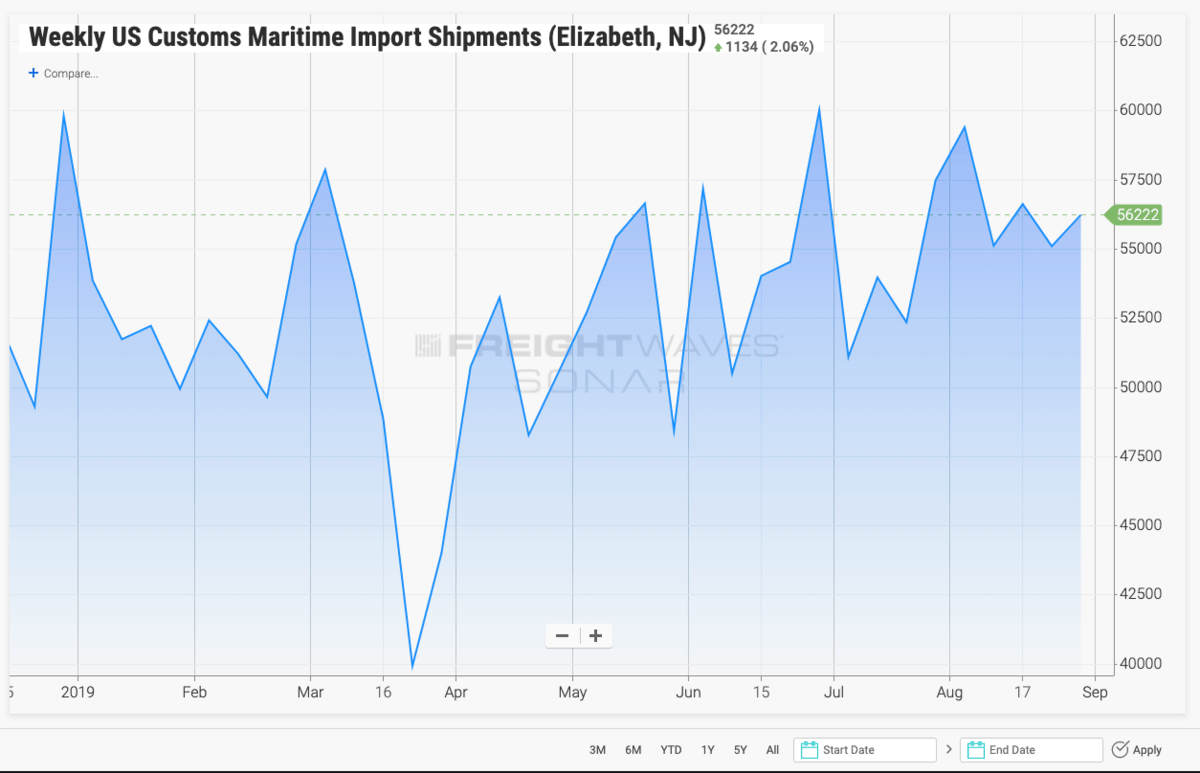

Through July, the five largest east coast ports from New York-New Jersey down to Savannah reported total container imports reach 5.58 million twenty-foot equivalent units (TEUs), up 6.6% from a year earlier.

On the West Coast stretching from Los Angeles-Long Beach through to Vancouver, Canada saw container imports of 7.25 million TEUs, down just over 1% from a year earlier.

As the U.S. trade war with China keeps a lid on trans-Pacific shipping demand, other all-water routes into the U.S. East Coast are keeping import levels growing, said Beth Rooney, Assistant Director at the Port of New York and New Jersey. The port reported July 2019 was the third highest monthly import total, reaching 336,972 TEUs.

Year-to-date through July, imports are up 5% and NY-NJ displaced Long Beach as the second busiest import gateway.

Despite losing some volumes from the trade war, Rooney said a fair amount of Chinese cargo has been replaced by cargo from India, Vietnam and other countries.

While the 2016 widening of the Panama Canal was heralded as a growth driver for the East Coast ports, NY-NJ is now getting more cargo via the all-water route through Suez.

Last year, the share of cargo coming via the Suez, Panama and from South America was split roughly in thirds. But this year, 30% of cargo is coming via the Suez while 20% is coming via Panama. Interestingly, a growing share of “around the world services”, which travel eastbound through Panama and back to Asia via the Suez is now a growing portion of port traffic at roughly 14%.

“The number of origins that we serve is now growing due to the Chinese tariffs,” Rooney said. “As manufacturing shifts further south from China, cargo has an opportunity to reach the east coast via the all water route.”

New York-New Jersey saw freight coming from China in July drop 6.3% from a year earlier, Rooney said. But containers originating in Vietnam increased 28% over the same time frame. July also received a boost as shippers ramped up imports ahead of the first set of 15% tariffs on $300 billion in Chinese goods.

“Some shippers are looking to get freight into ports before the start of new tariffs,” Rooney said.

The port is unloading more freight with each vessel move. Rooney said there’s been a “huge jump” in the number of vessel calls by container ships in the 13,000 to 14,000-TEU range. The number of ships at or above 13,000 TEU that have called on the port year-to-date through July was 114, up from 61 in the same time last.

Outside of the port’s ability to serve bigger ships with the raising of the Bayonne Bridge in 2017, Rooney said shippers have had to also adjust their schedules to fit the larger vessels. Instead of having to move boxes to smaller ships on separate days, now shippers have to have all their boxes ready on one day for a larger ship. That also means ocean carriers are getting better utilization on East Coast services.

“We never expected a huge influx immediately after the Bayonne Bridge rising because the rest of the supply chain has to adjust,” Rooney said. “By the second year, that is a reasonable time frame for supply chains to adjust.”

Along with the sourcing shifts, the East Coast ports capture the majority of trade with Europe, where the weaker euro continues to favor shippers from that point of origin, Rooney said.

She also credits the terminal operators for making investments to handle larger amounts of freight. Port Newark Container Terminal opened a new truck gate system, with increased automation such as optical character recognition for license plates and container numbers.

APM Terminals is using new Navis N4 terminal operating system to coordinate vessel, container and truck traffic.

Rooney said all the terminals with the exception of GCT New York have moved chassis operations offsite to free up more container space.

As the trade trends show no sign of lessening, East Coast ports are set fair for growth. Rooney said July and August are traditionally the busiest time at the ports, and “things are looking good for September, there’s no softening.”

“We are cautiously optimistic that we might retain the No. 2 spot with the year-end figures,” Rooney said. “We are certainly giving Long Beach a run for their money and making them squirm a bit.”

But let‘s not forget the Crescent City

Port of New Orleans President Brandy Christian says volumes up 12% this year. Maritime Logistics

Hapag-Lloyd launches cargo insurance product

Service is offered digitally for small and medium size shippers. Marine Link

Evergreen lines up yards for mega-ship order

Taiwanese liner operator taps one Korean yard and two Chinese yards for order. Splash 24/7

Coast Guard remains on scene in the Bahamas

U.S. Coast Guard has rescued 406 people in the Bahamas due to Hurricane Dorian. Coast Guard News.