East Coast ports took a larger share of the import container trade, the Intermodal Association of North America (IANA) said, as volume in the trans-Pacific trade lane remains weak due to the U.S.-China trade war.

IANA’s estimates of intermodal container activity underscore the deepening of the freight recession that railroads and trucking companies saw in the 2019 second quarter.

Container volumes fell 3.8 percent from the year earlier period to 4.56 million, compared to a 1.5 percent drop in container volumes during the second quarter, IANA said.

“Intermodal struggled in Q2,” IANA said in its latest review of quarterly market trends.

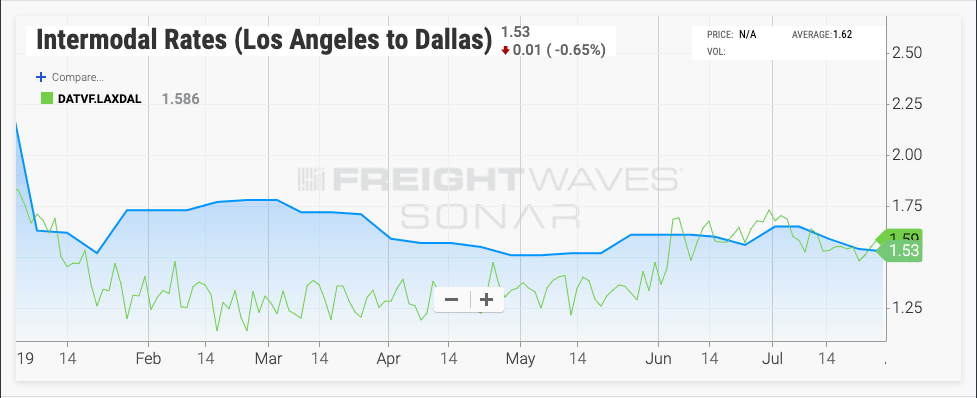

Domestic rail and truck container volumes fell 6.3 percent to 1.87 million from a year earlier as dry van rates hit a nearly two-year low, sending more freight back to trucks.

“Trucking capacity stayed loose and prices were much softer than in 2018 creating more intense competition with intermodal than last year,” IANA said.

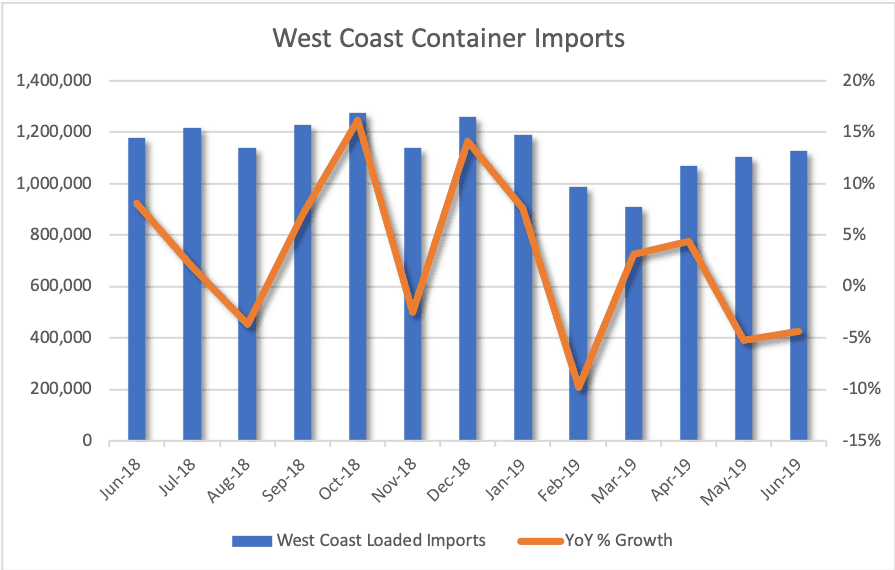

International marine container traffic into North America was essentially flat year-on-year at 2.38 million. IANA noted the strong start to the quarter with ocean container volumes up 6 percent in April. The month may have benefitted from front-loading of Chinese goods ahead of the 25 percent tariffs that President Donald Trump imposed on China in May.

Those tariffs slowed imports from China and “had an outsized impact on West Coast ports, particularly in the Southwest, since a higher than usual share of Chinese imports travel through this region,” IANA said.

The volumes of ocean containers moving through the U.S. Southwest fell over 10 percent, with container imports from China falling 5.6 percent.

The figures align with what the region’s ports reported for import volumes during the second quarter. Los Angeles, the largest U.S. port, saw inbound container volumes drop 3.9 percent during the quarter, while Long Beach, the second largest port, saw an 11 percent drop in import volumes over the same period.

But the East Coast ports saw the reverse with ocean container imports rising 10 percent in the second quarter. Buoyed by the favorable exchange rate between the euro and the U.S. dollar, the trans-Atlantic trade between Europe and the U.S. has been one of the stronger markets for ocean freight. But the wider Panama Canal and expansion projects are also allowing more ships from Asia to reach East Coast ports.

“Rising European imports helped push East Coast container imports higher, but so did imports from Asia,” IANA said.

IANA said the outlook for the second half of 2019 hinges on “where trade tariffs go.” A deal with China would help put more growth into ocean container volumes. But if tariffs were to be extended, “the second half would certainly decline,” IANA said.

Ports operator takes aim at Djibouti

DP World said takeover of Doraleh Container Terminal is illegal. (Maritime Logistics)

Korea plans to invest in ports

Government plans to spend $35 million to in expanding port capacity. (TradeWinds)

Maersk wants IMO 2020 fuel sooner

Container ship operator plans to get 10 percent of low-sulfur fuel from U.S. refiner PBF (BunkerWorld)