North America’s biggest shippers issued mostly upbeat forecasts for consumer spending for the back half of 2019. But the outlook is providing little boost to spot rates for container shipping as U.S. inventories stay high and the front-loading of Chinese imports appears to have played itself out early in the third quarter.

As FreightWaves Chief Economist Ibrahiim Bayaan reported, retail sales remain one pillar of the U.S. economy. Retail sales in July saw a month-on-month increase of 0.7%, which was better than the 0.3% consensus forecast. Annual sales growth of 3.4% in July accelerated from June’s annual rate of 3.3%.

Major retailers expect that growth rate to hold steady through the rest of the year. Walmart, the largest importer of containerized goods in 2018, according to Susquehanna Financial Group, raised full-year guidance on U.S. same-store sales.

Chief Financial Officer Brett Biggs said on the company’s earnings conference call, “The strong first-half results lead us to increase our full-year expectations … to the upper end of the original guidance of up 2.5% to 3%.”

Target, the second-largest importer of containerized goods, said on its second-quarter conference call that it expects comparable store sales growth of 3.4% for 2019.

Bayaan wrote that despite the weaker outlook in the manufacturing sector and the uncertain trade outlook, “retail continues to be a consistent source of strength in the freight economy, particularly as it relates to trucking and parcel demand.”

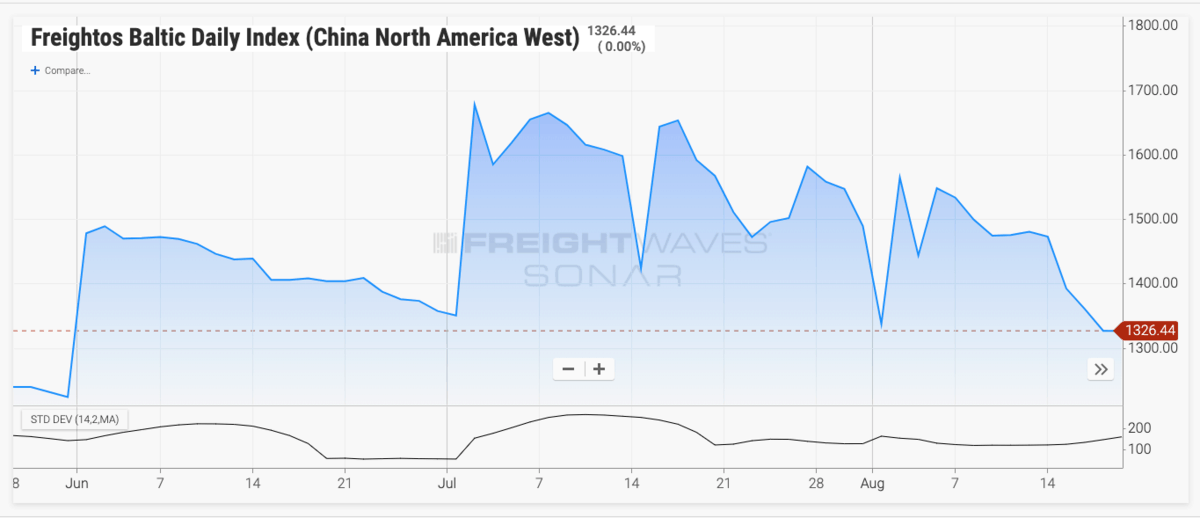

But not so much for ocean shipping. The Freightos Baltic Daily Index for China-North America West (SONAR: sailings is sitting at $1,326 per forty-foot equivalent unit (FEU). The Aug. 21 rate is the lowest since the start of June and a full 20% lower than its high point in July and down just over a third from a year ago.

Ethan Buchman, chief marketing officer for Freightos, said the August rate weakness reflects a bit of front-loading that took place in July. Shippers brought in goods to beat a Sept. 1 deadline for 10% tariffs on a portion of $300 billion in Chinese-made imports. July’s container imports into U.S. West Coast ports hit the highest level of 2019.

“Many August orders were brought forward by what turned out to be justified tariff fears, affecting demand this month,” Buchman said.

In response to the low demand, ocean carriers are canceling sailings. Orient Overseas Container Line, a unit of COSCO Shipping, canceled two sailings taking place at the end of August.

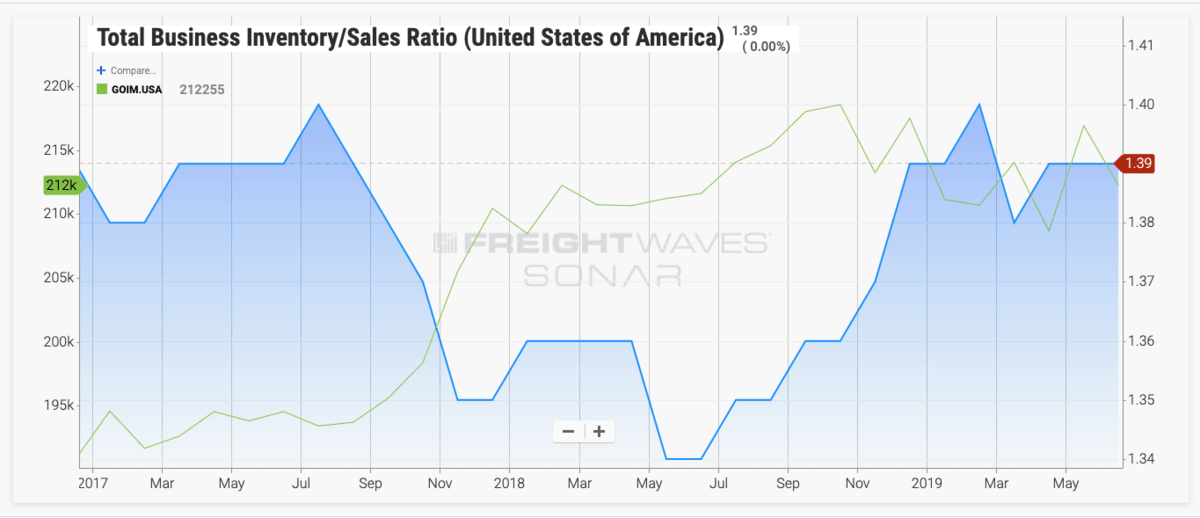

Going into what is supposed to be the peak season, many retailers appear to be sitting on adequate inventories, limiting further the need to accelerate containerized imports.

One measure of that goods stockpile, the U.S. inventories-to-sales ratio (SONAR: TBIS.USA), sits at 1.39 for June, compared to a 1.34 reading a year earlier. In the wake of the 2018 U.S. container import boom, the ratio sat at 1.40. U.S. retail inventories, excluding autos, were up 2.8% in June to $411 billion.

Walmart grew its U.S. inventory 4% in the second quarter. Biggs said the retailer, which imported just over 940,000 TEUs in containers last year according to Susquehanna, feels “good about the quality of the inventory position as we enter the back half of the year.”

Target grew inventory 3%. Chief Executive Officer Brian Cornell told analysts on the company’s conference call that “based on the health of our business right now and the momentum we have going into the back half, we feel very good about our inventory position.”

Australia has U.S.’s back in the Mideast Gulf

Australia says engagement limited to one frigate and one surveillance aircraft, but it’s something. (Maritime Executive)

Futures exchange to start offering for low-sulfur marine fuel

CME Group will list a contract basis U.S. Gulf Coast for 0.5% sulfur marine fuel. (BunkerWorld)

Chief executive about over seized tanker

Stena Bulk Chief Executive Erik Hanell meets with Iranian officials to release Stena Impero. (gCaptain)