Stock market analysts are not excited by the initial public offering (IPO) of the container- and forestry-products focused Port of Napier on New Zealand’s east coast.

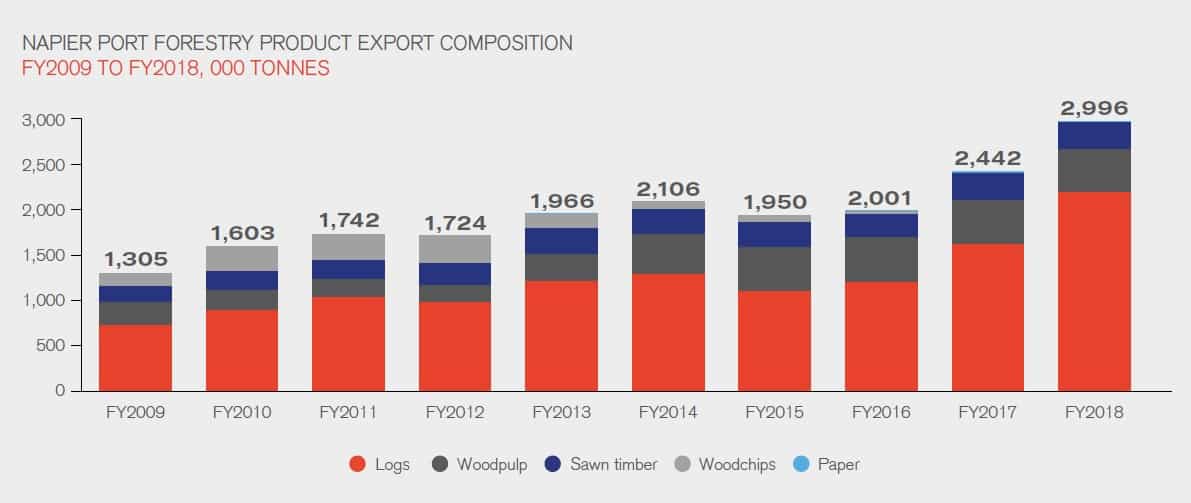

“Of late [the] bulk of growth has been driven by an increase in export of forestry-linked products on the back of increased availability. As per the company’s own forecast, forestry volumes might begin to flatline soon, which would lead to slower growth in the near-term and any decline over the longer term would have an adverse impact on the company,” wrote Sumeet Singh, head of research at Aequitas Research, who publishes insights via the Smartkarma equity research platform.

“…It has been reporting non-exciting but steady growth over the past few years mostly led by growth in forestry-linked products. Nonetheless, the company’s near-term prospects don’t appear very exciting and over the longer term a decline in harvesting of trees could lead to a fall in volumes, although this might still be well over a decade off. I’ve labelled this insight bullish as there is nothing as such wrong with the company, apart from a lack of robust growth,” Singh adds.

Current ownership

The port is indirectly owned by Hawke’s Bay Regional Council through its investment company HBIC. It is selling off 45 percent of the equity following a capital review on how to best fund the port.

A new wharf is needed. The purpose of the new wharf is to handle bigger ships, handle cruise ship demand, allow 24-hour berthing of box ships and generally provide greater operational resilience.

A bigger wharf will boost operating efficiency the port says, because currently vessels have to be shuffled around to fit all ship movements. And, of course, that’s costly. The new wharf will be able to handle box ships up to 320 meters (1,050 feet) in length and cruise ships up to 360 meters in length.

But building a wharf don’t come cheap.

The new wharf has a construction price tag between NZ$173 million and NZ$190 million (US$116 million and US$128 million). The council wants construction to begin in 2020 and be ready for use in 2022.

IPO: equity for sale; indicative prices per share

Hence the IPO, in which 45 percent of the equity will be sold. The council’s investment company will continue to hold the remaining 55 percent.

The equity to be sold also represents 90 million shares. An indicative price range of NZ$2.27 to NZ$2.60 has been set.

So that means the council hopes to raise between NZ$204 and NZ$234 million (US$137 million and US$158 million).

Apart from funding the construction of a new wharf, monies raised will also be used to pay the costs of the offer, pay down debt and to put some cash into a ring-fenced “future fund” so that the council can diversify its income.

“The Regional Council voted for the minority share option to provide the funding to grow the Port. This protects ratepayers from the costs of paying for Port expansion, retains majority Council ownership and control, and allows the Regional Council to retain its focus on protecting and enhancing Hawke’s Bay’s natural environment,” the council said in a statement.

Profile: Port of Napier

The port is located near the town of the same name on the east coast of New Zealand’s North Island.

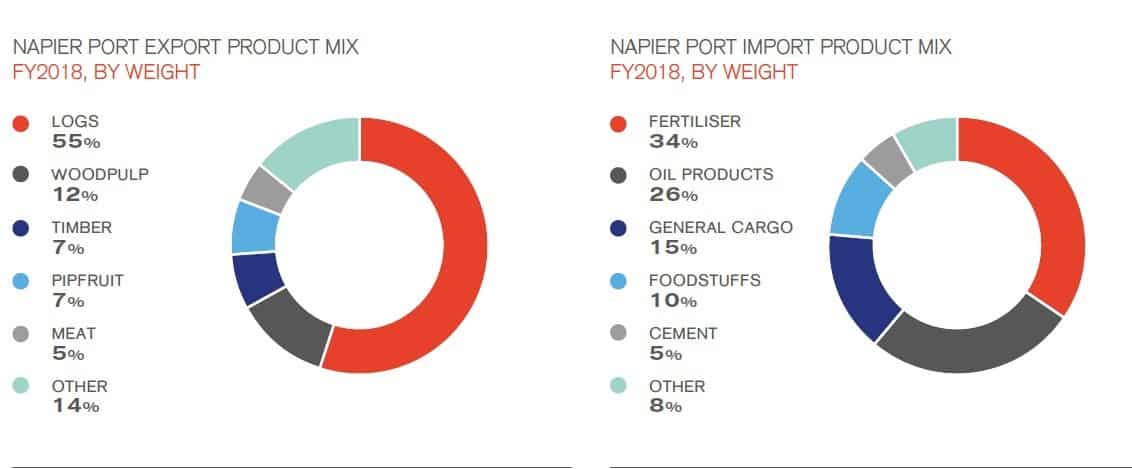

In the 2018 financial year (April to March), Napier handled 680 ships. Cargo throughput stood at five million metric tonnes (a metric tonne is equivalent to 2,204.6 U.S. pounds) and 200,000 twenty foot equivalent units (TEUs) of shipping containers. Bulk cargo volumes stood at three million tonnes. Napier is primarily an export port with 79 percent of its throughput by weight consisting of exports. About 55 percent of that is logs, 12 percent is wood pulp and 7 percent is timber.

The port generated NZ$92 million in revenues and a pro-forma earnings before interest, taxation, depreciation and amortization (EBITDA) of NZ$37 million.

According to council documents, the port has enjoyed an EBITDA growth of between 8.1 percent and 8.7 percent over the last 10 years.

Pro-forma EBITDA in 2016 was NZ$27.8 million and that rose to NZ$35.3 million in 2017. In 2018 it rose again to NZ$37.2 million. Forecasts for 2019 and 2020 are NZ$39.7 million and NZ$40.9 million respectively.

The port covers a 50-hectare site boasting 42,830 meters of warehousing, five wharves with six berths, an on-port packing facility of 8,000 square meters and 10 hectares of dedicated log storage. Equipment includes six mobile harbor cranes and 34 heavy container-handling machines.

The port is capable of handling box ships with a 40-meter beam (breadth), draft of 12.2 meters and up to 6,000 TEU.

Foreseen risks

IPO documents point out several important risks. General risks include wharf construction risk, Asian market risk (84 percent of the port’s exports go to Asia), customer risk and major shareholder risk.

There are some particularly noteworthy risks. As the port notes, and as analysts have highlighted, the port is very dependent on the forestry sector “particularly logs, wood pulp and timber. Any decrease in the supply or demand… for forestry products could have a significant adverse impact,” the port notes. It gives the example of a recent fall in log prices paid by Chinese buyers.

Another particularly important risk that hasn’t generally been much discussed is the risk from major natural disasters. “A significant earthquake could destroy or damage our assets, which are essential to our operations. If such an event was to occur, it is unlikely that our insurance policies would cover us for all of the damage.”

That’s not an insignificant risk in New Zealand.

Unfortunately, for New Zealand, the Pacific tectonic plate is being pushed underneath the Australian tectonic plate. That friction causes numerous local earthquakes. And every now and then it causes a Big One.

Just before 1:00 p.m. on Tuesday, February 22, 2011, a magnitude 6.3 earthquake devastated the New Zealand city of Christchurch and the town Lyttelton. Several thousand people were injured and, tragically, 185 people died. The earthquake also did very severe damage to the Port of Lyttelton.

IPO advisers

Joint lead managers to the IPO are Deutsche Craigs and Goldman Sachs New Zealand. Co-manager is Forsyth Barr. Auditors are Ernst & Young. Legal advice is provided by solicitors Belly Gully and the registrar is Link Market Services.

It is expected that the shares in the port will start trading on the New Zealand Stock Exchange on August 20 of this year.

Around the maritime world

Chinese makeover of Piraeus port bigger than thought

Cosco’s stake in port opens Chinese tourism and business to Greece. (Fortune)

APM unloads straddle carriers for terminal project

First six of thirty straddle carriers unloaded at Los Angeles. (Lloyd’s List)

Iran waves off U.K. countermeasures on shipping

Iran congratulates Boris Johnson on new role, but warns off trying to get ship back. (Maritime Executive)

Mexico gets IMO 2020 fuel offeringBravo Energy to sell low-sulfur fuel by this October. (Ship & Bunker)

John Sampson

Belly Gully is Bell Gully. Ha!