Market inefficiencies

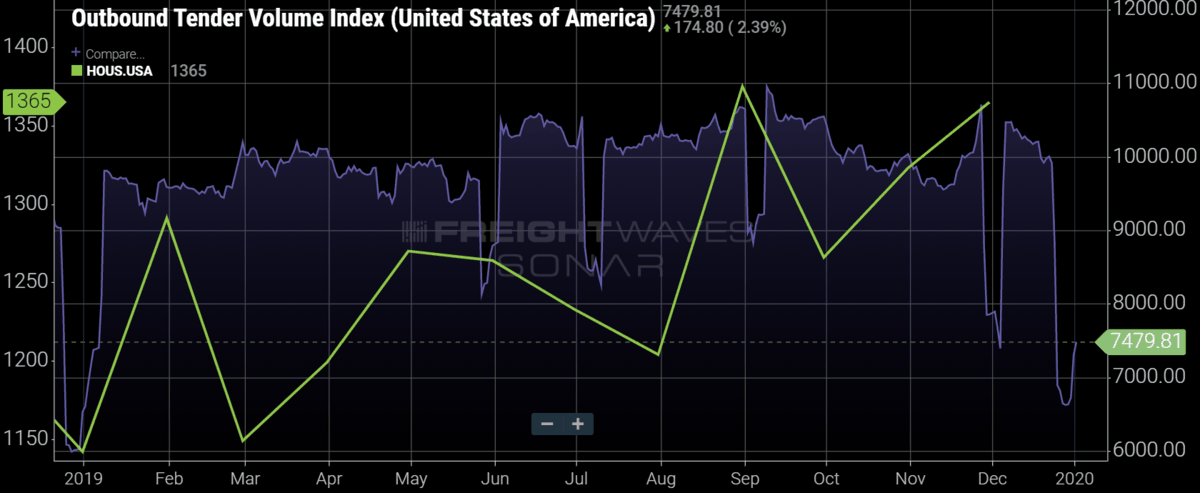

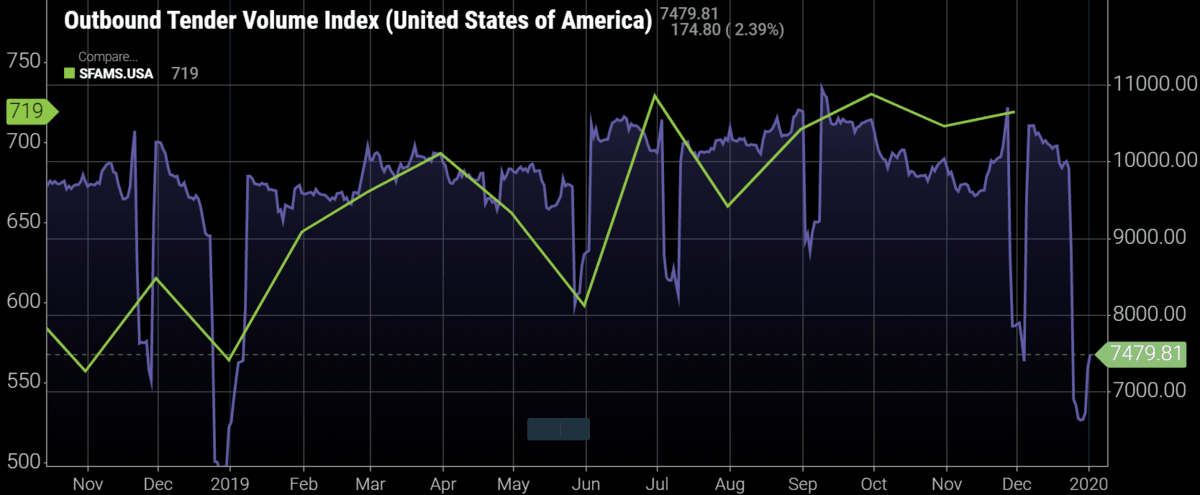

There were supply-side issues at play that limited the housing industry significantly in 2019. Unfortunately, many of those factors are going to slip into 2020. Construction in general has implications for freight activity; housing construction has major implications. Increased housing activity (HOUS.USA) translates to more freight activity, contributing to volumes (OTVI.USA). It doesn’t stop when flatbed trailers haul the building materials throughout the country but persists downstream as those homes get filled with new appliances and furniture.

One of the most frustrating things as an economist is market inefficiencies. An example of this is a strong demand for a good or service but a market that is unable to provide an adequate supply to meet that demand. Sometimes the inefficiency is due to pricing, availability or laws and regulations – then we see those goods hit grey and black markets. There are few protocols impeding progress, such as regulations holding back zoning and development when it comes to housing.

Strong consumer demand

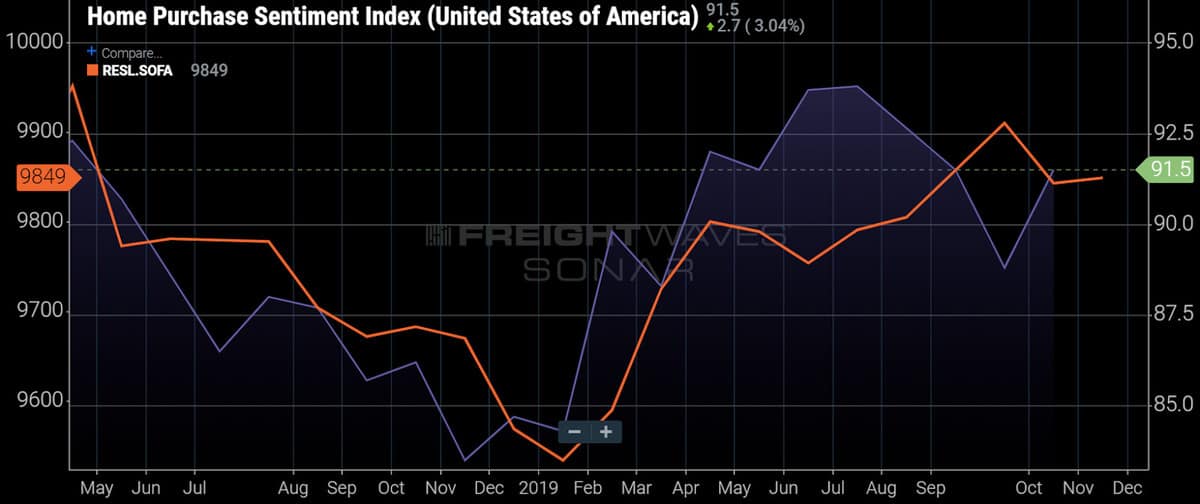

The Home Purchase Sentiment Index (HPSI) is a monthly survey put out by Fannie Mae. The Index is compiled from six main components that cover whether consumer sentiment moves up or down for: a good time to buy or sell; home prices; mortgage rates; job security; and household income. These are significant factors to consider before purchasing a home and the most recent HPSI survey shows a bump up to 91.5, closing in on the survey high of 93.8. The sentiment is applicable to more than housing; it carries over to big-ticket purchases and goods that go into these homes.

Consumers are more likely to make purchases and facilitate growth throughout the overall economy when stable conditions are in place. The elevated levels for the HPSI have real implications and are confirmed by the rising rates in housing permits. Further, increased housing activity translates to more freight activity, contributing to volumes (OTVI.USA). It doesn’t stop when flatbed trailers haul the building materials throughout the country, but persist downstream as those homes are filled with new appliances and furniture.

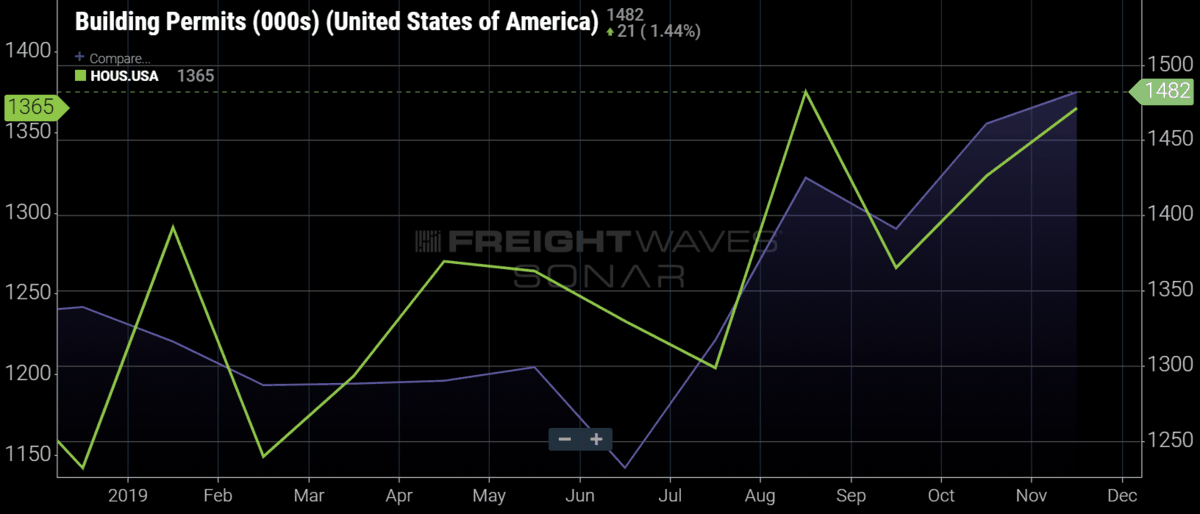

Housing permits are on the rise

Housing permits are a barometer for future construction and recently hit a 12 ½-year high, indicating that there will be more activity in 2020.

A permit is issued by a local jurisdiction to proceed on a construction project. The current surge in permits is promising for new construction activity and housing starts in 2020. As mentioned earlier, supply-side issues held housing starts back through much of the first half of 2019. Momentum began building in the second half of the year with single-family units gaining ground and hitting a 10-month high. Single-family housing starts make up roughly 70% of total new residential construction, while the more volatile multi-family units make up the remainder. Single-family starts jumped 16.7% in November 2019 compared to the year-ago level. It should be noted that the 2018 comparisons were weakening during this timeframe. Nonetheless, single-family starts posted month-to-month gains in five out of the last six months. The rise in permits and demand indicated by the HPSI signal that the trend will persist in 2020.

The South will lead the way

Growth is not evenly dispersed throughout the country, however. The majority of new construction will take place in the South, which over the last 12 months made up over 50% of all activity for new residential development. Housing starts in the South rose 10.3% in November from October and are currently at the highest level since 2007, but a far cry from the pre-Great Recession peak in 2006. Conversely, the more population-dense Northeast region contributes the least to overall housing starts (under 10%), with more of an emphasis on multi-family housing units.

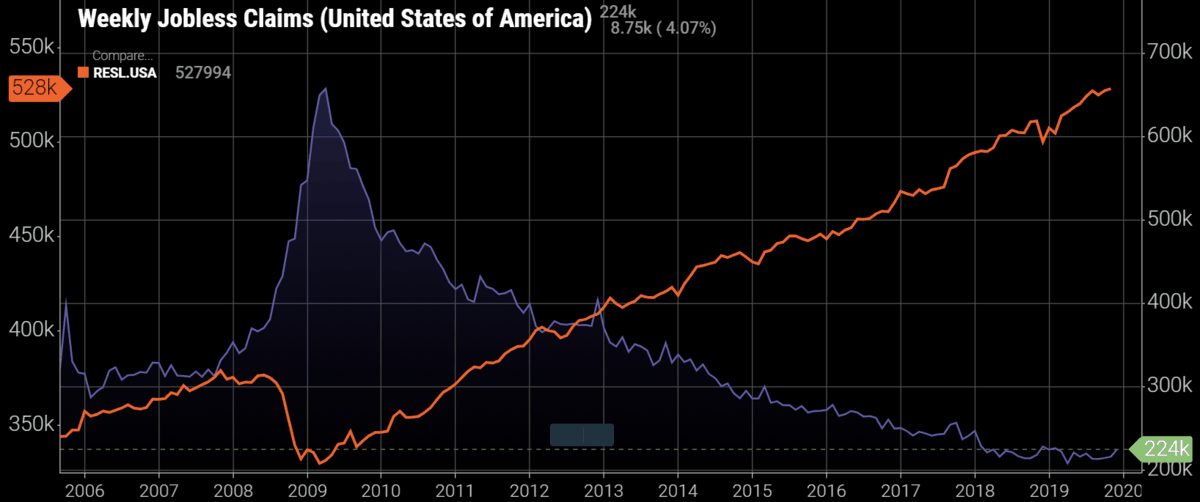

The landscape is a bit different this time around, compared with the early 2000s. There isn’t a bubble building, no predatory lending is taking place and consumers aren’t overextending themselves with debt payments.

Jobless claims for initial unemployment assistance are used as a barometer for layoffs. These claims are trending near historic lows, supporting more consumer activity within the economy. The labor market is holding steady, as evidenced by weekly jobless claims (WJC.USA). There is an understandably inverse relationship between claims and retail sales (RESL.USA). When individuals are gainfully employed, they are poised to make purchases. These purchases range from small home appliances to actual homes.

Roadblocks

Pricing is playing a major role for many potential homeowners. A tremendous amount of the overall demand for housing is for entry-level homes. The same roadblocks of limited buildable lots and lack of skilled labor that are limiting availability are also driving up prices for new builds and hitting entry-level price points hard. Though single-family new home sales are performing well, and the downstream effects of furniture and appliances are adding to freight volumes (OTVI.USA), there will be an uphill battle in the coming months.

Things don’t get more manageable for the more substantial housing component, existing home sales. Existing home sales make up more than 80% of total home sales and the median price for an existing home was up 5.4% in November 2019 compared to the 2018 level. Prices for existing homes are being propped up by a limited home inventory, which is causing home prices to outpace income. This makes it more difficult for would-be first-time homeowners to take advantage of historically low mortgage rates.

The outlook

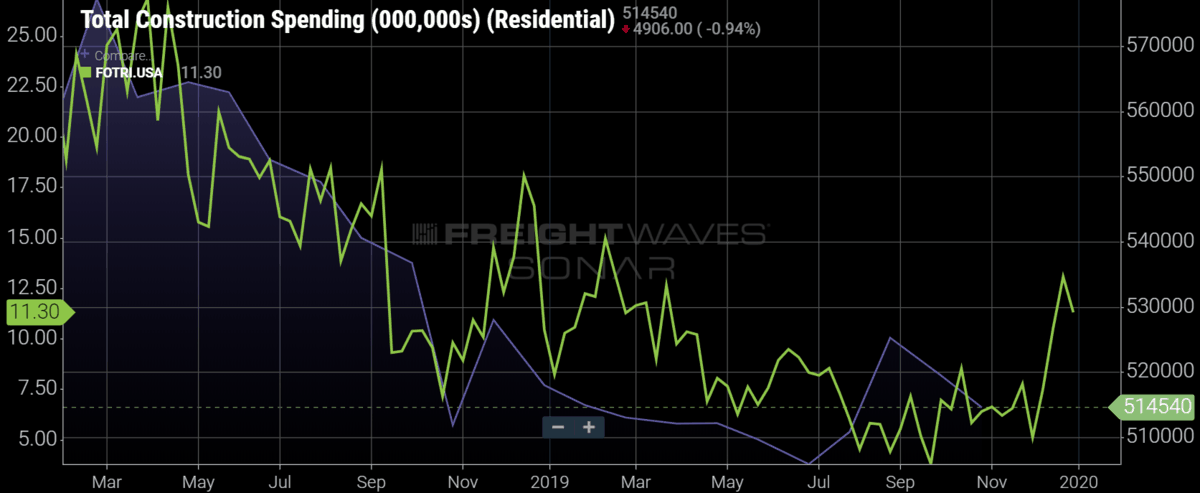

Housing activity began to pick up in the latter half of 2019. The momentum will likely persist in 2020. Demand is underpinned by high sentiment and stable conditions for consumers to act on their confidence. Unfortunately, inventory levels for existing homes will likely remain tight throughout the year. The tight inventory will apply upward pressure on home prices and keep them generally elevated. Housing starts will likely increase throughout 2020 despite the limited number of lots and skilled labor. However, it’s unlikely there will be an overt surge in starts throughout the year. The current obstructions that are keeping residential construction tame will also extend residential construction spending (COSP.RES). This translates to looser capacity for flatbed trailers that typically haul the building materials (FOTRI.USA).

Of course, this is a look at the overall industry. Conditions will differ in various cities. Survey data from the National Association of Home Builders show that builders are optimistic about current conditions and the outlook for the next six months for single-family homes. The sentiment is well-founded and market fundamentals will likely provide moderate growth within housing and construction through 2020. The effects of new residential developments mean there will be other construction projects coming online around these new homes and communities. These include more schools, offices, streets and highway projects that depend on freight.

Appliance Valley

Extraordinary home apparatuses upkeep tips. Referenced advances are extremely useful for machines enduring.

EDcook Real Estate

This blog is definitely helpful and informative. Great blog by the way and thanks for sharing these