The hairballs in the pipes of trade are multiplying.

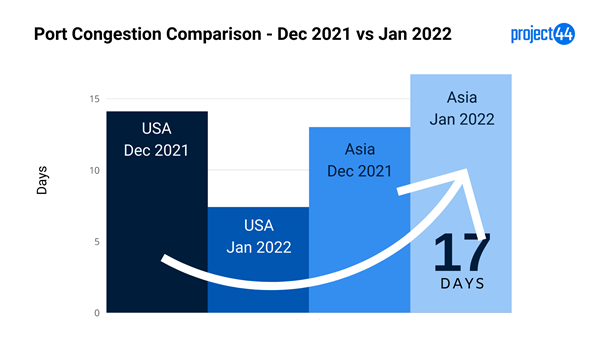

New data analyzed and released by project44 shows vessels waiting to berth in Asia recorded an average increase from 13 days in December to 16.7 days in January. Hong Kong, which has seen an increase in COVID cases, tops the list with the largest increase from 17.5 days to 22.5 days.

“The omicron variant of COVID-19 continues to impact port workers and other supply chain stakeholders,” said Josh Brazil, director of supply chain insights at project44. “This will continue to impact supply chain operations around the world and will be a major contributor to delays.” (Click here for story on project44’s data partnership with FreightWaves.)

This nauseating merry-go-round of congestion shows no signs of stopping. Even the lower volumes of Lunar New Year did not help the Port of Los Angeles clear out the tower of containers.

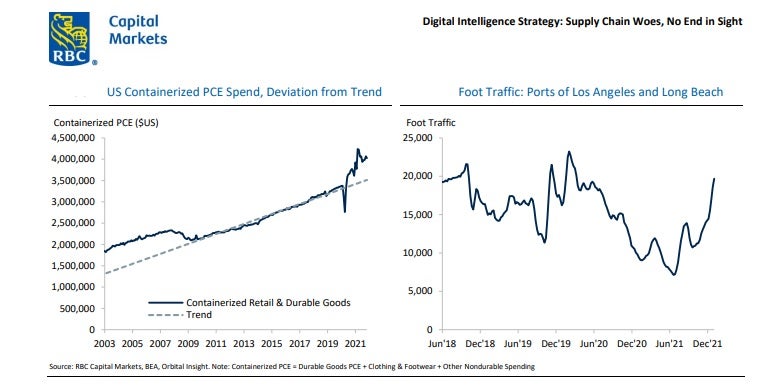

Michael Trans, head of digital intelligence at RBC Capital Markets, warned in a recent note the path toward “normalization” is “lumpier and significantly less linear than most realize.”

Added Trans: “The bottom line is that the supply chain stretching from Asia to California is simply not constructed to handle the current level of consumer demand for goods. Despite the Ports of LA & LB unloading a record number of ships and a record utilization of containers on ships last year, the infrastructure and logistics simply cannot handle the elevated volume, agnostic of COVID.”

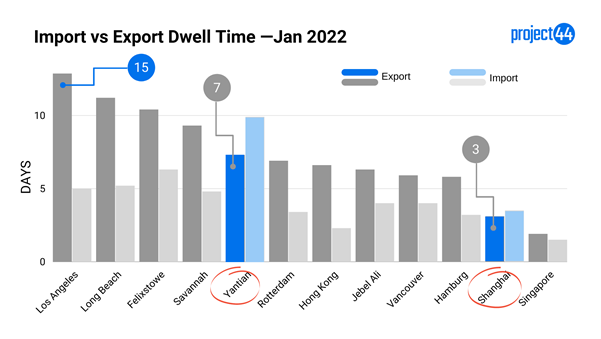

The trade causality in all of this is exports. The wait times for global exports are increasing. It should come as no surprise that Los Angeles and Long Beach top the list.

“January export container dwell times for Los Angeles were much higher than import ones due to some carriers prioritizing empties over full export containers,” explained Brazil. “Other carriers are ‘cycling’ their discharges [one box off and one box on], but for many of these carriers, prioritization of imports is most important.”

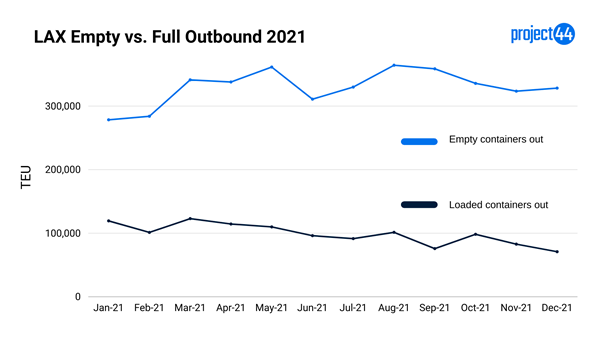

The empty box cycle can be clearly tracked.

In 2021, the Port of LA exported 3.95 million empty containers compared to 1.18 million full containers. At the end of January 2022, approximately 62,253 empty containers were waiting at the Port of Los Angeles to be shipped out.

But even with this empty-box push, visibility into the supply of the containers remains uncertain.

“Whether or not there will be enough empty containers positioned in the right locations after the Lunar New Year is a big unknown right now,” cautioned Brazil. “If they are not, we may see further delays.”

With delays on both ends of the trans-Pacific West trade lane, the ripple effects it is having on the rest of the world will continue. New shipping capacity coming on in the future will only add to the wait.

ricih20411

I get paid over 90$ per hour working from home with 2 kids at home. I never thought I’d be able to do it but my best friend earns over 10k a month doing this and she convinced me to try. The potential with this is endless. Heres what I’ve been doing..

https://www.salarybaar.com/