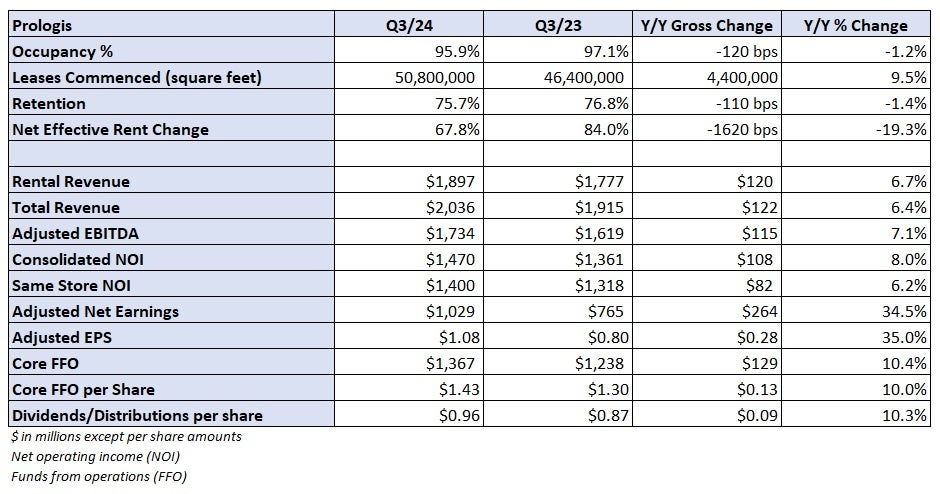

Logistics real estate investment trust Prologis beat third-quarter expectations Wednesday, reporting core funds from operations (FFO) of $1.43 per share, 5 cents higher than the consensus estimate. Revenue increased 6% to more than $2 billion even as some key metrics slid in the period.

Prologis (NYSE: PLD) saw occupancy across its portfolio slip 120 basis points year over year (down 20 bps from the second quarter) to 95.9%. Net effective rent change over the entire lease term fell more than 16% percentage points y/y to 67.8%. That’s 610 bps worse sequentially. However, total leases commenced represented more than 50 million square feet, a 10% y/y increase.

The company lifted the bottom end of its full-year 2024 FFO guidance range by 3 cents to $5.42 per share and lowered the top end by 1 cent to $5.46.

Click for full report – “Prologis says softness in logistics real estate market to last into mid-2025”

“The bottoming process is underway as our customers navigate an uncertain environment,” stated Hamid Moghadam, Prologis co-founder and CEO, in a news release. “Looking ahead, the supply picture is improving, and the long-term demand drivers for our business remain strong.”

Prologis will host a call at noon EDT on Wednesday to discuss third-quarter results.

Click for full report – “Prologis says softness in logistics real estate market to last into mid-2025”