Logistics real estate operator Prologis reported fourth-quarter results that were in line with analysts’ expectations. The company’s first take at full-year 2024 guidance was also as expected.

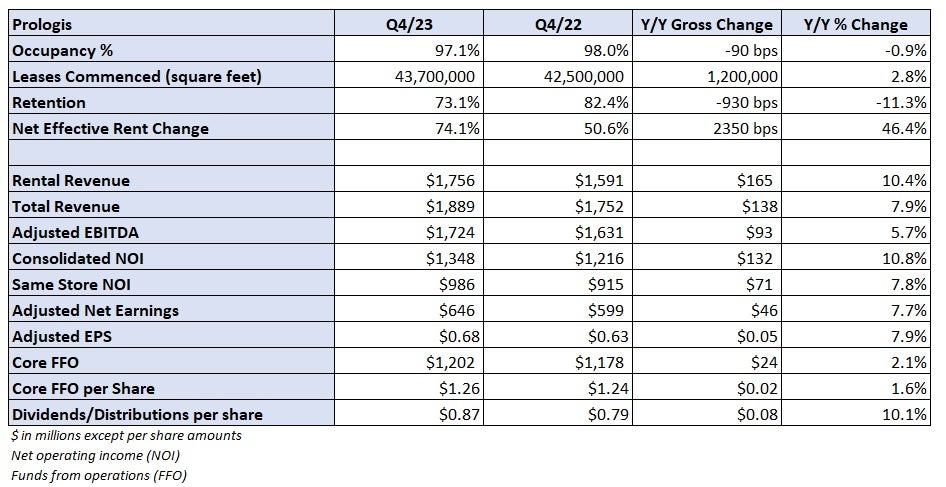

The San Francisco-based company reported core funds from operations (FFO) of $1.26 per share, which was 2 cents higher year over year (y/y). Rental revenue of $1.76 billion was up 10.4%, pushing total consolidated revenue to $1.89 billion, 7.9% higher y/y.

In 2023, Prologis (NYSE: PLD) grew earnings by double-digit percentages for a fourth straight year.

Link to full report – Prologis sees occupancy dipping through Q2 before sustained rebound

“We closed 2023 adding another year of exceptional performance,” said Hamid Moghadam, co-founder and CEO, in a news release issued Wednesday before the market opened. “While uncertainties remain in the economic and geopolitical environment, we are positive about the outlook for 2024.”

The company’s full-year core FFO guidance of $5.42 to $5.56 per share bracketed the consensus estimate of $5.52 at the time of the print. Excluding net promote, the company’s outlook is $5.50 to $5.64 per share, or 9% higher y/y at the midpoint of the range.

During the fourth quarter, occupancy of 97.1% was flat with the third quarter but 90 basis points lower y/y. The company commenced leases representing 43.7 million square feet of space in the period, a 2.8% increase from the year-ago quarter. Net effective rent change (over the entire lease term) was 74.1%.

The company will host a call Wednesday at noon EST to discuss fourth-quarter results.

Link to full report – Prologis sees occupancy dipping through Q2 before sustained rebound

More FreightWaves articles by Todd Maiden

- Forward Air-Omni merger dustup heads to trial Friday

- Truckload linehaul rates stabilizing, Cass report shows

- Court OKs second Yellow terminal sale; liquidation only half complete