The 2015 lifting of the ban on American petroleum exports, advances in technology, and oil production cuts by OPEC and Russia have all contributed to rapid growth in the American oil and gas industry. The EIA is currently forecasting an average annual crude oil production of 10.69M b/day for 2018, and 11.44M b/day in 2019. It’s hard to overstate the significance of the shift in the geopolitical balance of power resulting from the United States’ emergence as a net exporter of oil and gas products: our producers are gaining market share and pricing power, and now higher energy prices tend to stimulate, rather than drag down, our national economy.

New applications of hydraulic fracturing technology have opened up large shale formations to relatively less risky oil and gas exploration—‘frac’ing’ is in large part responsible for the surprisingly fast growth in American petroleum production. Frac’ing is an especially truck-intensive form of petroleum production, especially compared to conventional wells, because it involves a higher number of low volume wells that are designed to be moved around quickly. The hydraulic fracturing itself—the injection of water, proppants like sand, and other chemicals to break open shale and release gas and oil molecules—requires the movement of large amounts of raw materials to job sites.

Lastly, because frac’ing sites tend to be fairly transient, pipeline infrastructure is often not completely developed and the transportation of oil and gas away from the well relies on trucks. FreightWaves has covered the flatbed trucking capacity market in petroleum industry-associated lanes including KMAs like New Orleans, Birmingham Houston, Dallas, Lubbock, and Oklahoma City.

These two aspects of the American ‘shale revolution’—its rapid growth and truck-intensive nature—mean that the transportation and logistics side of the business has become much more complex. Isolated areas of West Texas experience traffic jams composed solely of frac sand trucks, and the roads themselves are being degraded by heavy use. Millions of pounds of white frac sand, which are ultimately sourced in Wisconsin and Minnesota, shipped by railroad to terminals in fracking areas, and then delivered to job sites on a nearly just-in-time basis, are still being managed by antiquated logistics processes. Phone calls, texts, manually composed emails, and yes, even fax machines to transmit invoices and bills of lading are all combined in a time-consuming, largely improvised fashion that delays the flow of information, money, and sand.

Enter PropDispatch, a digital platform that streamlines the ordering, delivery, and payment for proppant, chemicals, and equipment in the frac’ing industry. FreightWaves spoke to PropDispatch co-founder and CEO Dom Pere’ twice by phone.

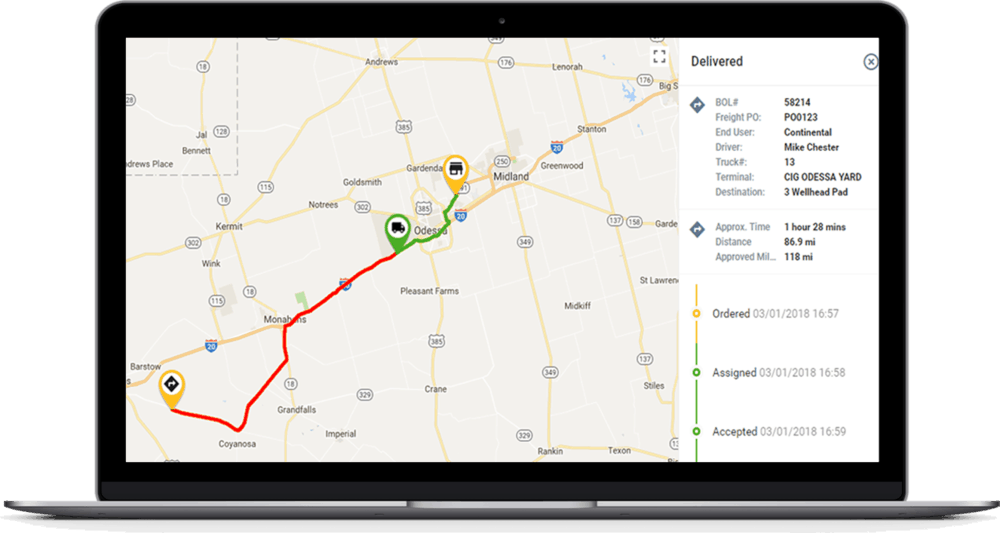

“We have created a technology that is really last mile specific for the ordering, assigning (to a driver), dispatching, tracking, delivery, and payment for oilfield commodities, like frac sand and also chemicals and equipment,” said Pere’. “We’re four and a half years into this; about a year before the downturn, we saw a need. I’m an oil and gas logistics guy, and so is my partner… we were being hired by service companies to handle delivery, and last mile was the biggest choke point, in terms of antiquated systems and technology. PropDispatch changed how frac sand was ordered: we have a mobile app, so that an engineer on site can order ten truckloads of sand and watch it progress, almost like a pizza delivery. That was the first generation of PropDispatch. We’ve now built it into a collaborate platform utilized by all stakeholders in frac logistics (operators, service companies, carriers, drivers, dispatchers, terminals). We have an engine that shows basin- and job-level analytics, we’ve automated the process of how loads are delivered, reconciled and paid, by deploying auto-reconciling functionality like you’re depositing a check on your phone. And it automatically reconciles, so drivers don’t have to stop at a truck stop two weeks later and email or fax something, which is still unfortunately industry standard.”

PropDispatch launched its NextGen version system in mid-April in Canada, and is now in its third week of launching in the United States. Pere’ estimates that about one third of the proppant market is on PropDispatch, with the other two thirds still being managed by older, unintegrated voice and paper processes.

Pere’ said that the NextGen version of PropDispatch “uses data analytics to generate some advanced KPIs like load/weight times, cost per pound, demurrage, driver churn—all the things you need to watch when you’re trying to be efficient,” with the result of cutting last mile costs by 25%. “Our realtime load tracking comes from the GPS on the phone of the driver, which is the same technology as Uber, and there’s a dashboard where you can see terminal, driver, carrier, well stats, such as how many turns per day. You base all your operational decisions on the realtime data that you’re getting automatically via the system.”

Ultimately, Pere’ said, “our technology allows customers to reduce their cost per ton of proppant into the blender. That cost, $500 a load, is reduced, and your drivers are doing more with less.” Recent developments in frac’ing have made sourcing frac sand efficiently even more important: lateral well lengths are increasing, and more proppant is needed to open up the rock. A 2017 report by the Energent Group found that frac wells on average used 11M lbs of proppant, and that some companies were testing techniques that required 5,000 lbs of sand per lateral foot. As laterals lengthen from an average of 7,500 ft in the Permian Basin to, in some cases, two miles, truckload volumes will intensify and need better management than ever.

Pere’ also reflected on the driver shortage in the national freight market and how it impacted the oil and gas industry. “Transportation and logistics isn’t a bottleneck yet, but it’s heading in that direction,” said Pere’. “From a national market perspective, there’s more loads than trucks, and the same thing is happening in oil and gas, with a bit more demand than supply. It used to be that there’s oilfield trucking and there’s OTR, and they’re different. But shifts in tech and last mile—going from pneumatic to boxes—has opened the door for OTR capacity to come into the oilfields. I would strongly state that the oilfield is pulling capacity from petrochemical and retail… people who want to make more money and don’t mind being in remote places are looking at oilfield driving.”

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.