Third-party logistics provider Radiant Logistics announced record results Thursday after the market close. The Renton, Washington-based company reported adjusted earnings per share of 20 cents, 2 cents higher year-over-year but a penny light of consensus, for its fiscal fourth quarter ended June 30.

On a call with analysts, management said demand has returned in all of the verticals it serves except for the cruise line industry. Pressed about the emergence of the delta variant and a recent increase in COVID cases, founder and CEO Bohn Crain said, “We’re continuing to see positive trends,” referring to the year-over-year comparisons.

“I don’t think anybody is emotionally prepared for another shutdown,” Crain continued. “Delta notwithstanding, the world’s going to stay open for business and we’re going to find our way through it however unpleasant it might be. There’s certainly no denying the realities of the pandemic but at least my sense is commercially we are and will continue to stay open for business.”

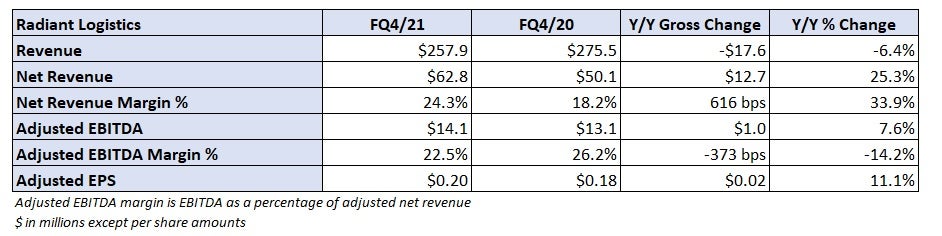

Radiant (NYSE: RLGT) reported revenue of $258 million, 6.4% lower year-over-year. However, the year-ago quarter included $126 million in COVID-related project revenue. Excluding those air charters, revenue was 71.9% higher in the quarter.

Net revenue increased 25.3% to $63 million, with the net revenue margin improving 620 basis points to 24.3%.

Management said the company reinstituted its share buyback program, which was suspended along with acquisitions early on during the COVID outbreak. Radiant repurchased $1.9 million in stock during the quarter and will use half of its future free cash flow to continue buying shares.

“In the months ahead, we will continue to closely monitor how we and the economy are progressing and expect to continue to be active in our stock buy-back activities and look forward to re-activating our acquisition efforts as the opportunity presents itself,” Crain stated in a press release.

Crain reiterated his belief that Radiant’s shares are undervalued, as the stock trades at roughly 6.5x trailing 12 months’ earnings before interest, taxes, depreciation and amortization.

Adjusted EBITDA ended the fiscal year at $48.8 million, 27.4% higher year-over-year.

Crain believes the company’s non-asset business model and growth profile warrant a higher multiple.

“As we have previously discussed, we also believe that our current share price does not accurately reflect Radiant’s intrinsic value or long-term growth prospects, particularly given our unlevered balance sheet, and therefore represents an excellent investment opportunity for both the company and our shareholders,” Crain said in the release.

Asked if there were any “material” M&A transactions in the pipeline, Crain coyly replied, “Only time will tell.”

A recent filing with the Securities and Exchange Commission revealed that the company is reviewing prior financial practices surrounding the way it records revenue and calculates agent commissions.

“The company has identified and expects to report certain internal control deficiencies … with respect to the recording and processing of revenue and the calculation of operating partner commissions,” the filing read. The notice stated that “these deficiencies represent material weaknesses in the company’s internal control over financial reporting,” saying the revenue recognition and agent commission calculation practices “lack the level of precision necessary to ensure the completeness and accuracy” of reporting.

Todd Macomber, CFO, said in a recent conversation with FreightWaves that Radiant has never made an adjustment to revenue or commissions and that the auditors have not proposed any changes to journal entries. The company doesn’t expect to report any adjustments to prior financial results.

“Now that these issues have been identified, we wanted to get them communicated and begin our work on remediation,” the filing stated. “Fortunately, our financial reports themselves are in good shape and we continue to deliver record results.”

Lain Barclay

Could you talk more about Radiant Logistics and their core business? I gather it’s a multi-modal logistics and transportation network, but I’d love to hear a description of them from a more knowledgeable source. Would love to hear about their service offerings, why it picked up recently and why they posted record FQ4 results