(Editor’s note: Two changes have been made to the original article. The first version was not clear that DEF usage did not start with a specific model year, but that it was implemented in 2010. Secondly, DEF is not added to fuel tanks. It treats exhaust.)

A lengthy series of events has come together to drive the price of diesel exhaust fluid (DEF) higher, a trend that recently took another jolt higher in the spot market.

The spot price of DEF and its most important component, urea, have both climbed sharply in recent weeks after being on an upward inflationary ride for most of 2021. Those increases from earlier in the year already have hit the retail price of DEF, a product that diesel users need to meet standards set down in an Environmental Protection Agency regulation implemented in 2010. DEF is used to treat exhaust gases.

One seller of DEF who requested anonymity said it is generally blended into trucks at a rate of 3-4% of the diesel that is dispensed into the oil tank.

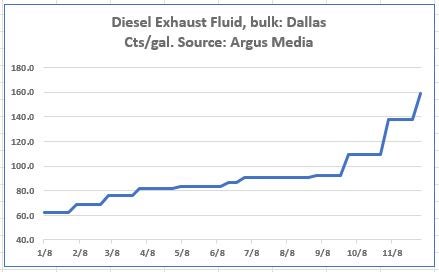

When 2021 began, the Argus DEF Weekly, a product of Argus Media, assessed bulk quantities of DEF at Dallas at 60.5 cents per gallon. By the first weekly assessment of the second half of 2021, the price had risen to 91 cents per gallon.

After remaining relatively steady for most of the third quarter, it’s been off to the races in the fourth quarter of 2021. The weekly Argus assessment climbed quickly to $1.09/g, got as high as $1.38/g for most of November and in its most recent publication had skyrocketed to $1.59/g.

If the DEF prices closes the year at that level, it would mark an increase over the 12 months of roughly 162%.

The increase in DEF prices has coincided with an increase in the price of urea. Urea is a fertilizer product but as a component in DEF accounts for roughly a third of the composition of the fuel additive. DEF has been referred to in some parts of the world as “urea water,” because urea and treated water are the components of DEF.

Urea’s price has been on fire as well, though recently it has shown some signs of a pullback.

The U.S. Gulf Coast price of urea opened 2021 at just over $300 per metric ton, according to the Argus assessment. By midyear, it was up to $430/mt. It opened the fourth quarter at approximately $680/mt, and in the week of Nov. 24, Argus assessed urea in the Gulf Coast at $802.50/mt. Its most recent assessment, published last Wednesday, showed a pullback to $769.50/mt.

On its website, truckstop operator Pilot FlyingJ lists “pump” DEF, purchased at the dispenser with fuel, to generally be listed at $3.699 to $3.799/gallon, with some exceptions..

Kevin Kennedy, the director of business development at 7 Oil Company in Cinnaminson, New Jersey, said his firm supplies bulk quantities of DEF to retail stations and end users. In the last year, he said, his prices have probably doubled. Kennedy added that it has been movement in the last three months that has probably accounted for half of that doubling.

“The squeeze does exist and it’s supposed to get worse,” Kennedy said. “That’s the word.”

However, Kennedy also said his company has been able to meet its requirements, despite reports of tight supplies.

At Edris Oil Service in York, Pennsylvania, President Tim Naylor said getting DEF has been “a pain in the butt.” And he has run out of it a few times.

“The last time, my supplier said we are going to run out of supply this week and can’t make a delivery,” Naylor said. He was forced to go to a different supplier, so “it’s not good.”

His own wholesale cost was a “little over” $1 a few months ago; it’s now $1.75/g, Naylor said.

Several market observers contacted by FreightWaves all told a generally similar tale of how the price of DEF got to this level. But ultimately, they all come back to the same factor: the price of urea as the leader of the inflationary trend and the resultant increase in the price of DEF.

Urea’s tightening market earlier this week got attention from The New York Times. An article about urea was headlined: “This Chemical Is in Short Supply, and the Whole World Feels It.”

The reasons for the urea increase are numerous, according to industry observers. They can be traced back as far as February, when the Texas deep freeze shut down or cut back operations at fertilizer plants in that state.

Another key factor is the rising price of natural gas, which is a key component of making many fertilizers, including urea. That increase in prices, which has been less severe in the U.S. than in other parts of the world, led some plants in places like China to cut back their production because it was no longer profitable to operate at their previous levels.

The price of natural gas around the world is starting to show some signs of pulling back. For example, S&P Global Platts reported Tuesday that in China, a key market for LNG, trucked LNG prices have dropped to less than the equivalent of around $16/million BTU. Platts reported they were about $24/MMBtu a month ago.

In the broader Asian market, Reuters reported that waterborne LNG has slid in recent days to $34.60/MMBtu, down about $1.50 from a recent peak.

In the U.S., the price of natural gas delivered at the Louisiana-based Henry Hub settled Monday at $3.657/thousand cubic feet, which is generally equivalent to a million Btus. Last Wednesday, natural gas settled at $4.25/Mcf; a few weeks ago, the price was solidly above $5/Mcf.

Chinese cutbacks in urea exports, driven by trade war issues and the rising price of natural gas, have been felt in South Korea and Australia. Both those countries produced DEF from urea, much of it imported from China. DEF in Australia is known as AdBlue.

Earlier this week, the Australian National Road Transport Association asked the country’s government to convene a task force to study the current squeeze, according to Argus. In South Korea, the squeeze in mid-November was severe enough that owners of diesel cars lined up to buy DEF.

In the U.S., some fertilizer plants that went down for their normal summer maintenance stayed offline longer than expected. On top of that, some plants also were shut down because of the impacts from Hurricane Ida, which hit the Gulf Coast region in late August.

The market for DEF is expected to increase, according to Jon Pertchik, CEO of Truckstops of America (NASDAQ: TA). On the company’s third-quarter conference call with analysts, Pertchik said the natural exit from the nation’s truck fleet of vehicles manufactured in 2011 or earlier means that “the demand for DEF will continue to grow.”

More articles by John Kingston

One-day commodity diesel price decline greatest in more than 30 years

Reserve oil being reserved into market that may have peaked

TA reports strong earnings, but diesel sales suggest a demand plateau

Matt Wells

^ you beat me to it. To blend DEF in the fuel tank can cost 20k in repairs. DEF systems have been one of the worst and most expensive money rackets in history. If it fails expect a few thousand to have it repaired.

Bill

Text if this article is borne from utter ignorance. DEF is not blended in ANY tank oil or otherwise. DEF tank is exclusive to def fluid ONLY. To do otherwise is catastrophic to the engine Please educate yourself before writing an article

Dick

Definitely does not get blended in with the fuel. Learn your facts before reporting.

Charles

🔥🤡🔥#FJB and the rascal scooter he rode in on !!! #BIDEN needs to be #RECALLED by an emergency constitutional convention !! 💥 This is just out of hand !! 🤮🤮👎👎👎

CA+Trucker

He doesn’t have anything to do with it.

Get edumacated.

Larry Ames

It’s much the same for clean fresh Motor Oil out West, short supplies from the major refiners & suppliers.

having to go to secondary suppliers at increased costs.

Lillian Rogers

Start working at home with Google! It’s by-far the best job I’ve had. Last Wednesday I got a getting a check for $19474 this – 4 weeks past. I began this 8-months ago and immediately was bringing home at least $170 per hour. I work through this link, go to tech tab for work detail.

Open This Website…………………………………..>> http://Www.NETCASH1.Com