Federal Reserve Chair Jerome Powell said Sunday his committee is unlikely to consider cutting the federal funds rate at its next meeting in March. The implication from his remarks in a “60 Minutes” interview was that the board would not entertain the idea until the following meeting in May.

“We want to see more evidence that inflation is moving sustainably down to 2%,” Powell said. “We have some confidence in that. Our confidence is rising. We just want some more confidence before we take that very important step of beginning to cut interest rates.”

For months, analysts have been warning of the inflationary effects of turmoil in the Red Sea, where the Houthis, a Yemeni rebel group, have sought to shut down shipping in protest of the Israel-Hamas war. The corridor is pivotal in global trade due to its role in facilitating the flow of goods, including oil and various commodities, between Asia, Europe and the Americas.

Despite security measures undertaken by the U.S. and its allies, it’s uncertain whether these efforts will halt Houthi attacks altogether. Some vessels continue to navigate the Red Sea with armed guards on board as a precaution.

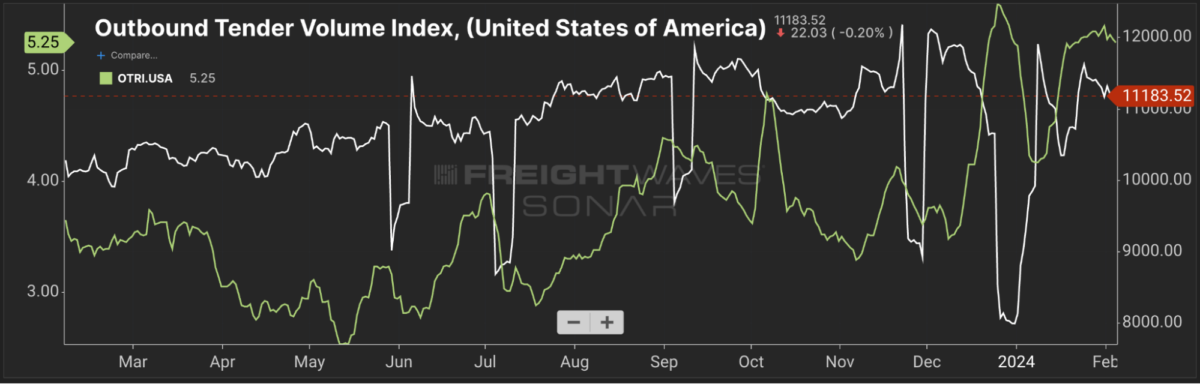

In the U.S. these inflationary pressures make interest rate cuts, which would help to spur freight demand, less likely. Should those conditions persist, the cumulative effect of reduced business activity, alongside curtailed consumer expenditure, could edge the economy toward recession.

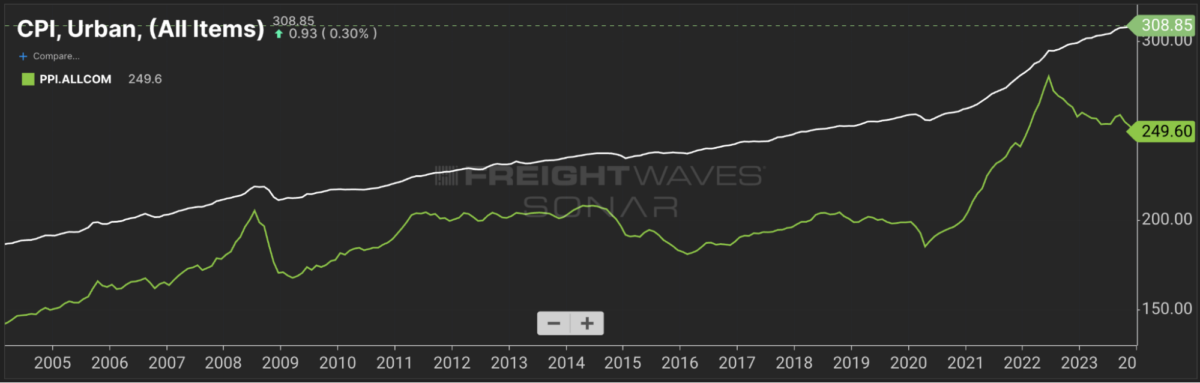

In January, J.P. Morgan Global Market Strategist Jordan Jackson wrote: “Core goods inflation, which has been disinflating all last year, and [is] in outright deflation on a 3- and 6-month annualized basis, could reverse higher, complicating the Fed’s objective of controlling inflation down to 2%.”

This, of course, is always the Fed’s precarious balancing act, navigating between inflation control and fostering an environment conducive to sustained economic expansion. So far in this crisis, Powell’s actions have largely been proved right.

But the risk of holding interest rates too high for too long is that the U.S. consumer could finally start to buckle. That would reduce freight demand in the second half of the year, right when carriers should be regaining pricing power. It could push the long-sought freight recovery further into the future.

Assessing the delays

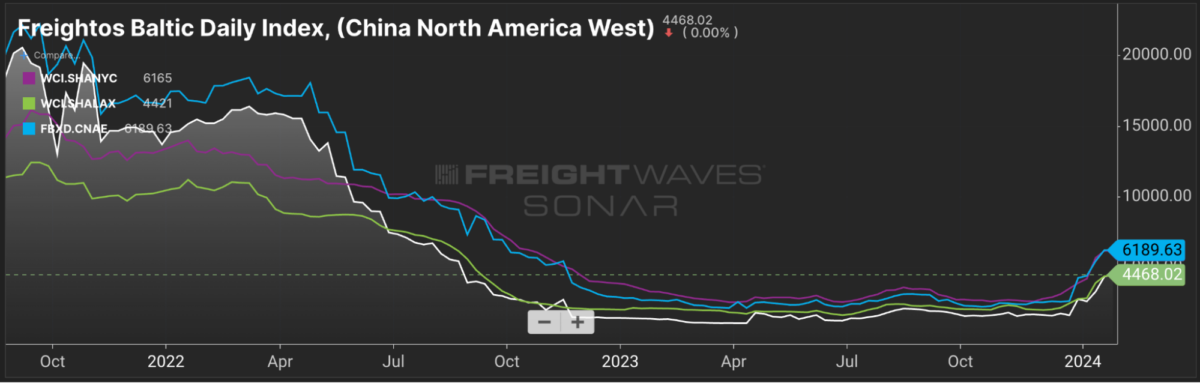

The Red Sea disruptions have elongated shipping transit times from seven to 20 days, with an average probably closer to 10. This rerouting, largely circumventing the traditional Suez Canal route in favor of detours around Africa, has inflated shipping rates considerably over last year’s figures, hitting specific routes like East Asia to Northern Europe the hardest. Something like 12% of all global trade was moving through the Red Sea before the attacks.

Container vessels have borne the brunt of these changes, with up to 90% rerouted, leading to a potential 20% to 25% dip in global container capacity. A swath of global companies have voiced concerns over these challenges, signaling potential delays and the exploration of alternative logistics solutions.

Retailers and manufacturers are likely to transfer the burden onto consumers. Particularly vulnerable sectors include consumer goods, apparel and chemicals. Major retailers like Walmart, H&M and Target, which rely heavily on the Suez Canal for transporting goods from Asia, are expected to be impacted.

Consider a specific example of how doubling the shipping cost of a container from $2,000 to $4,000 could ripple through to U.S. consumers. (For reference, that doubling is less drastic than how container spot rates to the U.S. have trended over the past two months.) Assume the container is filled with electronics, a common import from Asia to the U.S.

The direct cost to ship this container of electronics has doubled. This increase must be absorbed by the supply chain somewhere.

An importer in the U.S. pays the shipping fee. With the cost to bring in a container now $4,000 instead of $2,000, the importer’s expenses have sharply increased. If the container holds 1,000 units of a product, this change alone adds $2 more cost per unit.

RELATED: Red Sea turmoil drives Chinese exports to rail, other alternatives

To maintain margins, both wholesalers and retailers are likely to mark up their prices. If the added cost is $2 at the import level, by the time it reaches retail, this increase could be magnified to $4 or $5 per unit.

For a consumer, this means that an electronic item that might have cost $100 before the shipping rate increase could now cost $104 or $105. While this seems a small increase on a single item, it’s worth considering the cumulative impact across all affected goods.

As numerous containers and a wide variety of goods are affected by these increased shipping costs, that effect can significantly contribute to inflation. Consumers might start to see across-the-board increases in prices for imported goods, from electronics to clothing and beyond.

It should be noted that other analysts, like those at Goldman Sachs, suggest that the impact on inflation will remain muted, with a possible y/y inflation increase of 0.2%. They argue that the current situation is different from the pandemic, when shipping and inflation both jumped significantly.

After all, consumption and production readings have defied recession predictions over the past two years.