The release of crude oil from the U.S. Strategic Petroleum Reserve, announced Tuesday by the Biden administration, comes at a time when the price of gasoline has become a major political issue and when there are some signs oil markets are setting up for a steady decline.

The U.S. will release 50 million barrels of oil from the Strategic Petroleum Reserve (SPR), a storehouse of oil that was created in the 1970s as protection against disruption of oil supplies. The overriding fear when the SPR was created was the world facing a disruption coming out of the Middle East. But releases of oil from the SPR over the years have been tied more to disruptions like hurricanes, the occasional Mideast disruption (such as the start of the Libyan revolution in 2011), and on a few occasions, political pressure to “do something” about rising gasoline and diesel prices.

It currently stands at a little more than 600 million barrels. Its capacity is 727 million barrels and it was at that level in 2009.

At 50 million barrels, the oil to be released covers about 2.5 days of U.S. consumption. However, there are also releases planned in coordination with the U.S. out of South Korea, India, China, the U.K. and Japan. The total amount of oil to be released from those countries was unclear at the time the U.S. made its announcement.

Oil markets have recently been receding from recent highs as traders anticipated the release of oil from the SPR. But there is an old adage in commodity markets to “buy the rumor, sell the fact.”

That played out inversely Tuesday as oil markets posted some of their biggest gains in weeks after a significant downtrend for almost all of November. But on the day of the SPR release announcement, ultra low sulfur diesel (ULSD) on the CME commodity exchange rose 5.89 cents per gallon to $2.3843/g, up 2.53%, the largest one-day increase since Aug. 24. Markets reportedly had been hoping for a bigger release, which was a factor in the increase even as more oil supplies were announced for the market.

In that reversal Tuesday, the price of West Texas Intermediate (WTI) crude, particularly important to the trucking sector that serves the U.S. oil patch, climbed $1.75 per barrel, or 2.3%, to $78.50/b.

But even after those gains, prices are still well below recent highs. Between Nov. 1 and the Tuesday settlement on CME, WTI is down 6.6% and ULSD is down 4.2%.

Andrew Lebow, a longtime oil analyst with Commodity Research Group, noted that the “buy the rumor, sell the fact” may have gotten a boost from the fact that 32 million barrels of the 50 million barrel release is not a sale of crude. Rather, it is a swap, in which crude will be offered onto the market now in exchange for returned supplies later. “That may have been seen as less bearish than if it had been an outright sale,” Lebow said in an email to FreightWaves.

There are several factors for the recent decline in oil prices, beyond the anticipation of even more oil to be put on the market through an SPR release. The value of the U.S. dollar has soared in the last month, and there has long been an inverse relationship between the greenback and the price of oil: When the former rises, the latter falls. That has been very much on display during November.

Another factor are several forecasts for the first half of 2022 that show a slowdown in the pace of demand increases alongside an expected increase in supply. The forecasts have concluded that such a combination should put an oil market that has been in deficit into one of surplus.

As senior commodity strategist at Bloomberg Intelligence, Mike McGlone wrote in his daily commentary Wednesday, “Though we’re concerned about distortions, free-market forces are poised to pressure commodity prices in 2022, notably on the back of enduring bear markets in crude oil and natural gas.”

The International Energy Agency (IEA), in its monthly report published last week, reiterated the argument that markets are shifting toward one of surplus.

“The world oil market remains tight by all measures, but a reprieve from the price rally could be on the horizon,” the IEA said in its report. That relief would come in the form of rising supply, the IEA said, prior to the SPR release. “Preliminary data and satellite observations of stock changes in October suggest the tide might be turning.”

SPR releases don’t just happen; buyers need to bid on the crude that is being offered. There are times in the past when an SPR release was greeted with a collective yawn from the industry for any one of a variety of reasons. For example, an offering of SPR crude in the wake of Hurricane Katrina in 2005 offered 50 million barrels of crude onto the market but only a little more than 20 million barrels were sold.

Getting all that oil sold can run into some roadblocks. For example, what’s going to be released from the SPR under the Biden administration proposal is sour crude (defined that way because of a higher sulfur content) so a refinery that is engineered to maximize its operations by running lower-sulfur sweet crude may avoid buying SPR crude.

Additionally, some refiners might look at the logistics of getting crude out of a particular storage reservoir on the Gulf Coast and decide that it’s easier to continue to buy on the open market.

But even if oil isn’t sold, the fact that it suddenly becomes available to the market adds a cushion in inventories that would be expected to have a downward impact on prices.

What is ironic about the big announcement of the SPR sale is that the U.S. has been selling crude fairly steadily out of the SPR in recent months. As U.S oil import dependence has fallen on the back of the huge increase in U.S. crude production — from roughly 5 million b/d in 2008 to a pre-pandemic level of 13 million b/d — oil sales were commenced to keep the size of the stockpile more in line with import dependence.

S&P Global Platts reported earlier this year that SPR sales were going to be roughly 200,000 b/d between October and December, with sales at 180,000 b/d having been completed between April and June earlier this year. Additionally, Congress has authorized significantly higher sales in fiscal 2023.

Some 200,000 b/d of sour crude are expected to hit the market from the U.S. Strategic Petroleum Reserve from October through December, mere months after the U.S. completed April-June deliveries averaging 180,000 b/d.

For diesel consumers like truck drivers, if they’ve been hearing reports of declining prices, they are not likely to have seen that at the pump. The average retail weekly diesel price published by the Department of Energy came in Monday at $3.724/g, a drop of 1 cent from the prior week and the first decline in 10 weeks. But that 1 cent decline has occurred even as the commodity and wholesale prices were falling hard in November.

Retail prices are not set by oil companies; they are set by the owners of the individual stations, who even if they are operating under the banner of a major oil company still have pricing power on their own. They generally try to hold off on price decreases as much as they can, even as their wholesale prices slide.

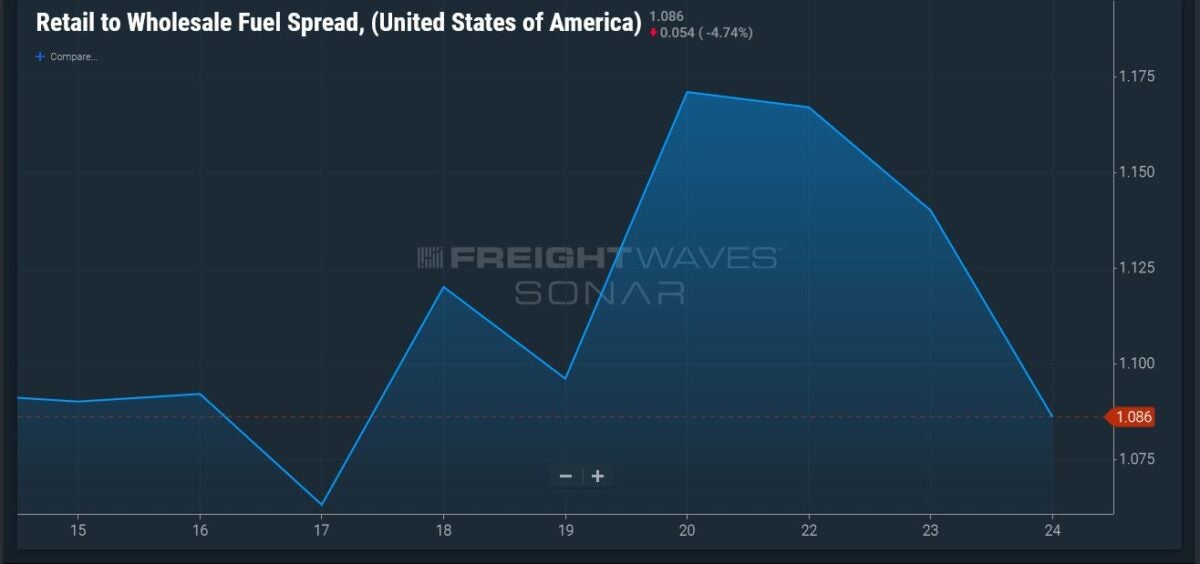

The results can be seen in the FUELS.USA data series in SONAR, which is a simple measurement between the retail price of detail found in the DTS.USA data series and the ULSDR.USA series, which reflects the wholesale price of diesel.

That spread tends to float near the range of $1 to $1.05/g. But it topped out recently at $1.171/g Saturday before sinking Wednesday to $1.086/g, a sign that retailers’ ability to hold up prices in the face of declining wholesale numbers is fading.

But if you think retailers can always hang on to gains in wholesale declines, the market can work the other way too. As recently as early October, the FUELS.USA spread stood at 76.2 cents per gallon, a sign that retailers then were unable to capture increases in wholesale prices.

More articles by John Kingston

PAM, flying high on Wall Street, sets $1 billion target for 2025

Close Teamsters vote at XPO Albany certified as win for union

At Railtrends, an introspective look at an industry’s struggle for market share

Richard M Rehmer

This is foolishness on the Biden administration another we are trying to help the American people when in fact it is the Administration that is causing the problem with the damn climate policy that forbids American oil producers to pump American oil. Under Trump, America was oil independent we produced enough American oil to meet America’s needs, and we did not need to buy expensive politically motivated foreign oil. With the Biden climate policy, we are totally dependent on OPEC, Russia, and other countries not affiliated with OPEC. He shut down the XL pipeline that would have brought Canadian oil because of his climate policy and basically it has been proven pipelines are basically carbon natural transportation for oil and natural gas. North Dakota oil has to be either transported out by truck or train making it expensive, they flare off most of the natural gas because of Biden climate policy. All the Administration does claim it is helping America, 3 days’ worth of oil. that fools the American public .with this magnanimous jester, yet he caused the problem to reward a small group of climate idiots and punishes the rest of the country. EV is so far off that it isn’t even a choice for transporting goods across the nation. Batteries technology let alone the infrastructure to make them work is so far off in the future it isn’t viable yet. Fuel cell technology is better but the infrastructure and technology will take longer. No, we need oil period. PUMP AMERCIAN OIL< DRILL AMERIAN WELLS ON FEDERAL LAND or bankrupt Americans

Charles Pyatt

WOW ⚠️⚠️ ANOTHER BONEHEAD MOVE BY THE BIDEN ADMINISTRATION …. NOW WE WILL BE SITTING DUCKS WITH EMPTY NATIONAL RESERVES IF THE ENEMY STRIKES US !!! 🤮🤡🤡🤡🤡🤡🤦♂️🤦♂️🤦♂️🤦♂️