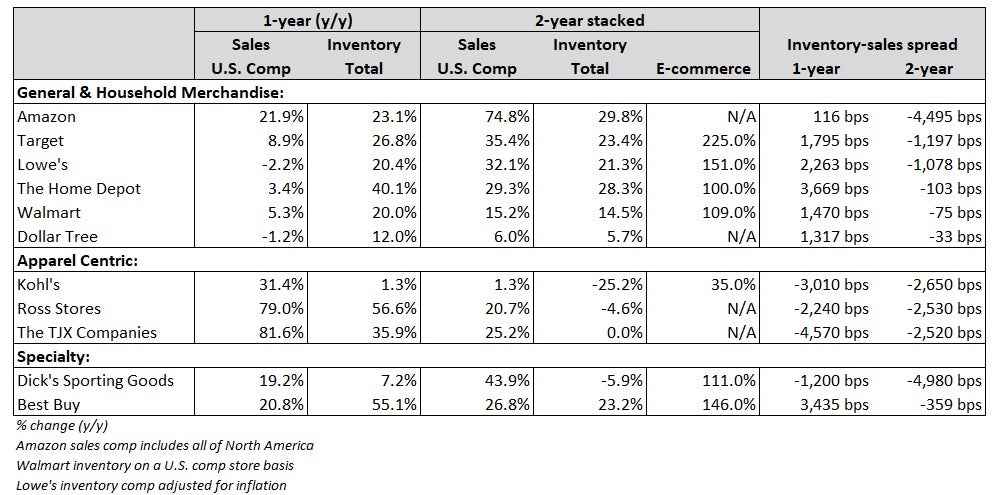

Inventory levels increased for the nation’s largest retailers during the fiscal second quarter that ended July 31. However, when looking at merchandise positions relative to sales, many big-box chains are operating at a significant supply deficit compared to two years ago.

Elevated consumer demand and bottlenecks throughout the supply chain suggest it may be a while before the group can rebuild stockpiles to historical levels (relative to sales), meaning the dynamics of this freight cycle could potentially linger well into next year.

Often a tell of future container traffic, inventories were severely depleted within months of the pandemic’s onset. As lockdown mandates were lifted, the economy roared back to life on the back of a strong consumer with stimulus dollars to spend. Retailers accustomed to carrying thin inventories saw merchandise positions quickly sold through and have struggled to catch up to demand for more than a year now.

Inventory positions expanding at first glance; easy comps and inflation helping

During the quarter, many retailers saw improvement in inventory-sales spreads, or the rate of inventory growth less the rate of sales growth. Inventories growing faster than sales, in addition to product being turned more quickly, suggest retailers are seeing a better flow of merchandise.

While inventories increased year-over-year, the comps are to diminished stock levels from a year ago. Last year’s May-through-July quarter included heavy buying of household merchandise that led to a number of stockouts across many SKUs.

Additionally, inventories are reported in absolute dollars, which can be distorted by inflation.

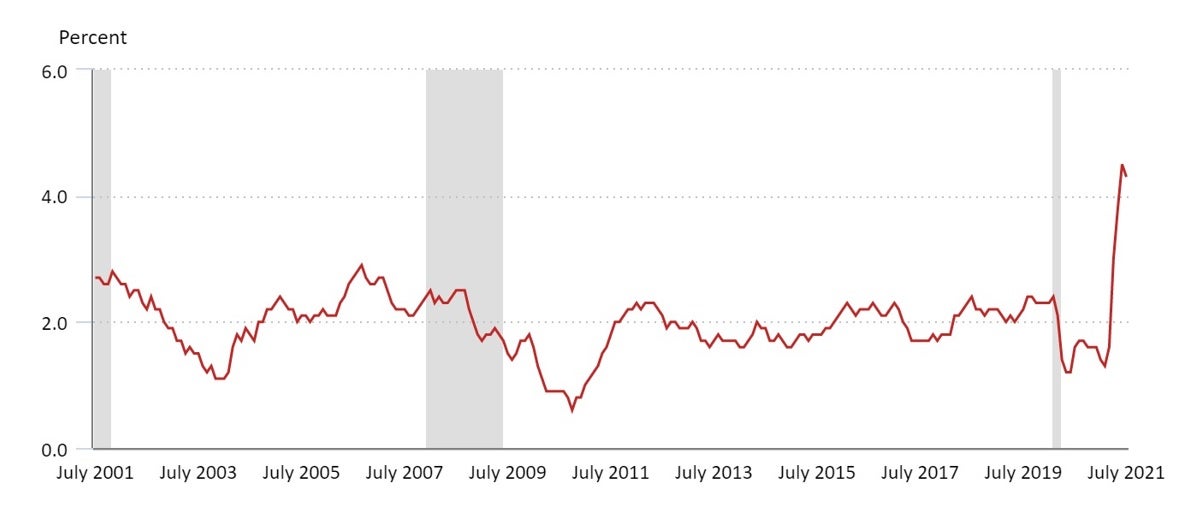

The Consumer Price Index, a measure of the change in prices paid by consumers, was up 0.5% (seasonally adjusted) from June to July. A 0.9% sequential increase in June was the largest one-month hike since June 2008.

Excluding food and energy, the unadjusted index was 4.3% higher over the last 12 months, the highest growth rate in more than 20 years. The all-in index showed a 12-month inflation rate of 5.4% in July compared to an annual rate of just 1.4% in January.

Home improvement chain Lowe’s (NYSE: LOW) called out 400 basis points of commodity inflation during its second-quarter call. Almost 20% of its $3.5 billion inventory build was tied to rising prices for commodities like lumber.

Inventories way behind sales on 2-year comp

While many chains saw increases in stock levels during the recent quarter, some are still seeing sales growth outpace inventory growth. Further, across the industry inventory-sales spreads remain materially negative when looking at results on a two-year comp.

Retail sales have surged over the last two years and some retailers have seen changes in inventory lag sales growth by as much as 50 percentage points.

Dick’s Sporting Goods’ (NYSE: DKS) two-year inventory-sales spread is down 4,980 bps as inventories (-5.9%) have far underperformed sales growth (+43.9%) since 2019. Conversely, Walmart (NYSE: WMT) is operating closer to parity with inventory growth (+14.5%) largely on par with sales growth (+15.2%) over the same stretch.

The most recent Census Bureau data shows the retailers’ inventories-to-sales ratio stood at 1.08x in June, near the record low set in April of 1.07x and significantly lower than pre-pandemic levels of 1.45x. Retailers barely have enough stock on hand to cover one month of sales when they traditionally carry enough for one and a half months.

Inventory continues to be added but not quick enough to keep pace with demand.

The National Retail Federation (NRF) is calling for core retail sales, which exclude sales from auto dealers, gas stations and restaurants, to increase 10.5% to 13.5% year-over-year in 2021 to approximately $4.5 trillion. That growth rate is on top of a 6.6% increase last year.

Through the first seven months of 2021, the NRF said core retail sales were up 15.5% from 2020.

Sales guidance raised; pinch points exist

The commentary from retail management teams regarding product availability was generally positive, with most noting a willingness on the consumer’s part to switch buying preferences toward the brands currently available versus waiting on their first choice to arrive.

Additionally, there has been a significant reduction in markdowns and promotions as stores have been able to leverage low inventory positions along with high consumer demand into more full-price selling.

While general and household merchandisers will see more formidable sales comps in the back half of 2021, many have upped their full-year outlooks as they expect the current demand environment to last. Still, some noted conservatism in their raised guidance, citing transportation and supply chain headwinds as the reasons for not raising the bar higher.

Walmart now expects U.S. comp sales to increase by 5% to 6%, up from the prior call for a low-single-digit increase. The growth is on top of the 8.5% increase in sales recorded last year.

Management said, “We wish we’d bought even more aggressively” as the company is still seeing “above normal” stockouts in some general merchandise categories. Overall, they said inventories are in “good shape,” on a call with analysts.

Walmart has increased buying lead times and entered vessel charter agreements to have its merchandise moved exclusively in the back half of the year.

Dick’s Sporting Goods now expects full-year sales to climb between 18% and 20% versus the prior expectation for 8% to 11% growth.

Management sees some “pockets of low inventory” but said they “feel better” about stock positions for the rest of the year even if “there is a little less clarity around Q4 right now.” The company’s new guidance calls for elevated freight expenses to continue into the first quarter.

Target (NYSE: TGT) pushed its back-half sales outlook to the high end of its prior range as customers are “returning to our stores in droves.” The company now expects high-single-digit sales increases during the last two quarters of the year on top of 20% growth rates recorded in the year-ago periods.

Management noted some empty shelves in stores as Target has “simply sold beyond our expectations,” John Mulligan, Target executive vice president and chief operating officer, said on a conference call. “Our team has been successfully addressing supply chain bottlenecks, which are affecting both domestic freight and international shipping.” He said the company has been expediting ordering and buying larger quantities on the belief “that replenishment could take longer than usual.”

Supply chain chaos was on full display in Dollar Tree’s (NASDAQ: DLTR) earnings report.

The company reeled in its fiscal 2021 outlook due to higher ocean shipping rates. The revised guidance calls for an additional $185 million to $200 million in freight costs compared to the outlook just one quarter ago. Management said its ocean carriers are likely to honor a smaller percentage of contractual commitments than previously believed, forcing it into the spot market, where rates have spiked.

The new full-year earnings per share range of $5.40 to $5.60 is 7% lower than the quarter-ago guide and shy of the $5.65 reported last year. The implication is higher freight costs will essentially wipe out all of the top-line benefit from elevated consumer demand this year.

Dollar Tree has begun booking its own ocean vessels to address capacity concerns and will look to merchandise suppliers outside of Asia to lower transportation expenses moving forward.

Apparel retailers late to the recovery; experiencing delivery delays

Apparel-centric chains like Kohl’s (NYSE: KSS), Ross Stores (NASDAQ: ROST) and The TJX Companies (NYSE: TJX) saw sales soar for the second straight quarter. A recovery in apparel lagged the broader retail rebound as many consumers opted to buy household products versus clothing to adjust to stay-at-home lifestyles last year. A surge in apparel spending didn’t occur until this past spring.

Also, many apparel retailers have been rightsizing inventory and thinning out the number of vendors they work with, which has further pressured inventories.

Kohl’s (two-year inventory-sales spread down 2,650 bps) raised its full-year sales guidance again. The chain expects sales growth in the low-20% range, up from the prior guide of a mid-to-high teens percentage increase.

The company is “light on inventory,” ending the quarter in a position lower than hoped for, CFO Jill Timm stated on the company’s earnings call. “I would definitely say inventory was a little bit lighter than we expected at the end of the second quarter. We didn’t make the progress back that we would have expected, and that definitely is going to weigh a little bit from a sales perspective.”

In addition to higher sales, temporary factory closures abroad and port congestion were called out as the reasons for the shortfall.

Ross Stores (two-year inventory-sales spread down 2,530 bps) Vice Chair and CEO Barbara Rentler told analysts, “Supply chain congestion is causing all kinds of receipt delays right now, and we expect those actually to worsen as the year goes on.” She said there is “plenty of supply” available but delivery dates continue to be delayed. “In reality, what’s happening is that merchandise deliveries are sliding. So it could slide two weeks, 30 days. They are sliding.”

Management from The TJX Companies (two-year inventory-sales spread down 2,520 bps), parent company of T.J. Maxx, Marshalls and HomeGoods, noted “overall product availability in the marketplace remains excellent.” But it pulled earnings guidance due to “the continued uncertainty of the current environment,” notably an uptick in COVID cases.

The company is continuing to add lead time to its buying plans and expects freight costs to step higher again in the back half of year.

No letup in freight’s flow

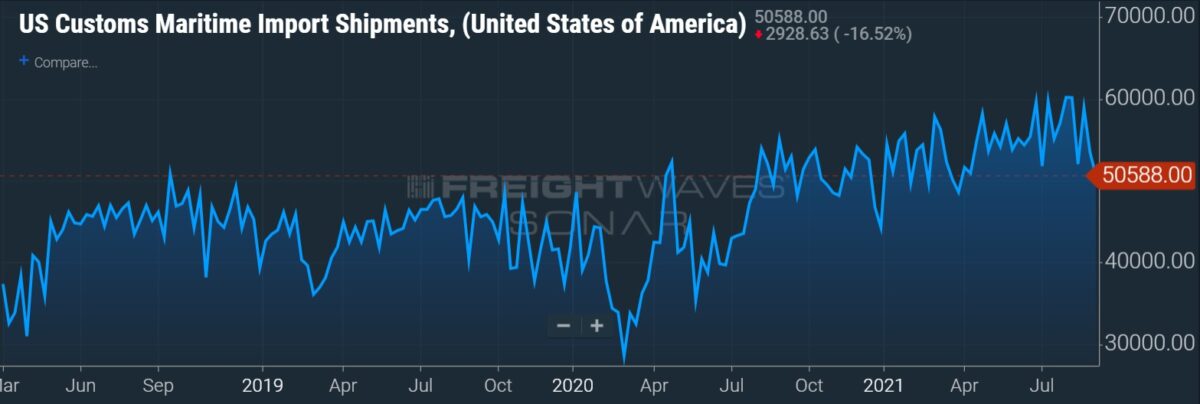

Nothing says the inventory correction remains unfinished more than the number of loaded containers landing at U.S. ports.

Container imports at the nation’s 10 largest ports are up 25.6% over the last 12 months, according to data provided by The McCown Report.

The NRF reported that inbound retail containers increased 35.6% year-over-year to 12.8 million twenty-foot equivalent units during the first half of 2021. The comp was easy relative to a pandemic-marred first half last year. However, the NRF expects full-year 2021 TEUs of 25.9 million, a 17.6% year-over-year increase and a new record. Of note, the group is forecasting inbound container flows to remain above the 2 million-unit level for the rest of the year.

Ted Decker, The Home Depot’s (NYSE: HD) president and COO, summed up the inventory situation best. “I’d say it’s been a category-by-category story. There’s a COVID outbreak in a factory. There’s a shipping constraint. There’s a domestic transportation capacity constraint. It’s been a story of two steps forward, one step back.”

Curtis W. Cotten

Starting now, you’ll be earning cash every month from home. You can get more money online than $45,000 by completing an easy job online. During the last four weeks, I have earned $45,150 from this job. It is easy to join and to earn a living from these websites. They are just great.

Follow the steps here to get started right now.➤➤➤➤➤ http://www.fullwork.cf