Roadrunner Transportation Systems, Inc. (NYSE: RRTS) reported a loss of $1.78 per share compared with the break-even consensus estimate.

The asset-right and asset-light logistics service provider’s reported revenue of $507.1 million in the first quarter of 2019 was down 11 percent year-over-year. Its operating loss was $20.8 million compared to a $13.4 million operating loss in the first quarter of 2018. RRTS reported adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $0.7 million compared to $3.1 million in the first quarter of 2018.

Management said that the revenue decline was attributable to an expected slowdown in the ground expedited market and lower volumes in the Less-Than-Truckload (LTL) segment given restructuring and planned service area outages. Further, management said that the Truckload & Express Services (TES) and Ascent Global Logistics (Ascent) segments reported lower adjusted EBITDA due to difficult comparisons.

On the call, management provided some insight into each division as well as its turnaround plan.

Active-On-Demand, roughly half of TES revenue – this segment offers premium mission-critical air and ground transportation solutions – total revenue declined 26.7 percent year-over-year as demand for expedited air improved, but was more than offset by aircraft availability, which reduced the capture rate and resulted in an earnings headwind. Adjusted EBITDA was down 30.2 percent at $7.5 million.

The LTL division continues to see the impact of re-tooling efforts. RRTS is now focused on making its city-to-city operations the core focus of the division. While the company wants to increase density in its tier one and tier two lanes, its primary focus is to improve yields and eliminate unprofitable freight. These actions have resulted in declining shipments. This was seen in the quarter as revenue per shipment increased 6.9 percent (revenue per hundredweight increased 3.2 percent) while shipments per day declined 13.7 percent. Management said that the year-over-year comparisons will get easier as they are lapping the prior periods when the yield improvement strategy began. Further, they plan to implement a general rate increase similar to other LTL carriers this year and reiterated the goal for the division to exit 2019 operating at a break-even level. LTL reported an adjusted EBITDA loss of $5.2 million in the period.

RRTS Key Performance Indicators – LTL

The Ascent division reported a 10.7 percent decline in adjusted EBITDA to $7.1 million. On the domestic side, lower brokerage load counts and planned fleet reductions were partially offset by improved broker spreads and operating costs. Both the international freight forwarding and retail groups reported revenue growth from increased account penetration and customer acquisition.

RRTS Key Performance Indicators – Ascent

RRTS’ first quarter 2019 loss was much lower than the more than $15 per share loss seen in the first quarter of 2018. RRTS completed a 1-for-25 reverse stock split, which was more than offset by a $450 million rights offering (36 million common stock shares) in February 2019. Net proceeds from the offering were used to redeem preferred stock, pay unpaid dividends and add more than $30 million to general corporate purposes.

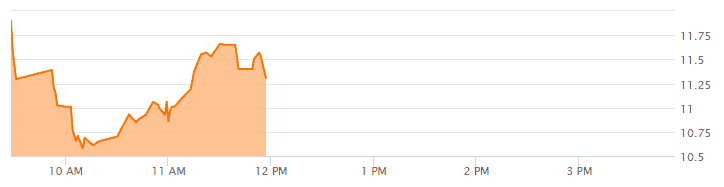

The offering essentially allowed RRTS to lower its debt load by $389 million by replacing dividend-paying preferred shares to common stock shares. Long-term incentives to management are based on a rights offering price of $12.50 per share. The stock is down roughly 10 percent today at $11.30, bouncing back from early session lows.