It is the year of the retail investor, and listed shipowners, like other public companies, have seen a wave of newcomers buy their stock.

Shipowners are happy. They need all the buyers they can get to boost their tepid trading liquidity. Retail buyers of shipping stocks are not so happy. In the case of several tanker equities, retail enthusiasm appears to have been heavily countered by institutional selling.

Diverging from fundamentals

Retail investors are getting a lot of ink, much of it negative. Famed Wall Street Journal columnist Jason Zweig recently lamented that “swarms of willfully ignorant investors are day-trading their way through the pandemic … computer algorithms pick up on such trades and pile in to ride the momentum … in the old days, the little guy mimicked the big boys; right now, it may be the other way around.”

A central criticism of some retail investors — with traders on the Robinhood platform getting the most press — is a lack of focus on listed companies’ fundamentals that can drive valuations away from those fundamentals.

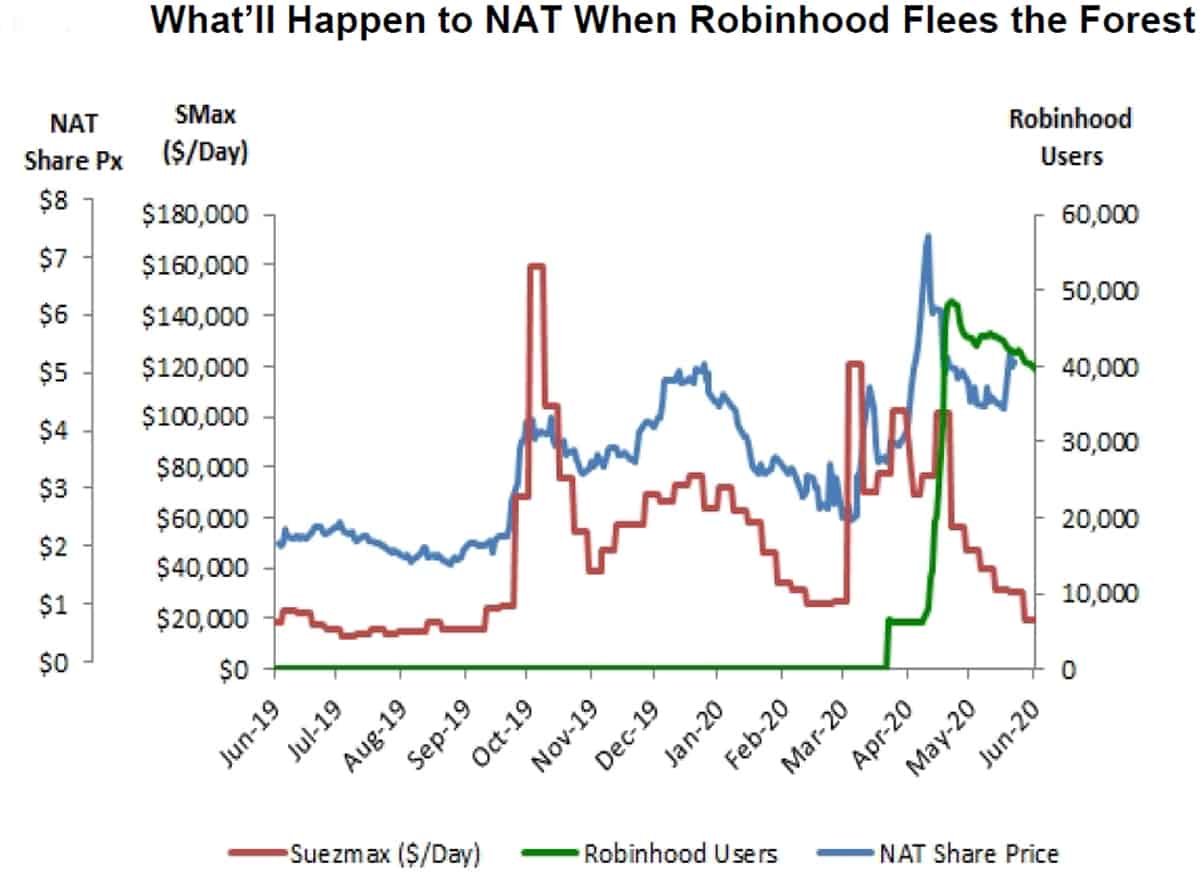

In ocean shipping, shares that become uncorrelated with freight rates exemplify this divergence. Evercore ISI analyst Jon Chappell commented in a research note on Monday, “As many shipping investors are all too aware, if the historically tight correlation of stock prices and spot rates breaks, it can be painful for both longs and shorts until fundamentals eventually return to relevance.”

Why VLCC stocks lag NAT

Retail focus on the tanker sector has been primarily driven by the floating-storage thesis, which posits that tankers removed from transport service for storage duties will equate to higher spot rates for the tankers still available for transport.

Floating storage most directly affects owners of very large crude carriers (VLCCs; tankers that carry 2 million barrels of crude oil). Ironically, analysts highlight Nordic American Tankers (NYSE: NAT) as the main benefactor of the “Robinhood effect” — and NAT doesn’t own VLCCs, it owns Suezmaxes (tankers that carry 1 million barrels).

According to Chappell, “The correlation of NAT shares with Suezmax rates was extremely tight until right about the time that the ‘floating storage’ took hold, NAT was on CNBC, and Robinhood user ownership spiked. Spot rates have plummeted back to trough levels of late, yet the stock price has been somewhat resilient.”

In follow-up comments to FreightWaves, Chappell explained, “There’s an element of broader retail participation across the [tanker] group, especially as the floating-storage theme gained broader market attention, but NAT has been the outlier, by far, both from the holders on retail platforms and share-price performance.

“NAT has outperformed [VLCC owners] DHT [NYSE: DHT], Euronav [NYSE: EURN] and Frontline [NYSE: FRO] by 29-37% year-to-date and by 66-73% over the last three months. Meanwhile, the Suezmax rate spike was shorter in duration and of lesser magnitude than the VLCC spike and that segment [Suezmaxes] now sits near 52-week lows while VLCCs are still making very good money.”

One reason the top VLCC equities didn’t perform as well as NAT may relate to “the big boys” — the institutional investors — who are historically less attracted to NAT.

“The institutional investor base was early to the VLCC names, either because they believed in the 2020 market fundamentals before coronavirus or they were quick to identify the floating-storage potential,” said Chappell. “But just as rates were skyrocketing and retail was getting involved, institutions began fading the rally, so I think they put a lid on the VLCC upside through taking profits, whereas they rarely get involved in NAT, so there was no selling as Robinhood and his merry men were adding aggressively.”

Then the recovery of oil pricing spurred further selling by larger funds that had shares of VLCC owners more so than NAT. “Tankers were the only beneficiary of plummeting [oil] demand across energy, so funds were buying tankers to hedge other energy positions,” said Chappell. “When energy began to rally, they sold the tanker positions.”

According to analyst J Minztmyer of Seeking Alpha’s Value Investors Edge, retail investors were “attracted by the eye-popping daily rates and the primary stock of focus was NAT, which ironically was one of the most overvalued stocks. These retail investors absolutely had an impact on these stocks. NAT had record levels of daily volume about six weeks ago.”

Mintzmyer also saw institutional fund behavior counterbalancing retail. “We can argue that retail traders shot themselves in the foot a bit by trying to ‘trade earnings’ and keeping a hyper-focus on daily rates changes, while not really understanding or appreciating the long-term bullish value prospects. However, retail investors and traders at least stepped up to participate.

“Institutions, on the other hand, have primarily stayed out of the sector. They loved it in December, but with COVID-19, there hasn’t been much inquiry. Many of the hedge-fund types I’ve worked with have actually been trying to short the sector, not so much as a valuation play, but more as sort of ‘Anti-Robinhood’ because they’ve seen these waves come and go.”

Past, present and future investors

The retail-versus-institutional mix came up during a virtual panel on Monday presented by Marine Money.

“You saw a steep increase in liquidity, the amount of shares traded,” recalled Lois Zabrocky, CEO of International Seaways (NYSE: INSW) of the initial wave of retail buying. “There was retail interest that was short-lived but there is also retail interest that is more ‘long’ and more interested in industry fundamentals. There was a tremendous amount of short-term interest that came in and went out of our shares very quickly, but there is still a reasonable component that is ‘long-only.’”

According to Craig Stevenson, CEO of Diamond International Shipping (NYSE: DSSI), “We started off with fast money, people trying to make a quick buck, but now it’s like a sector rotation out of growth and into value. When you’re playing with 50-cent dollars, there’s a lot of value here.”

Jefferies shipping analyst Randy Giveans explained during the Marine Money event, “In March and April, the only questions people were asking were: What are the rates today? What are the floating-storage economics? All people cared about was today, today, today.

“Now they’re asking: What do rates look like in a quarter? At the end of the year? In 2021? People are starting to see a little further ahead. There’s less of a myopic focus on things like intraday Brent moves, and more of a focus on supply-demand fundamentals — which is probably healthier than just day-trading the rates.”

Mintzmyer told FreightWaves that retail money focused on tanker stocks “was mostly fast-money traders who sort of came and went between mid-March and mid-May without much regard for long-term fundamentals.

“For tanker prices to appreciate meaningfully in the longer term, we need to see large funds come back to the space. Retail interest and traders will help at the margins and will improve liquidity, but cannot support stock valuations. This is evident in the average price-to-net asset value discounts of 30-40% or more across the board — an obviously broken market, just due to not enough investors to buy available shares. There just aren’t enough buyers with deep enough pockets out there.” Click for more FreightWaves/American Shipper articles by Greg Miller