All thawed out

Internet of Things (IoT) devices have become wildly popular in the cold chain. They can give shippers, carriers and honestly everyone else much-needed insight into what happens during a shipment. What happens on the road? Is the reefer running continuously? Were there any disturbances on the road that could have damaged the product?

SmartSense by Digi has announced its new product, SmartSense Voyage, which provides real-time visibility, control and tracking of moving assets throughout the entire supply chain. The T1 sensor is an ultracompact, durable, GPS-enabled, global cellular network device designed for temperature accuracy and dependable connectivity, and it is easily reusable technology made from recyclable materials.

“Customers trust SmartSense to meticulously track stationary assets and support their

compliance efforts across tens of thousands of sites. And now we are bringing that same

reliability and capability to the dynamic challenges of moving assets,” said Guy Yehiav,

president of SmartSense by Digi. “With SmartSense VOYAGE, businesses can confidently

monitor shipments in transit, ensuring products arrive in optimal condition, bolstering supply

chain efficiency and customer trust.”

Temperature checks

A story from across the pond is impressive cold chain news. ISD Solutions has completed construction of the U.K.’s tallest freezer warehouse. The warehouse has 101,000 pallet positions and is 45.7 meters, or 155 feet, tall – just over 15 stories. The facility also has 20 loading docks with inner dock freezer rapid-action doors that help control humidity during loading and unloading of trailers.

Jason Denning, ISD director of industrial and commercial projects, said in a Food Manufacturer article, “We know that the UK is severely lacking in frozen warehousing space, and we also know that high-bay automated warehouses are what is needed to make up this shortfall.”

In the U.S., cold storage facilities are aging out or lack offerings for niche products, or they are being sold out of space before a building is completed. According to Colliers, there is a 3.4% vacancy rate for cold storage buildings in top U.S. markets. A large plot of land may be tricky to find in major metropolitan areas, but going up instead of out might be something to borrow from the Brits.

Food and drug

From the very beginning of frozen foods’ existence in consumers’ homes, there have been stables like chicken pot pie and Salisbury steak, the quintessential TV dinner. Since that time, the frozen food market has been taking off and claimed a staggering $83.5 billion value as of 2024. The frozen food sector is still rapidly growing; it’s consumers’ tastes that have changed.

According to Grandview Research, “Frozen snacks market is expected to grow at a CAGR of 11.6% from 2025 to 2030. Busy schedules, convenience, the expansion of e-commerce, and changing lifestyles are driving the demand for frozen snacks. As more people move into urban areas seeking career growth opportunities, fast-paced lifestyles are increasing the need for convenient food alternatives like frozen snacks.”

The frozen dinner market is on the downhill slide, but coming in to replace it are plant-based frozen meals and small bites or treats, as Conagra found in their most recent study on frozen food.

Frozen food won’t be going anywhere anytime soon, but the freezers might look a little different here in a few years.

Cold chain lanes

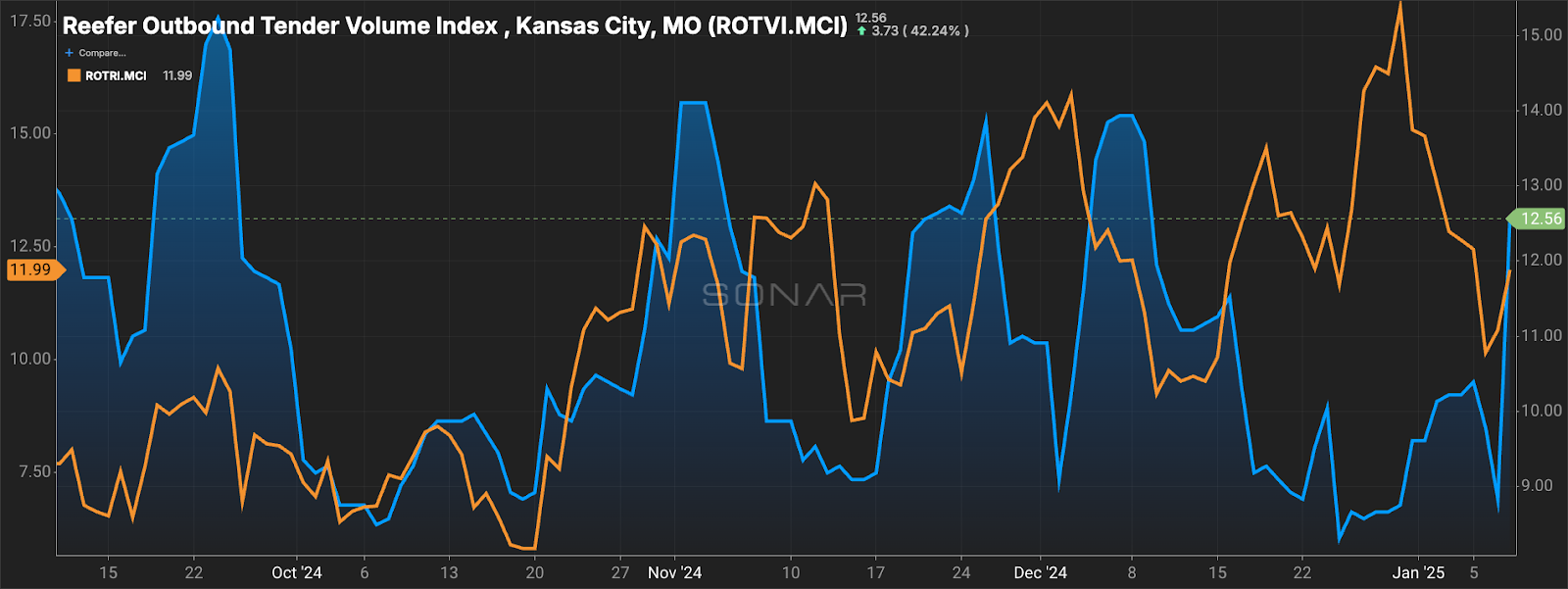

This week’s market under a microscope is Kansas City, Missouri. This Midwestern hub for rail and trucking came to a screeching halt over the weekend due to a crippling ice storm that stranded trucks on the highway for days, in some cases. As for the reefer freight market, it is loosening. Reefer outbound tender volumes are on the rise – a week-over-week change of 30%, to be more precise. Reefer outbound tender rejections are technically increasing after a post-holiday drop but are still down 297 basis points week over week for a ROTRI of 11.99%.

The national average for reefer rejections is 15.41%. The fact that Kansas City is under that bodes well for reefer capacity. Shippers can expect better routing guide compliance than they’ve seen through the end of 2024 and lower spot rates from carriers compared to most other markets

Is SONAR for you? Check it out with a demo!

Shelf life

UPS broadens network with double health care acquisition

ILA, USMX reach contract agreement on automation, avoiding port strike

Cold chain RFID market to hit $4.6 billion by 2030

Vertical Cold Storage opens distribution center in Kansas City

Arcadia Cold Storage warehouse to break ground in Joliet

Wanna chat in the cooler? Shoot me an email with comments, questions or story ideas at moconnell@freightwaves.com.

See you on the internet.

Mary

If this newsletter was forwarded to you, you must be pretty chill. Join the coolest community in freight and subscribe for more at freightwaves.com/subscribe.