All thawed out

In a westward expansion, FreezPak Logistics is taking up residence in its first West Coast facility: a new cold storage facility in the Los Angeles area, that is 150,000 square feet of both freezer and refrigerated pallet positions. This location will also offer overseas container plugs, United States Department of Agriculture/Food Safety and Inspection Service/Food and Drug Administration inspections, cross-docking, port drayage, less-than-truckload and truckload transportation, dedicated fleets, repacking, and same-day order fulfillment. Being just 20 miles from the ports of Los Angeles and Long Beach makes the site ideal for imports and exports of temperature-sensitive goods.

“This new facility in Los Angeles is a monumental step in FreezPak’s growth journey,” said Michael Saoud, co-founder and co-CEO.

“By establishing a presence in this vital market, we are not only extending our reach to the West Coast but also ensuring our customers have access to the most efficient and innovative cold storage and logistics solutions available,” said David Saoud, co-founder and co-CEO.

Temperature checks

Fan favorite Lineage makes headlines again. Lineage’s initial public offering last July saw its shares debut at $82, surpassing its $78 offer price, and valued the company at $19.2 billion. It raised $4.45 billion, marking the largest global stock market debut of the year.

This time the headlines have a different twist. The cold storage giant is facing layoffs. The actual number of employees affected hasn’t been disclosed.

Despite the strong per-share figure at its IPO, its current stock prices are down around $53 – a 34% drop in the past six months. The falling stock price likely has the company facing some difficult decisions as it navigates the full first year of being a publicly traded company.

Fourth-quarter financials aren’t out yet but based on results in Q3, which was also the first quarter Lineage published financial data as a public company, the financials were holding strong. There was year-over-year growth, net revenue increased to $1.34 billion and occupancy was 77.6%. The biggest concern was the soft demand in the food space, but a rebound is still expected.

Food and drug

Conagra Brands recently announced plans to market GLP-1 friendly labels to drug users as a way to boost frozen food sales and get consumers spending money on groceries. That might be a path that the rest of the frozen section and other areas of the grocery store have to adopt as GLP-1 users have cut back on grocery store spending by about 6%.

GLP-1 drugs work to lower blood sugar levels and promote weight loss. Originally created to target Type 2 diabetes and obesity, the drugs have now widely spread to a larger demographic as a weight loss drug. They help curb appetite.

This widespread adoption of the drug has hit grocery stores hard, with salty and sweet snack items seeing the biggest drop-off in purchases. Research by Cornell and Numerator found, “Among categories, chips, sweet bakery, side dishes and cookies showed some of the largest reductions in spending following GLP-1 use, decreasing by an average of 6.7% to 11.1%.”

The biggest section of the store to get hit is frozen foods as consumers become more mindful of portion sizes and opt for less processed foods. According to a Food Business News article, “The market opportunity for GLP-1 drugs is projected to grow from an estimated $133 billion now to $150 billion by 2030. The increasing rates of obesity and diabetes in the United States are driving this growth, with Centers for Disease Control and Prevention data indicating more than 100 million US adults are obese.”

Cold chain lanes

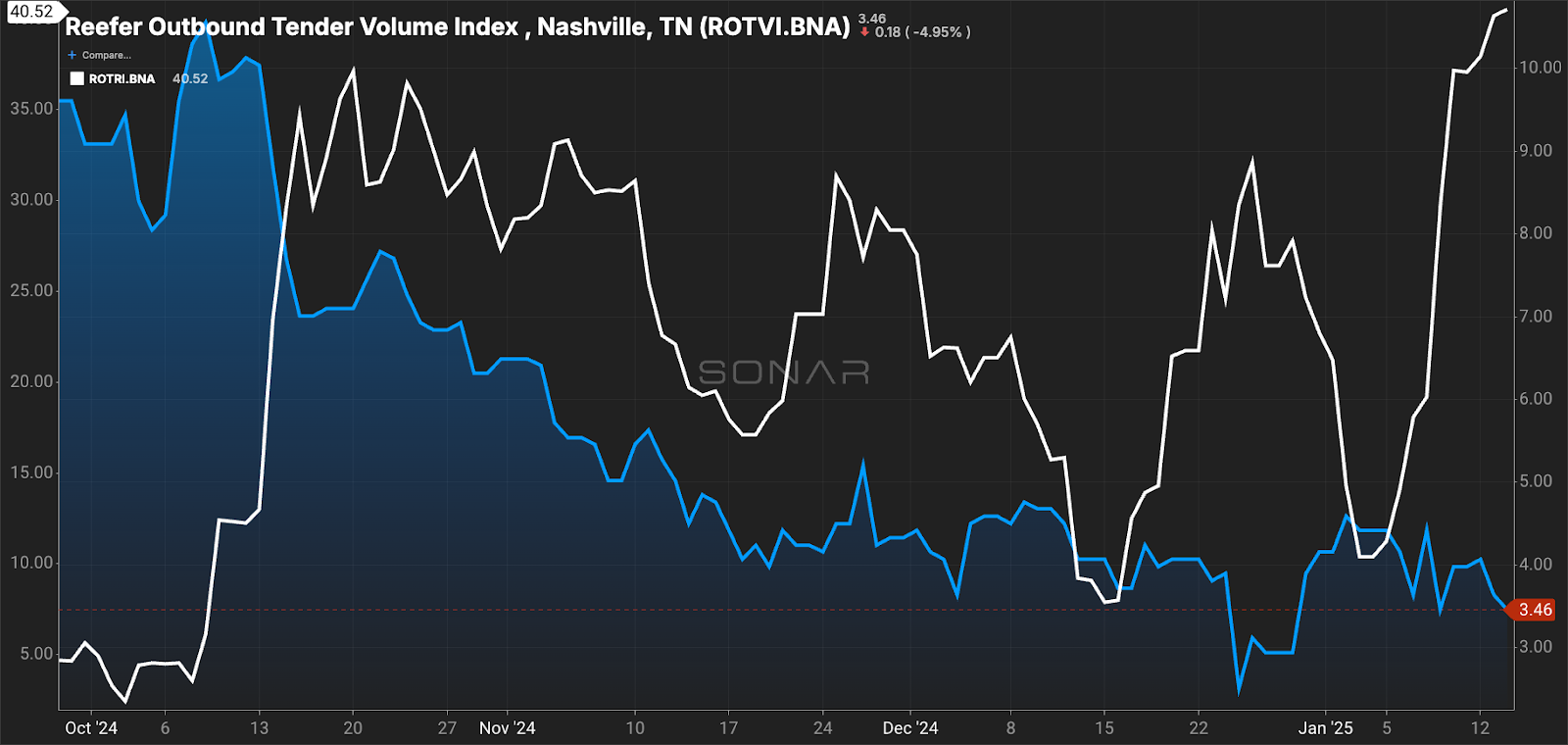

This week’s market under a microscope is the home of country music, Nashville, Tennessee. Reefer outbound tender rejections have risen to the highest levels in the past 365 days. With the ROTRI hitting 40.52%, Nashville will be experiencing incredibly inflated spot rates. Compared to historic averages for mid-January over the past few years, it’s nearly 3,516 basis points higher year over year. The only exception to that is 2022, when the ROTRI was 46.29% at this time of year.

Reefer outbound tender volumes have dropped 4.59% w/w. The current reefer outbound tender volume levels are the lowest they’ve been for the past three years. Low reefer volume and high reefer rejections will cause shippers and brokers to have to prioritize what shipments need to be moved or be prepared to pay an elevated rate to get goods moving. Carriers are in for a decent return on a load moving out of the Nashville market.

Is SONAR for you? Check it out with a demo!

Shelf life

FACT SHEET: Biden-Harris Administration highlights historic food system investments

Cold chain industry slams Nepra for placing it in commercial tariff category

Trucking industry sees a silver lining: Spot rates rise across the board

Hydropac unveils ice pack solution for pet food cold chain logistics

Wanna chat in the cooler? Shoot me an email with comments, questions or story ideas at moconnell@freightwaves.com.

See you on the internet.

Mary

If this newsletter was forwarded to you, you must be pretty chill. Join the coolest community in freight and subscribe for more at freightwaves.com/subscribe.