All thawed out

It’s the end of the year, which means it’s that much closer to the Jan. 1 implementation of the American Innovation and Manufacturing Act. Aim authorizes the Environmental Protection Agency “To address HFCs [hydrofluorocarbons] by: phasing down their production and consumption, maximizing reclamation and minimizing releases from equipment, and facilitating the transition to next-generation technologies through sector-based restrictions on HFCs.”

This act is intended to reduce HFC emissions by 30% over the next three years and has three pillars: HFC phasedowns, reclamation and minimization, and sector-based transitions.

HFC phasedown is a balanced allocation program that decreases the production and consumption of HFCs.

Reclamation and minimization will encourage recovery of refrigerants and cut HFC emissions from existing equipment.

Sector-based transitions will guide specific industries toward adopting next-generation refrigerants and technologies, following defined timelines to ensure a smooth transition.

This whole process is expected to take place over the course of three years: Jan. 1, 2025, to Jan. 1, 2028. This rollout method will impact industries a little differently. Guidelines will differ based on refrigerant charge size. For example, supermarkets using large refrigeration systems with a charge exceeding 200 pounds must abide by stricter rules than, say, a restaurant walk-in cooler or freezer. Nonrefrigeration applications of HFCs, like those used in blowing agents in manufacturing insulation foams, will also be affected by the regulations.

The general consensus is that self-contained refrigeration systems will be the first impacted industry. Unfortunately, that means cold storage warehouses and aspects of the supply chain will be the first to adopt these changes and the costs associated with the transition.

The transition is expected to bring a 20%-40% increase in expenses related to new refrigerants and technologies. This accounts for upgraded system components, enhanced reporting requirements and annual reporting expenses to the EPA.

Food and drug

The National Frozen & Refrigerated Foods Association recently announced the winners of its first-ever Penguin Pitch. Essentially it’s a contest for emerging brands to help find the next big name in frozen and refrigerated foods. This year’s finalists had mozzarella sticks, frozen bao buns, frozen waffles and a twist on pizza rolls, to name a few.

The winner of Overall Excellence is Big Mozz giant mozzarella sticks. What makes these sticks different from the traditional ones in the freezer aisle is the cleaner label, the size and the overall taste. The company’s top market is food service; the sticks are in Yankee Stadium.

CEO and Founder Matt Gallira said in an interview on the From the Cold Corner podcast, “What is succeeding in frozen is premium. There’s more brand discovery happening in frozen than there ever has been. We’re a premium corner of a subset of frozen handhelds and appetizers. We make a premium mozzarella stick – and that’s it – but I would love to see more premium branded items start to appear in the frozen set because a rising tide lifts all boats.”

The company is debuting two new flavors: super ranch, which is available at Whole Foods, and a Flamin’ Mozz, which is in the New York tristate area.

Cold chain lanes

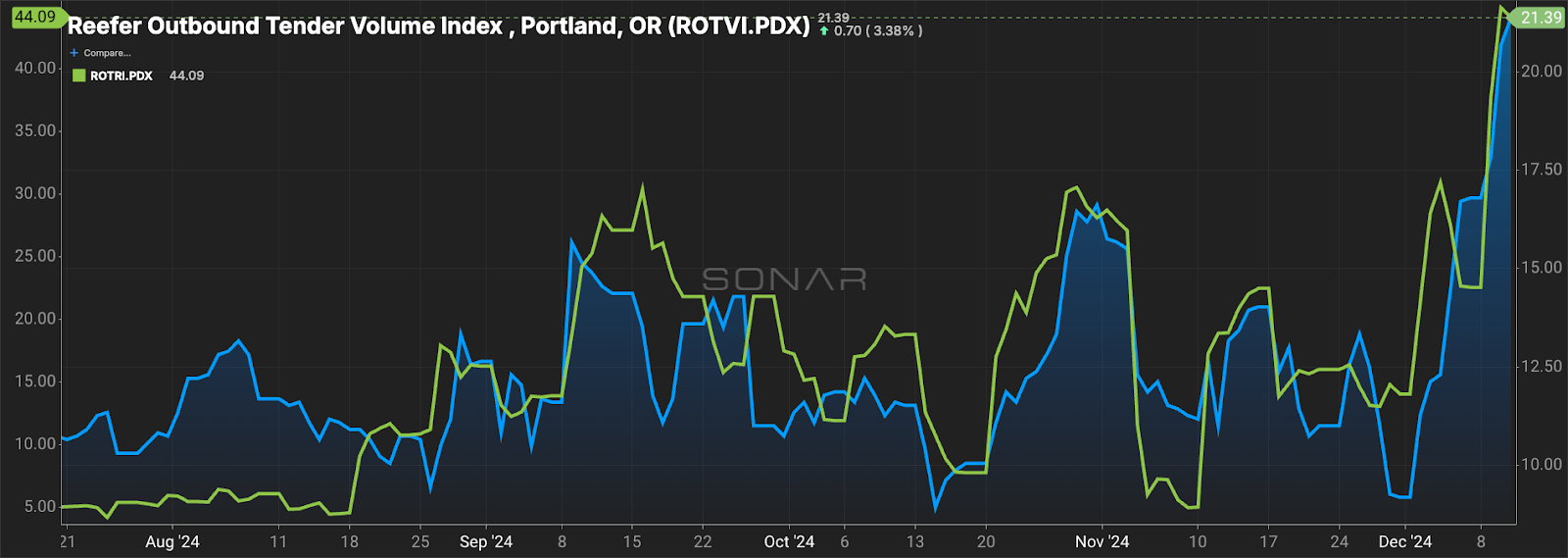

This week’s market under a microscope is Portland, Oregon, in the Pacific Northwest. Portland is keeping plenty cold, with reefer outbound tender rejections climbing to 44.09% a 1,317-basis-point increase week over week. On the same trajectory are reefer outbound tender volumes, which are up 73% w/w. To say Portland is experiencing a capacity crunch would be an understatement.

Before the spike, the Reefer Outbound Tender Reject Index was at 22.42%, which is already a strong signal of an inflationary market. The likely culprit for the increase in rates is the Christmas tree market. Oregon is one of the top producers of Christmas trees, and most are shipped on reefer trailers. Shippers should take this influx of demand as a sign to book loads out further and be prepared to pay more for spot loads.

Is SONAR for you? Check it out with a demo!

Shelf life

Carrier sponsors World Cold Chain Symposium 2024 to help build a global sustainable cold chain

‘Emerging’ B.C. family cooks up something special in the frozen meals business

This popular brand sells the most single-serve frozen dinners

CPKC, Americold exploring co-development opportunities in Mexico

Premier Nutrition, Hometown Food Co. launch frozen breakfast line

Wanna chat in the cooler? Shoot me an email with comments, questions or story ideas at moconnell@freightwaves.com.

See you on the internet.

Mary

If this newsletter was forwarded to you, you must be pretty chill. Join the coolest community in freight and subscribe for more at freightwaves.com/subscribe.