All thawed out

The global pharmaceutical industry is expected to reach a valuation of $5.3 billion by 2032. The current valuation is $2.6 billion, as of 2024. This includes everything from raw materials and active ingredients to finished products and medical devices from manufacturers to distributors, wholesalers, pharmacies and health care facilities.

IAG cargo, the cargo division of International Airlines Group, recently reported a 22% increase in tonnage in 2024 versus 2022, which signals anticipated growth in demand for temperature-sensitive airfreight in the pharmaceutical industry.

Jordan Kohlbeck, head of pharmaceutical at IAG Cargo, said in an American Journal of Transportation article: “The safe, controlled movement of pharmaceuticals is more important than ever due to increasing global demand, medical advances, regulatory requirements and the undeniable need for rapid response to medical crises. As the industry continues to grow, ensuring life-saving medicines and treatments reach patients in optimal condition will become even more important.”

Temperature checks

The pharmaceutical industry and the cold chain go hand in hand. However, in more remote parts of the world, difficulty ensuring the reliability of the cold chain can put pharmaceuticals at risk. Vaccine storage in such regions has long been a struggle as power outages, fuel shortages and other issues can ruin vaccines before children receive them. Some progress is being made with vaccines and applications that don’t require temperature-controlled transportation, but there is still a long way to go.

This need for reliability has spurred innovation in solar-powered fridges and freezers, originally created in the 1980s. This technology has become such a valuable resource for the country of Malawi that it has since replaced all of its gas- and battery-powered fridges with solar-powered ones. This swap has increased the nation’s pharmaceutical cold chain locations to 1,200, meaning people don’t have to travel as far for the care they need.

In a Gates Foundation article, Gray Phiri, a cold chain manager in Malawi, said, “Even in places with grid power, we realized we should also be thinking about having solar fridges at those facilities.” The article noted, “Today, all 29 of the country’s district-level vaccine storage facilities use solar-powered units, with electricity available as backup.” Roughly 60% of Malawi’s cold chain locations are now supported by solar-powered fridges funded by Gavi, the Vaccine Alliance.

Food and drug

As if the freezer aisle couldn’t get any cooler, Little Debbie comes along and says, but wait there’s more. Notable in the freezer section is the company’s partnership with Hudsonville Creamery that produces Little Debbie ice cream pints, in iconic flavors of time-honored classics like Zebra Cakes, Star Crunch and Cosmic Brownies.

Now Little Debbie has moved into the ever-popular ice cream bar market. Again teaming with Hudsonville, the brand has brought back four ice cream bar flavors in time for summer: Birthday Cake, Strawberry Shortcake Rolls, Nutty Bars and Star Crunch.

The ice cream bar market was valued at $6.35 billion in 2024 and is expected to grow to $10.58 billion by 2033. It’s one of the fastest-growing markets in the frozen dessert sector. Popsicles still have over 60% of market share, but ice cream bars are rapidly taking a bite out of that.

Cold chain lanes

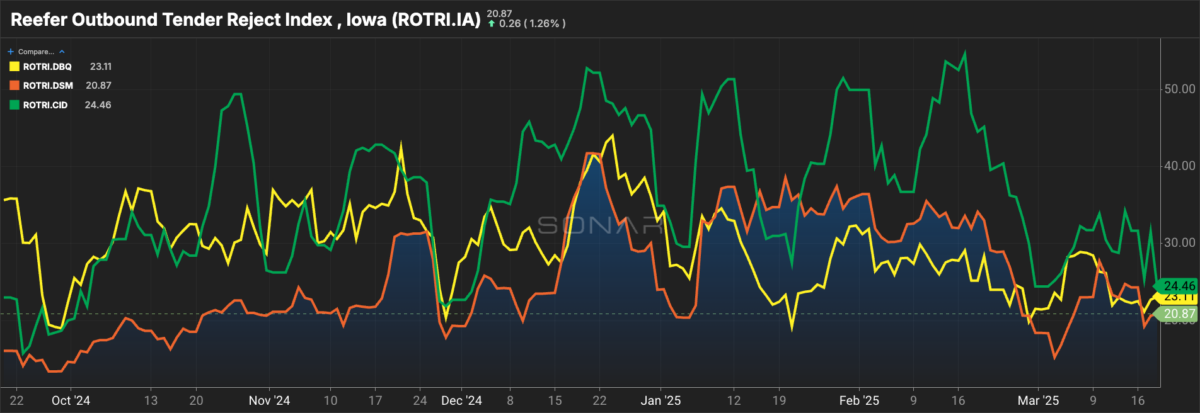

This week’s market under a microscope is a broader look at Iowa, made up of three relatively small markets: Des Moines, Dubuque and Cedar Rapids. While these markets might not be the largest, they have held the top spots for reefer outbound tender rejections pretty much since the beginning of the year. Reefer outbound tender rejection rates consistently above 20% indicate some inflationary spot rates in the market.

Reefer outbound tender rejections in Des Moines have fallen 246 basis points week over week, whereas Dubuque and Cedar Rapids have seen increases of 114 basis points and 2,446 basis points, respectively, in the same time period.

While reefer rejections remain elevated, the impact is not as significant as if, for example, it were Atlanta, with an average of 20% rejections. That would hamper such a large market, drastically affecting supply and capacity compared with when a smaller market is elevated.

Is SONAR for you? Check it out with a demo!

Shelf life

Utility Trailer introduces advanced options to enhance versatility, performance and efficiency

Pennsylvania bills would benefit port truck drivers, reefer units

CCT and Tower Cold Chain unite to unveil major product launch at LogiPharma 2025

Tive signs strategic partnership agreement with Nippon Express Holdings, Inc.

Porter Logistics expands services to cold chain logistics

Wanna chat in the cooler? Shoot me an email with comments, questions or story ideas at moconnell@freightwaves.com.

See you on the internet.

Mary

If this newsletter was forwarded to you, you must be pretty chill. Join the coolest community in freight and subscribe for more at freightwaves.com/subscribe.