Shipping of containerized cargo into Russia has evaporated. Shipping of tanker cargo out of Russia is booming. It seems the world doesn’t miss selling consumer goods to Russians but can’t stop buying Russia’s oil cold turkey.

Sanctions do not prevent liner companies from calling in Russia with their container ships. Yet they’ve stopped anyway, choking import options. FourKites reported Wednesday that Russian consumer goods imports via all transport modes are down 87% versus pre-invasion. Imports of industrial products are down 91%.

Tanker companies, like the liners, are not prevented by sanctions from calling in Russia. But unlike in container shipping, there are more than enough tanker operators still willing to go.

“We’re not taking a moral high ground,” said Lars Barstad, CEO of tanker company Frontline (NYSE: FRO), during a conference call on Tuesday. “We’re following what the politicians want us to do. What we have decided to do is follow the sanctions. What the EU, U.S. or U.K. decides, we follow.”

He added, “I think one has to keep in mind that ever since this war started, the EU has been importing large amounts of gas and oil from Russia. These are actually molecules that the world needs.”

Russia’s exports still high after invasion

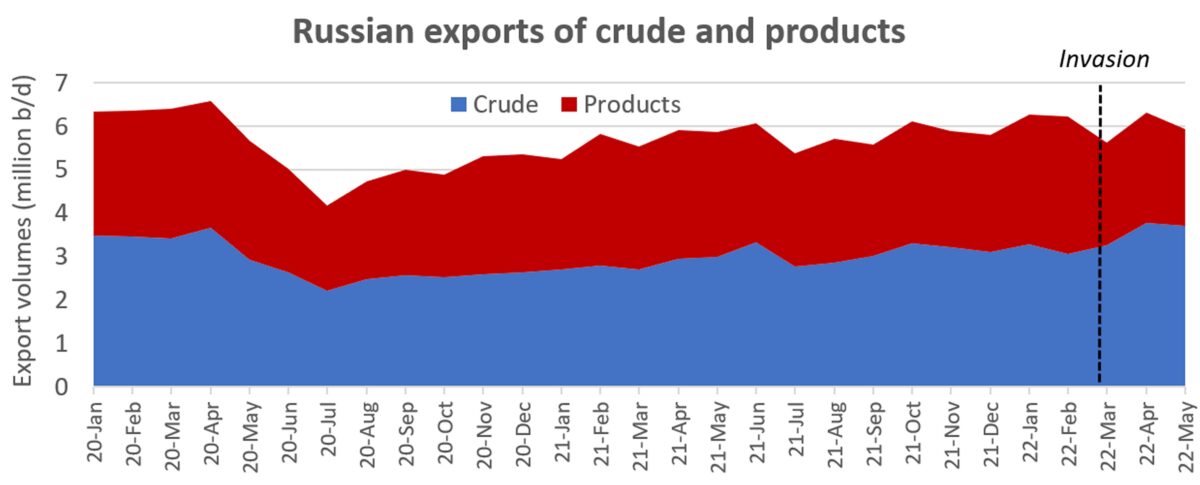

Data provided to American Shipper by Kpler shows that Russia exported 3.77 million barrels per day (b/d) of crude in April, the highest monthly tally since June 2019 (excluding the CPC blend with Kazakh oil).

Preliminary Kpler data for May shows combined crude and products exports of 5.95 million b/d. That’s down only 4% from February, when Russia invaded Ukraine, with the decline due to a drop in products exports. Russia’s combined crude and products exports are actually up 1% this month year on year.

“Russian oil and products exports from the Black Sea and Baltic are not down that much” since the invasion, said Barstad.

According to Reid l’Anson, senior commodity analyst at Kpler, “Russian seaborne oil exports remain strong. For now, India is stepping in to buy most of the Russian oil shunned by EU-27 countries. There is also a bit of evidence that China is picking up purchases.”

Private tanker owners fill the gap

Even though there are no sanctions on Russian oil, the potential risk is still too great for most publicly listed tanker companies.

Barstad said that Frontline has “basically refrained from taking the risk.” International Seaways (NYSE: INSW) CEO Lois Zabrocky said earlier this month, “Since the onset of violence in late February, International Seaways has not booked any Russian cargoes loading in any Russian ports.”

Barstad acknowledged, however, that Frontline had loaded one Russian cargo in the past month. “We have on one occasion, yes. But that was under contract. You are sometimes not in a good legal position if you refrain from calling. It’s a contractual issue.”

As U.S.-listed players pull back, private European tanker owners have filled the gap.

“Russian crude is still allowed to trade. You’re allowed to load and to transport it. So, owners that don’t feel they risk much — and this is the independent owners — they measure the risk they can live with against the premium they can make. And they’ve moved into this trade,” said Barstad.

“I’m obviously not going to criticize how owners decide to conduct their business,” he added.

An investigation by Lloyd’s List using tracking data found that most of the Russian oil is now being moved aboard ships of private Greek owners.

‘A highly inefficient trade’

Russian crude is transported aboard tankers in the Aframax (750,000-barrel-capacity) and Suezmax (1 million-barrel-capacity) segments.

Because there are no U.S. sanctions targeting the shipping of Russian petroleum — sanctions akin to those targeting Iranian and Venezuelan tanker exports — owners of Aframaxes and Suezmaxes are profiting from the war. Even those abstaining from the Russia cargoes.

Europe has replaced much of its Russia-sourced petroleum with imports from the Middle East, the U.S. and West Africa. Russia has switched export destinations from Europe to Asia. “This is a highly inefficient trade,” Barstad noted.

Tanker demand is measured in ton-miles: volume multiplied by distance. Barstad said that 6% of the world’s crude and products cargoes (i.e., the volumes that are being redirected) “now travel at least 50% longer, if not twice the distance. And some would even argue 2.5 times the old distance.”

The independent owners that switched into the high-paying Russian export trade “are pulling tonnage out of normal bread-and-butter non-Russian trades,” said Barstad. Lower available tanker capacity raises rates in trades that have nothing to do with Russia.

“So, you basically have the same effect on the tanker market [outside Russia] as if you were going to Russia and lifting the barrels yourself.”

Click for more articles by Greg Miller

Related articles:

- Russia’s isolation deepens as shipping lines make final port calls

- Noose tightens on Russian economy as import options dwindle

- Shipping isn’t waiting for sanctions. It’s refusing to move Russian cargo

- How invasion of Ukraine could ease shipping logjam off US ports

- Biden-EU energy pact: LNG shipping game changer or wartime hype?

- Armada carrying US LNG heads to Europe, but it won’t be enough

- Why Russia-Ukraine war has not ignited crude tanker rates (yet)

- How Russian invasion of Ukraine could impact ocean shipping

Tradeimex Info Solution Private Limited

Extremely useful information which you have shared here about import export data provider This is a great way to enhance knowledge for us, and also beneficial for us. Thank you for sharing an article like this.