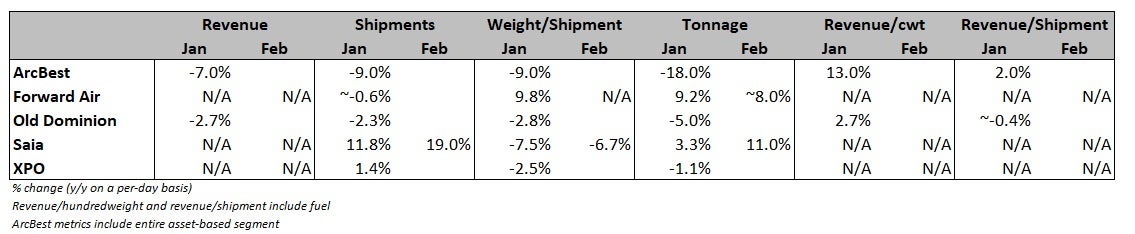

Less-than-truckload carrier Saia Inc. reported an 11% year-over-year (y/y) increase in tonnage per day during February. The increase was the combination of a 19% jump in shipments, which was partially offset by a 6.7% decline in weight per shipment.

The y/y per-day growth rates accelerated from January, when the carrier’s shipments increased 11.8% and tonnage was up 3.3%. Inclement weather in January led to a larger-than-normal number of terminal closures during the month. Saia (NASDAQ: SAIA) also had an easier tonnage comp in February (down 7.6% last year), which was twice the decline that was logged in January 2023.

The February increases were a little better than the fourth quarter, when shipments were up 18% y/y and tonnage increased 8%.

March is a big month for LTL carriers and volumes in the period will dictate results for the first quarter. The month also provides a strong indication on demand for the full year.

Saia doesn’t provide any revenue-based metrics like yields or revenue per shipment in its intraquarter updates, however, management said on its fourth-quarter call in February that it expects revenue per shipment to increase by a low-single-digit percentage in 2024.

The company is executing a big growth plan this year. A $1 billion capital expenditures outlay includes roughly $550 million for real estate. The budget includes the 28 terminals it recently acquired from bankrupt Yellow Corp. (OTC: YELLQ) as well as other additions and expansions. In total, it expects to grow its net door count by 12% to 14% this year.

The bulk of the remaining budget will be used to purchase tractors and trailers.

Other carriers like ArcBest (NASDAQ: ARCB), Old Dominion (NASDAQ: ODFL) and XPO (NYSE: XPO) are expected to provide updates for February in the coming days.

Freight Zippy

Saia is doing quite well.

Much of this growth is the same freight that Yellow could not generate a profit on???