Less-than-truckload carrier Saia is still seeing sizable volume growth even though a full year has passed since Yellow Corp. ceased operations and the comparisons have gotten tougher. While the year-over-year growth rates have cooled, they are still notable by historical measures and given that the industry is still struggling to exit a prolonged freight recession.

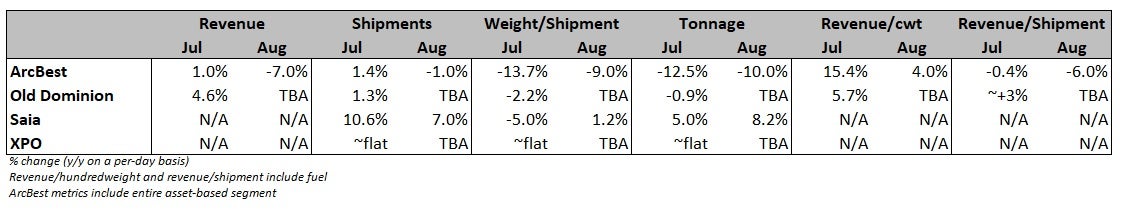

In the first two months of the third quarter, Saia’s tonnage per day was up 6.6% year over year as an 8.5% increase in shipments was partially offset by a 1.8% decline in weight per shipment, a Wednesday news release showed. By comparison, the carrier logged a 9.7% y/y increase in tonnage during the second quarter as shipments jumped 18.1% and weight per shipment was down 7.1%.

Saia (NASDAQ: SAIA) pounced on Yellow’s (OTC: YELLQ) downfall a year ago, quickly onboarding the carrier’s customers and acquiring some of its terminals. It has acquired 28 terminals from Yellow for $236 million over the past year. It reopened six of those locations in August after opening eight terminals earlier this year. It has also been upgrading to larger facilities in some markets. It plans to open 18 to 21 service centers in total this year.

While the y/y comps are more formidable, Saia’s growth rates were stronger in August than in July. The company reported an 8.2% y/y increase in tonnage for August, following a 5% increase in July. On a two-year-stacked comparison, tonnage was 15% higher in August after an 8.4% increase in July.

Saia does not provide revenue-based metrics as part of its intraquarter updates. Revenue per hundredweight, or yield, was nearly 9% higher y/y excluding fuel surcharges in the second quarter. Renewals on contract pricing were up 8.4% on average in the period, with the expectation for similar increases in the back half of the year.

The carrier’s freight mix has skewed toward lighter, retail freight and larger, national customers, both of which traditionally carry thinner margins. Prior to Yellow’s closure its average shipment weight was 1,443 pounds. So far in the third quarter, its shipment weights remain 100 pounds below that level. However, shipment weights ticked 2% higher from July to August.

Saia guided to 100 to 200 basis points of margin degradation in the third quarter from the 83.3% operating ratio it recorded in the second quarter. That’s in line with the normal seasonal change rate even as the company contends with cost headwinds from the new terminals. Its new locations operated at a loss during the second quarter.

Shares of SAIA were up 6% at 10:27 a.m. EDT on Wednesday compared to the S&P 500, which was flat.