LTL carrier says Northeast expansion to continue with new facilities, but segment remains at breakeven results.

Saia (Nasdaq: SAIA) beat Wall Street estimates for the third quarter on a stronger pricing and shipment growth in the less-than-truckload market, particularly among regional customers and third-party logistics providers.

The company’s expansion into the U.S. Northeast market remains at breakeven, with plans to continue its expansion in the region as more customers come onboard.

The Johns Creek, Georgia-based company reported third quarter revenue rising 19% from a year ago to $425.6 million and net income nearly doubling to $28.2 million, both quarterly records.

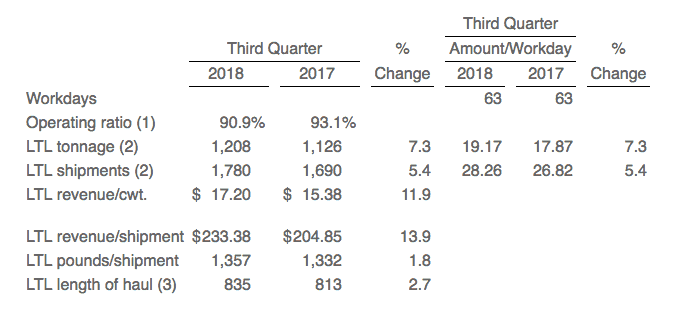

Earnings per share of $1.07 beat a consensus estimate of $1.04 per share for the quarter. Operating ratio also improved 220 basis points from a year earlier to 90.9%.

Chief executive Rick O’Dell credited better pricing and shipment growth in the LTL sector for the results. Revenue per hundredweight was up 11.9%, with tonnage up 7.3%.

Yearly contractual renewals saw an average price increase of 10.2%. O’Dell says the trends favor ongoing strength in the LTL market going into the fourth quarter as well as 2019.

“The average increase bodes well for expected positive pricing going into 2019,” O’Dell said.

Saia remains on a growth path as it builds out its national network, including expanding its Northeast coverage. It will open two new terminals in Massachusetts in December, its first in the state. For next year, it plans to open between four and six new terminals in the New England, including a major breakbulk facility slated for a first quarter 2019 opening.

Saia’s Northeast business, which it announced in May 2017, remains at breakeven. But O’Dell says as the company makes investment in the region, the growing volumes coming through its terminals and trucks will provide good incremental margins to the company.

Still, the company “shuffled the deck” this month with respect to its operations, O’Dell says. Paul Peck stepped into the role of executive vice president of operations, replacing Craig Thompson who has been in the role since August 2017. O’Dell says the change aims to imrp

“While the Northeast expansion has been successful, we are going back-to-basics from an execution standpoint,” O’Dell said. “Quite frankly, as much as our yield is up, I would have liked to have more than 200 basis points improvement in OR.”

In existing markets, it opened new terminals in Tacoma and Fort Worth. O’Dell says the opening of new terminals in existing markets frees up capacity for larger breakbulk facilities and provides more opportunity for taking long-haul freight. Terminal count stood at 158 at the end of the quarter.

“While the Northeast is a compelling multi-year growth opportunity for us, we are also opening terminals in our legacy geographies where customer service can be enhanced in a market that is closer to the customer,” O’Dell said.

Saia did see a front-loaded third quarter with tonnage and shipments up 10.3% and 6.7%, respectively in July, before tapering off to 2.8% and 2.7% in September. October month-to-date tonnage is up 1.6% with shipments up 1%.

O’Dell says the company saw normal seasonality during the quarter. He added that he saw no particular slowdown in the amount of freight occurring. But shifts in customer mix may also be playing a role as Saia sees more business from regional and third-party logistics customers, while business from nationwide customers was down for the quarter.

“I think things are still pretty good,” O’Dell said. “We’re not seeing anything in any segment that is particularly concerning or setting off any alarms.”