Several retail giants reported quarterly results this week that were favorably impacted by their status as “essential” providers during the pandemic. The fiscal second-quarter financial reports displayed favorable trends for the trucking industry – sales up and inventories down.

The run on home goods, food and consumables as stay-at-home lifestyles have taken hold amid COVID-19 was evident in financial results for Target (NYSE: TGT) and Walmart (NYSE: WMT). U.S. comparable sales climbed 24% year-over-year at Target and 9% at Walmart with e-commerce growth of 195% and 97%, respectively. Target’s consolidated revenue came in 14% higher than analysts predicted.

Target’s management team said that sales in August continue to see strength, up in the low double-digit percentage range year-over-year. The tone on future sales at Walmart was more subdued as the company’s July comp was up only a little more than 4% and management indicated demand is beginning to normalize.

Both retailers said they were seeing a “slow start” to the back-to-school shopping season as many regions have opted for virtual learning and there is still uncertainty if school districts that chose to reopen will remain open.

Home improvement heavyweights The Home Depot (NYSE: HD) and Lowe’s (NYSE: LOW) saw comparable sales surge during the quarter, up 25% and 35% year-over-year, respectively, with e-commerce activity growing in excess of 100% at both companies. Revenue at The Home Depot was 10% better than forecast and Lowe’s revenue came in 13% higher than consensus.

The Home Depot’s management team said sales have continued at the same clip through the first two weeks of August but they weren’t ready to “extrapolate” those trends to the back half of the year. The Home Depot’s quarter benefited from hotter weather compared to last year, driving an increase in the sale of air conditioners and fans. The company had fewer special events and sales, and increased commodity prices, namely lumber, also pushed revenue higher.

Lowe’s reported sales momentum has continued into August, noting strong demand for home improvement items like paint and lumber. All 15 of its U.S. regions recorded sales growth in excess of 30%. The company expects sales to moderate somewhat in the back half of the year but indicated favorable year-over-year comparisons.

Most major retailers include orders fulfilled in store, curbside or shipped from the business to consumer as part of e-commerce transactions if ordered online. Target reported 90% of its sales during the quarter were still fulfilled with the help of a store, with in-store pickup increasing more than 60%. The Home Depot said more than 60% of its customers opted for in-store pickup during the period.

Inventories moved lower for most of these essential businesses as sales spiked and restocking accelerated in lockstep with increases in positive COVID tests in some regions. Walmart and The Home Depot saw the largest supply squeeze, with inventories down in the 7% range from the beginning of February, the start of the retail fiscal year. Walmart reported a 10% decline in U.S. inventories on a comparable store basis.

Increased sales and lower inventories bode well for trucking companies with exposure to general merchandise and home improvement retailers, which are struggling to keep up with demand. Many of the nation’s largest carriers move freight for these companies.

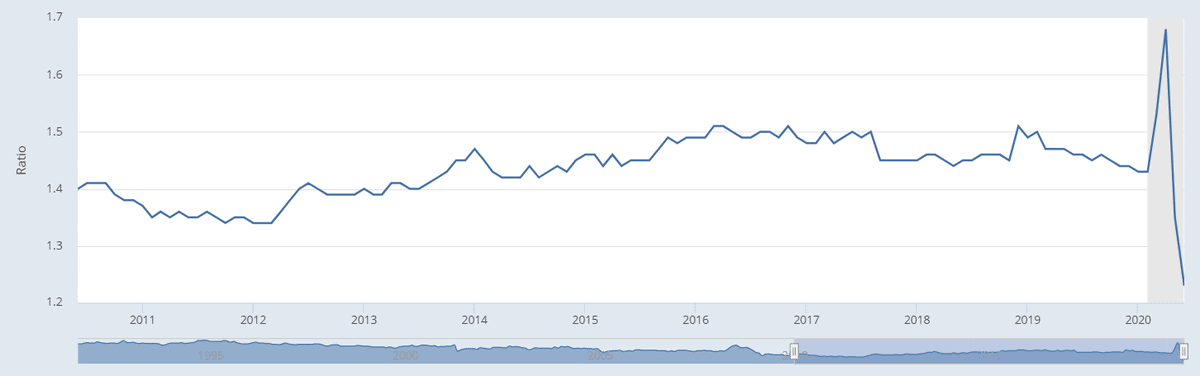

Census Bureau data shows retailers’ inventory-to-sales ratio (seasonally adjusted) declined to 1.23x in June, from 1.35x in May and 1.68x in April, when COVID-related lockdowns brought portions of the retail economy to a halt. The June reading provided a new low in the lagging data set.

While all of these retailers beat revenue forecasts by $3 billion to $4 billion during the second quarter, each acknowledged the impact stimulus payments had on the period to some degree, with some noting future performance will be contingent on a new stimulus deal.