Schneider National (NYSE: SNDR) is planning for the robust freight environment to carry well into next year.

CEO and President Mark Rourke said the industry appears to still be in the early stages of the current trucking cycle, “maybe the third inning,” during an appearance at Baird’s 2020 Global Industrial Conference this week.

The Green Bay, Wisconsin-based transportation and logistics company’s chief said none of its customers feel good about inventory levels, which gives him confidence that demand will remain high over the next couple of quarters. He said “market agitation” from the supply-demand imbalance has accelerated recently and capacity isn’t rapidly reentering the market like it has in past cycles.

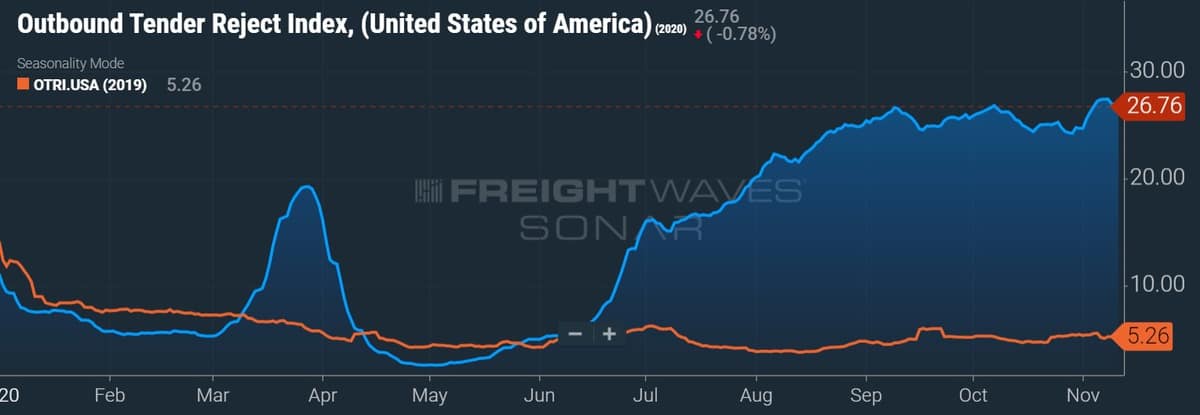

Outbound tender rejects (SONAR: OTRI.USA), a proxy for truck capacity, remain elevated at 27% and near all-time highs.

On contractual rate increases, Rourke said “upper single-digit, low double-digit is in the realm.” He based these expectations on recent conversations with customers, some of which have been initiated by shippers concerned with procuring consistent capacity. He believes a “multi-quarter correction” is required to cure the lack of supply.

He was quick to point out that rate increases will not provide a one-for-one contribution to earnings as driver pay is rising to combat the reduction in force brought about by the Drug & Alcohol Clearinghouse, COVID concerns and low driver school enrollments during the pandemic. The carrier recently announced a pay increase for team drivers.

Rourke believes an increase in the fixed portion of driver compensation will be required to bring sustainability to the position and lower turnover on a more permanent basis moving forward.

Curing the driver part of the equation will be key for Schneider as it attempts to grow its dedicated operation, which has 4,000 trucks currently. Management would like to grow the division to the same size as its one-way network, 6,000 trucks. Capital investment will favor the company’s dedicated and intermodal operations in 2021 with the one-way fleet remaining level.

Intermodal staging a comeback

Management plans to deploy fresh capital to its drayage fleet in 2021 and will look to add a few containers as well. Schneider didn’t take on the equipment it wanted to this year due to COVID-related delays at the original equipment manufacturers. Management believes equipment additions and the company’s tech-savvy intermodal offering should improve its ability to capture share.

Schneider continues to see double-digit growth quarter after quarter in the eastern portion of its intermodal network, noting that precision scheduled railroading initiatives have made the reliability of the service much more truck-like.

Intermodal traffic on the U.S. Class I railroads is up 10% year-over-year so far in the fourth quarter, according to the Association of American Railroads. Both of Schneider’s rail partners, BNSF Railway (Berkshire Hathaway Inc. NYSE: BRK.A) and CSX Corp. (NASDAQ: CSX), are seeing similar increases.

During the third quarter, Schneider reported a 2% year-over-year increase in intermodal deliveries, in line with volumes reported by the railroads, but revenue per order was down 4%. Congestion on the rails, capacity constraints and delays unloading containers at customer facilities led to revenue and margin headwinds in the period. The division reported 80 basis points of margin deterioration at a 90.7% operating ratio, but that was 430 basis points better than the second quarter.

Management is expecting sequential margin improvement during the fourth quarter as the company expects to capture rate increases in the current period and throughout 2021. The division’s long-term margin goal is 10% to 12%.

Technology and capital investment

In addition to investments in the dedicated and intermodal segments, Schneider CFO Stephen Bruffett said the company plans to spend more on external touch points in 2021, surpassing the $250 million in total net capital expenditures doled out this year.

Those plans include further investment in its new digital freight app, FreightPower. The load-booking technology increases visibility throughout the brokerage process, providing increased access to capacity for shippers and improving load options for carriers. Real-time rates and automatic tracking updates through geofencing technology allow both parties to better manage loads and equipment.

The company will also advance its initiatives and strategic investment with Mastery Logistics Systems, a provider of cloud-based transportation management systems designed for large transportation companies. The Mastery system will be rolled out to Schneider’s logistics group first.

Tim Kelly

I don’t think much of what these guys have got to say, I think they do everything they can do not to pay the carriers that work for them at least on their brokerage side. My wife and I have a small trucking company do a good job for our customers and brokers. We did a Walmart load for Schneider just a few weeks ago and they would not pay 50 dollars in detention. We send them our proof that we were there on time in the form of our ELD but that didn’t matter. We did the right thing we paid our driver because he was there. It is not a lot of money but I could care less what they have to say. Like I told the guy through email since he wouldn’t call me and tell me why. I won’t be hauling your freight anymore I’ll deadhead I’m not that small.