On its first quarter 2020 earnings conference call, truckload (TL) carrier Schneider National’s (NYSE: SNDR) management team said they expect the second quarter to be the trough of the COVID-19-related downturn. They said that billed miles in its TL division are down in the upper single-digit percentage range currently.

Management expects the current softness to continue into mid- to late May until businesses deemed “nonessential” are able to come back online, likely leading to recovery in June. In the carrier’s press release CEO and President Mark Rourke stated, “while there is still much to play out, we are starting to see encouraging signs that some impacted customers and suppliers are in the process of reopening or ramping up their operations.”

The company’s intermodal unit is faring a little worse as import volumes from Asia have receded. Intermodal volumes were down in the upper teens as April closed, but management noted that demand appears to have plateaued and that volumes appear to be “rebuilding.”

Contractual renewals have been delayed somewhat. Management said that they are seeing awards in TL come in with share gains of 5% to 8% with slightly lower pricing. The share gains in intermodal have been a little better than in trucking, but pricing has been slightly lower as well.

The Green Bay, Wisconsin-based company withdrew its full-year 2020 earnings guidance of $1.25 to $1.35 per share due to uncertainty around the timing of a recovery.

First Quarter 2020

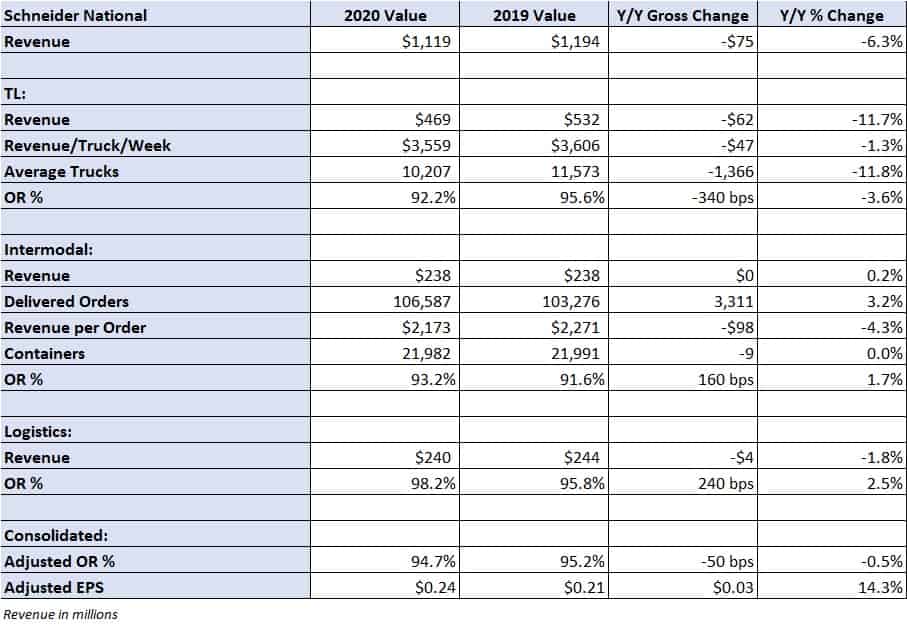

Schneider reported adjusted earnings per share of $0.24, well ahead of the consensus forecast of $0.19.

Total revenue declined 6.3% year-over-year to $1.12 billion. The revenue decline was largely due to the closure of its First to Final Mile (FTFM) unit and the loss of a large customer in the company’s import/export segment.

The TL division reported an 11.7% year-over-year decline in revenue to $469 million as average trucks in service declined by a similar amount due to the closure of FTFM. Lower pricing was also noted as a headwind. Revenue per truck per week was 1.3% lower at $3.559.

The company’s TL operating ratio (OR) improved 340 basis points to 92.2%. The first quarter result included a $7.6 million year-over-year decline in gains on equipment sales as used truck prices have declined significantly compared to the prior year period. Schneider booked $4.8 million in losses and impairments on the disposal of equipment. The closure of FTFM was a tailwind as that division operated at a $12.1 million loss in first quarter 2019.

Intermodal revenue was flat year-over-year at $238 million as volumes improved 3% and revenue per load was down 4%. Schneider continues to take market share in a declining intermodal market. U.S. container volumes on the Class I railroads were 7% lower year-over-year in the first quarter. Schneider’s rail partner in the West, BNSF Railway (Berkshire Hathaway Inc. NYSE: BRK.A), reported a 5.9% decline, while its rail partner in the East, CSX Corp. (NASDAQ: CSX), reported a modest 0.4% improvement.

The decline in revenue per order was attributed to an increase in freight mix to favor the East, which has shorter lengths of haul. Higher rail purchased transportation costs weighed on the division’s 93.2% OR, 160 basis points worse year-over-year.

Logistics revenue declined slightly, but the division’s OR backed up 240 basis points to 98.2%. “Continued brokerage net revenue compression,” as brokerage competition remains fierce and providers are forced to pay up when the market tightens and rates increase to honor contractual commitments, were the culprits.

The carrier ended the quarter with more than $1 billion in liquidity ($650 million in cash and investments, as well as $376 million in available credit capacity) compared to only $327 million in debt. Net capital expenditures (capex) expectations were lowered to $260 million from original guidance of $310 million. The carrier plans to maintain equipment replacements, but will trim some discretionary projects. Schneider recorded net capex of $307 million in 2019 and $332 million in 2018.

Shares of SNDR are off 1% in midday trading.