Schneider National missed third-quarter expectations and lowered its full-year 2024 guidance on Wednesday.

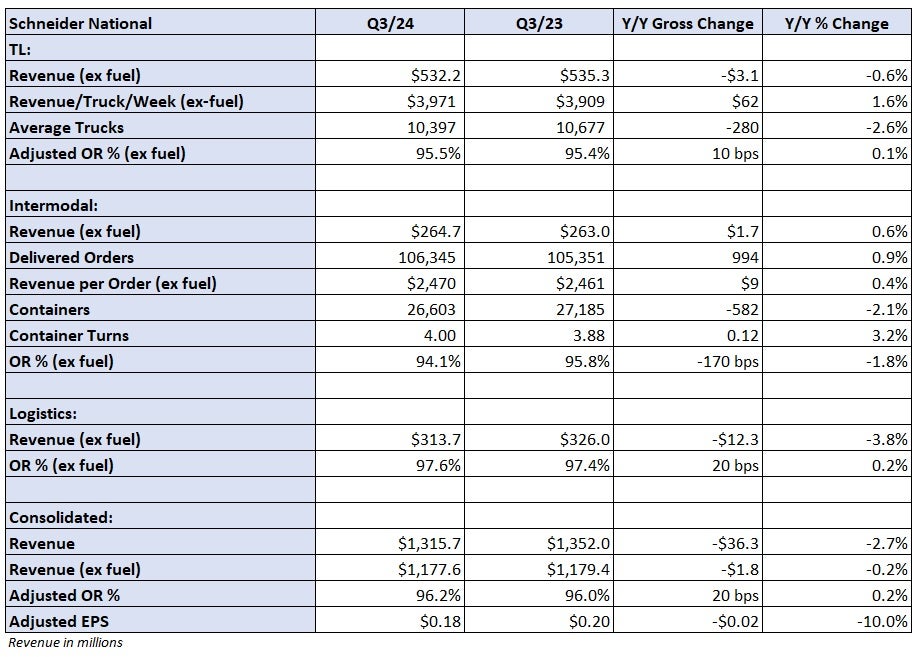

Adjusted earnings per share of 18 cents was 5 cents below the consensus estimate and 2 cents lower than the 2023 third quarter. The company said lower gains on equipment sales and equity investments were a 4-cent year-over-year headwind in the period. Elevated insurance costs, due to higher premiums and settlement expenses, were a 4-cent y/y drag as well.

Schneider (NYSE: SNDR) lowered full-year adjusted EPS guidance to a range of 66 to 72 cents, from 80 to 90 cents. The 2024 consensus estimate was 82 cents at the time of the print.

“We expect modest improvement in the fourth quarter over a year ago driven by continued stabilization across most of our businesses and improved seasonality, as we continue to position the enterprise for a more sustained market recovery,” said CFO Darrell Campbell in a Wednesday news release.

Click for full report: “Schneider National cuts outlook, ‘commoditized’ one-way fleet uninvestable”

Schneider saw consistent results across all segments during the quarter.

Truckload revenue of $532 million was down 0.6% y/y as average trucks in service declined 2.6%, partially offset by a 1.6% increase in revenue per truck per week (excluding fuel surcharges). Schneider’s dedicated unit saw a 4% increase in truck count while the network (one-way) fleet declined 12% y/y.

One-way contract pricing has been positive all year, “with contract rate renewals at the highest level since first quarter 2022,” President and CEO Mark Rourke stated in the release. However, he believes one-way market fundamentals “still do not support additional investment at this time as carriers are not being compensated for the value provided.” He expects one-way results to “remain challenged,” noting that recent “seasonality momentum” has not been sustained.

The unit recorded a 95.5% operating ratio, which was 10 basis points worse y/y and 120 bps worse than the second quarter.

Click for full report: “Schneider National cuts outlook, ‘commoditized’ one-way fleet uninvestable”

Shares of SNDR were up 3.9% at 9:56 a.m. EST on Wednesday compared to the S&P 500, which was up 1.6%.

Schneider will host a call with analysts at 10:30 a.m. EST on Wednesday to discuss third-quarter results.